Why Your Asking Price Matters Even More Right Now

If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing.

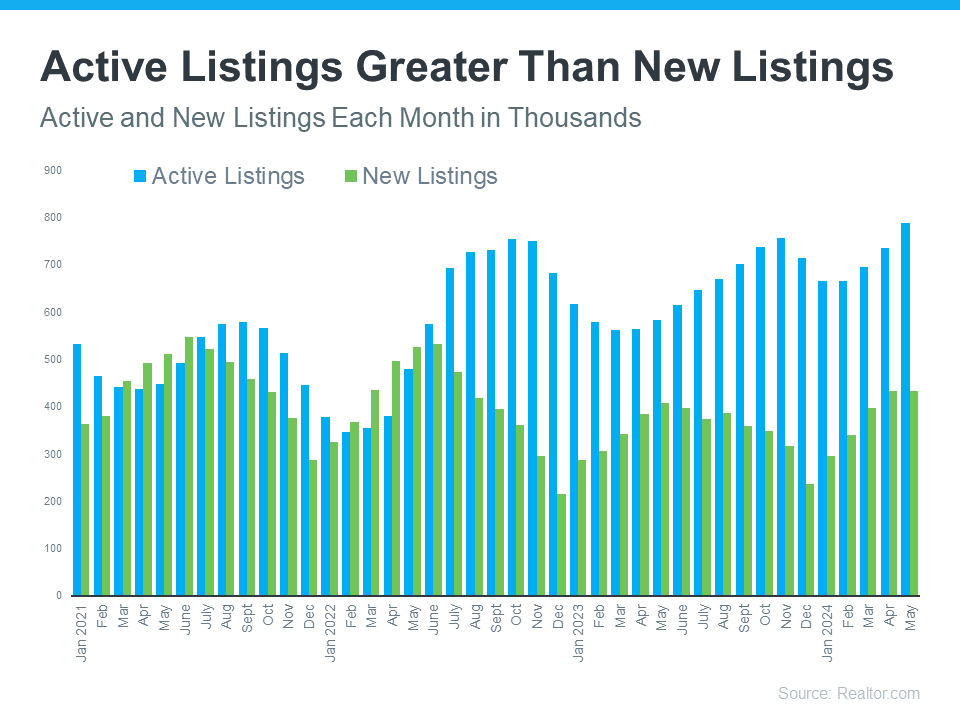

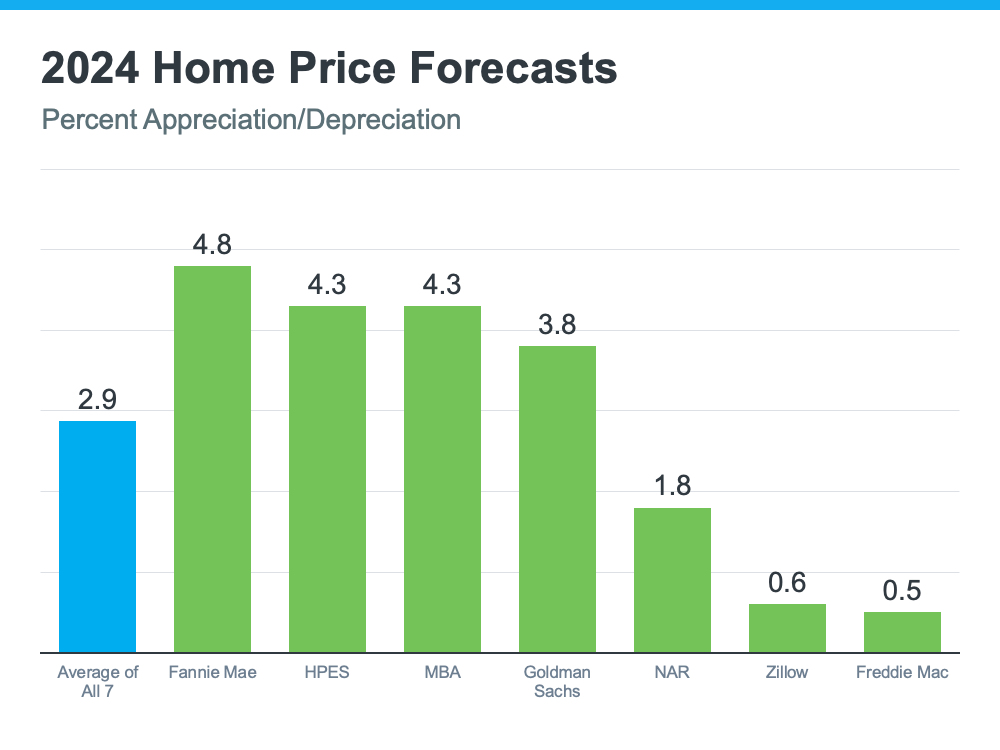

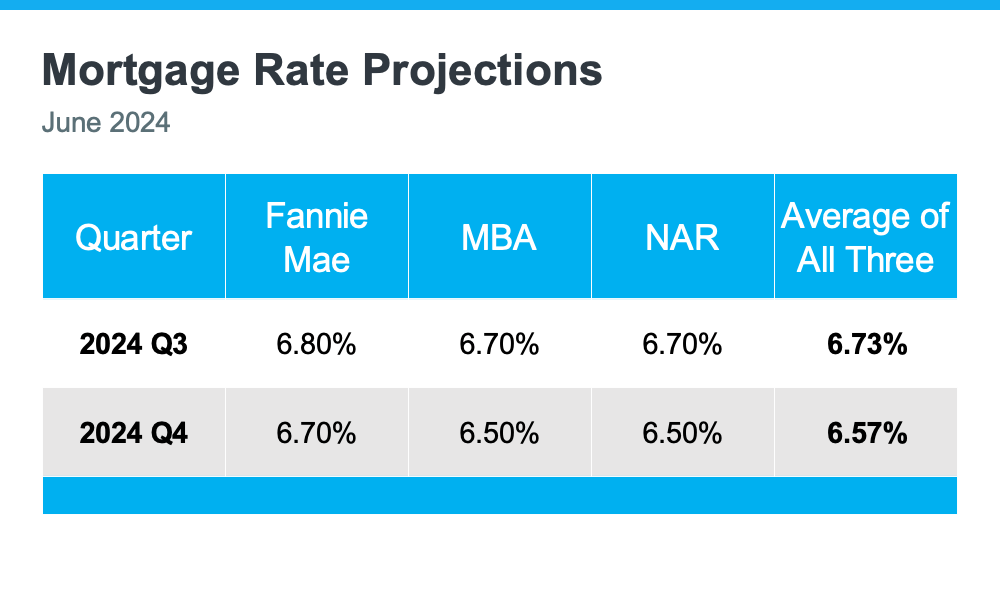

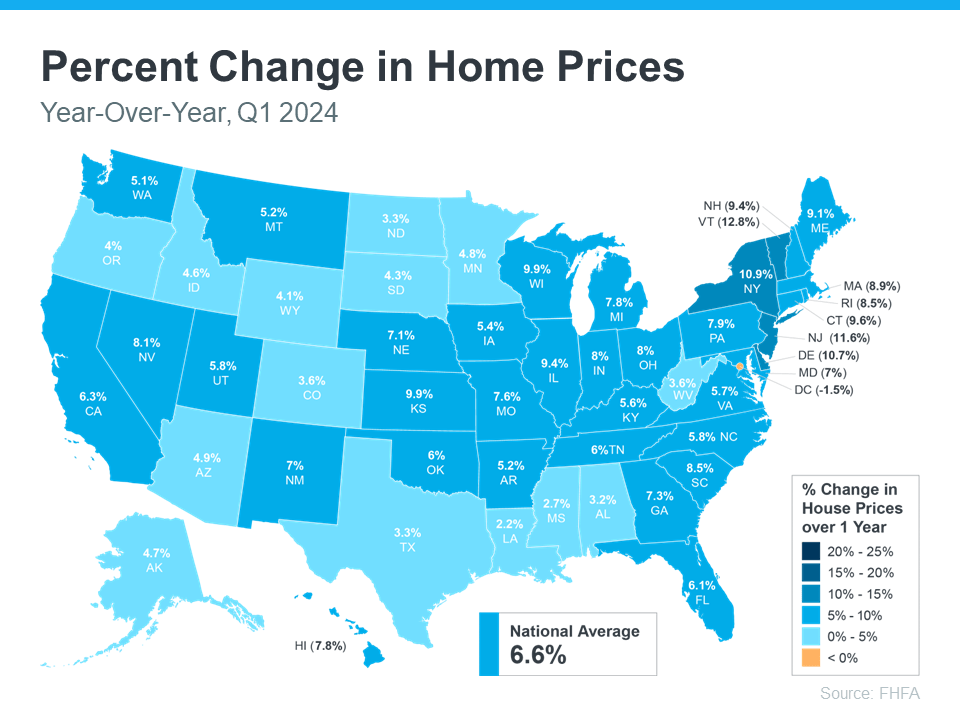

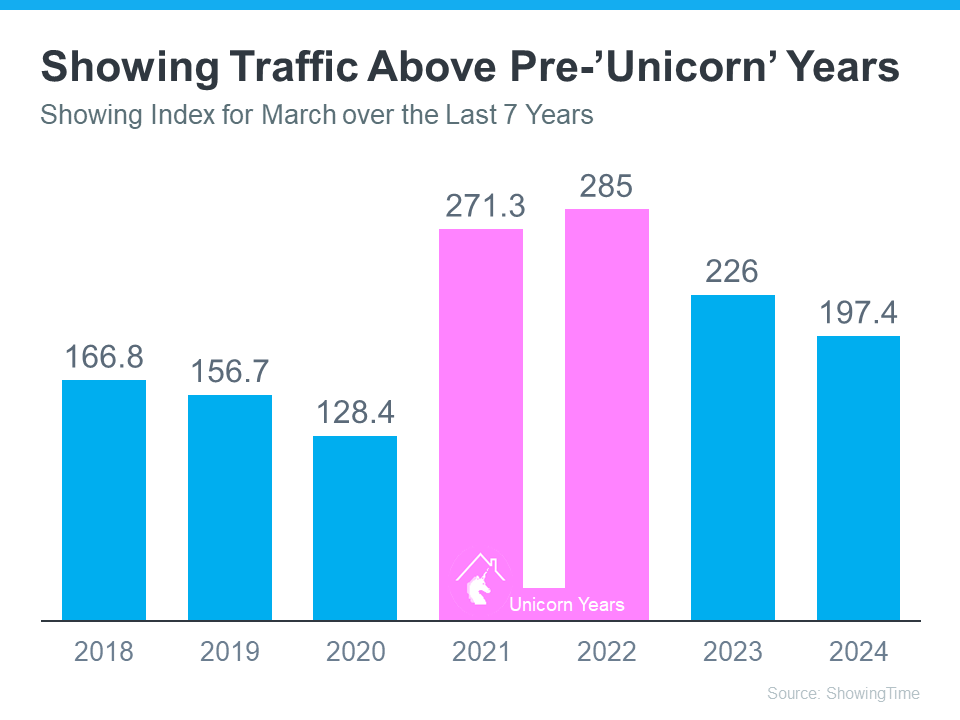

While home prices are still appreciating in most areas, they’re climbing at a slower pace because higher mortgage rates are putting a squeeze on buyer demand. At the same time, the supply of homes for sale is growing. That means buyers have more options and your house may not stand out as much, if it’s not priced right.

Those two factors combined are why the asking price you set for your house is more important today than it has been in recent years.

And some sellers are finding that out the hard way. That’s leading to more price reductions. Mike Simonsen, Founder and President of ALTOS Research, explains:

“Looking at the price reductions data set . . . It all fits in the same pattern of increasing supply and homebuyer demand that is just exhausted by high mortgage rates. . . As home sellers are faced with less demand than they expected, more of them have to reduce their prices.”

That’s because they haven’t adjusted their expectations to today’s market. Maybe they’re not working with an agent, so they don’t know what’s happening around them. Or they’re not using an agent who prioritizes being a local market expert. Either way, they aren’t basing their pricing decision on the latest data available – and that’s a miss.

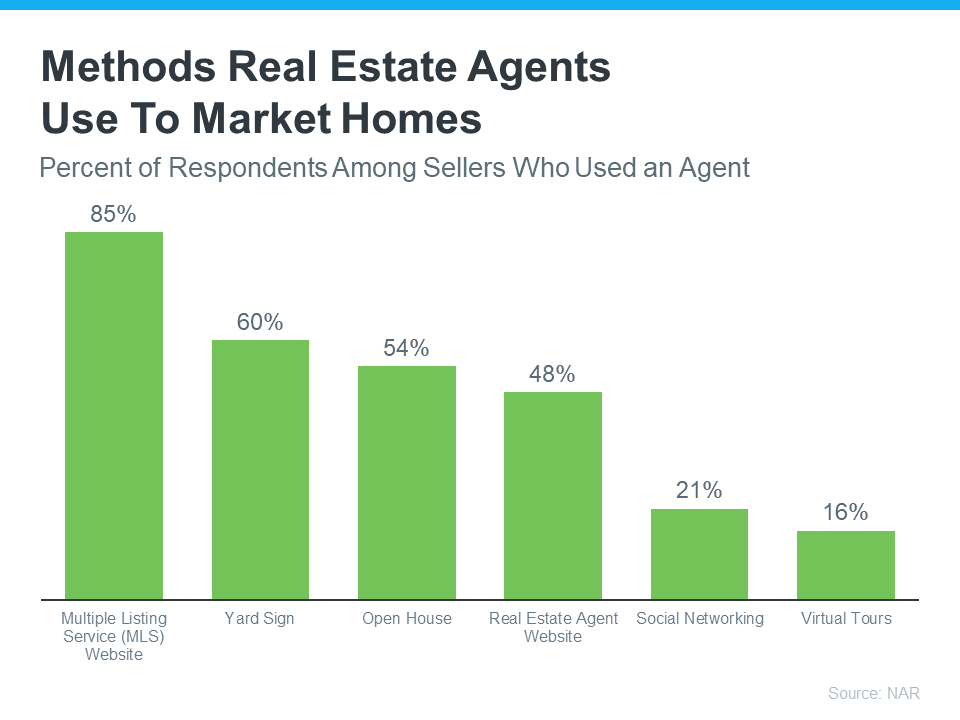

If you want to avoid making a pricing mistake that could turn away buyers and delay your sale, you need to work with an agent who really knows your local market. If you lean on the right agent, they’ll help you avoid making mistakes like:

- Setting a Price That’s Too High: Some sellers have unrealistic expectations about how much their house is worth. That’s because they base their price on their gut or their bottom line, not the data. An agent will help you base your price on facts, not opinion, so you have a better chance of hitting the mark.

- Not Considering What Houses Are Actually Selling for: Without an agent’s help, some sellers may use the wrong comparable sales (comps) in their area and misjudge the market value of their home. An agent has the expertise needed to find true comps. And they’ll use those to give you valuable insights into how to price your house in a way that’s competitive for you and your future buyer.

- Overestimating Home Improvements: Sellers who have invested a significant amount of money in home improvements may overestimate how much those upgrades affect their home’s value. While certain improvements can increase a home’s appeal, not all upgrades are going to get a great return on their investment. An agent factors in what you’ve done and what buyers in your area actually want as they set the price.

- Ignoring Feedback and Market Response: Some sellers may be resistant to lowering their asking price based on feedback they’re getting in open houses. An agent will remind the seller how important it is to be flexible and respond to market feedback in order to attract qualified buyers.

In the end, accurate pricing depends on current market conditions – and only an agent has all the data and information necessary to find the right price for your house. The right agent will use that expertise to develop a pricing strategy that’s based on current market conditions and designed to get your house sold. That way you don’t miss the mark.

Bottom Line

The right asking price is even more important today than it’s been over the last few years. To avoid making a costly mistake, let’s work together.