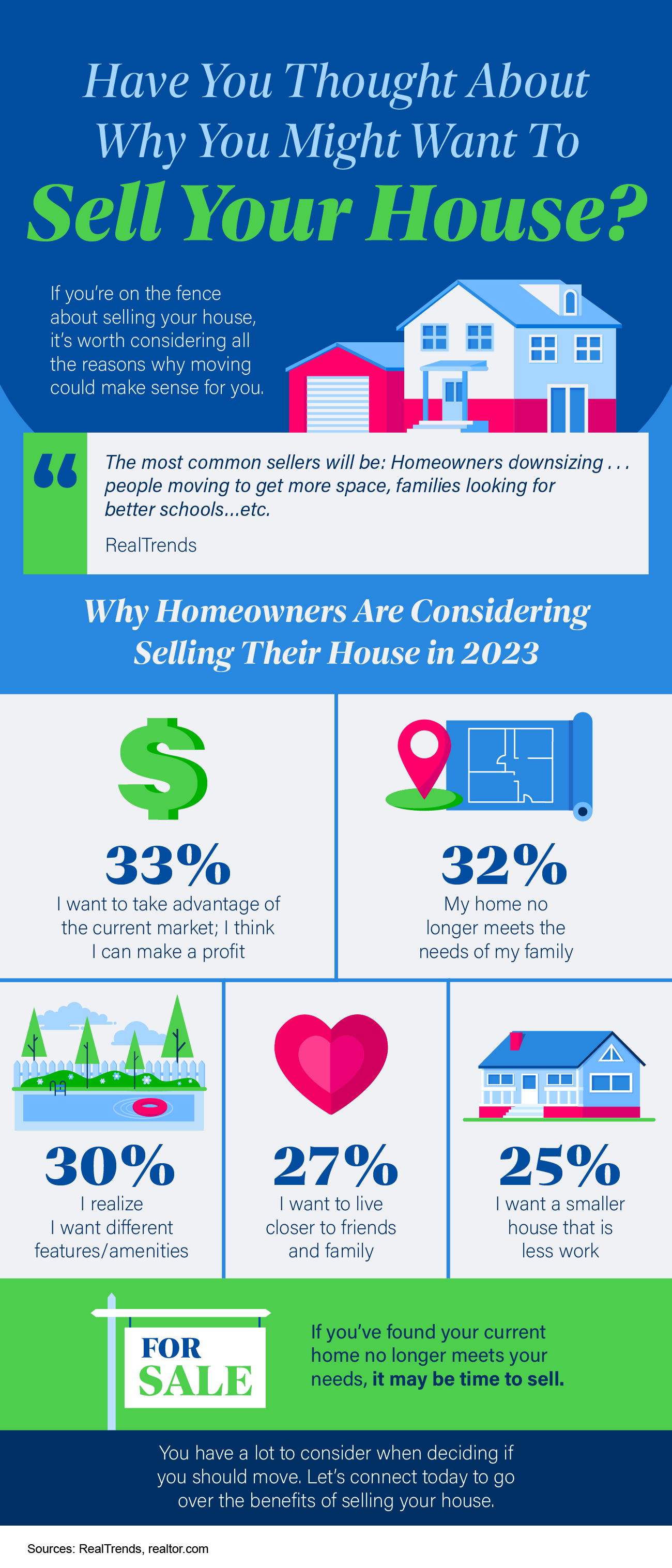

Some Highlights

- If you’re on the fence about selling your house, it’s worth considering all the reasons why moving could make sense for you.

- If you find your home no longer meets your needs, it may be time to sell.

- You have a lot to consider when deciding if you should move. Let’s connect today to go over the benefits of selling your house.

![Buying a Home May Make More Sense Than Renting [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2023/03/09112231/Buying-A-Home-May-Make-More-Sense-Than-Renting-MEM-1046x2938.png)