Ways To Use Your Tax Refund If You Want To Buy a Home

Have you been saving up to buy a home this year? If so, you know there are a number of expenses involved – from your down payment to closing costs. But did you also know your tax refund can help you pay for some of these expenses? As Credit Karma explains:

“If one of your goals is to stop renting and buy a home, you’ll need to save up for closing costs and a down payment on the mortgage. A tax refund can give you a start on the road to homeownership. If you’ve already started to save, your tax refund could move you down the road faster.”

While how much money you may get in a tax refund is going to vary, it can be encouraging to have a general idea of what’s possible. Here’s what CNET has to say about the average increase people are seeing this year:

“The average refund size is up by 6.1%, from $2,903 for 2023’s tax season through March 24, to $3,081 for this season through March 22.”

Sounds great, right? Remember, your number is going to be different. But if you do get a refund, here are a few examples of how you can use it when buying a home. According to Freddie Mac:

- Saving for a down payment – One of the biggest barriers to homeownership is setting aside enough money for a down payment. You could reach your savings goal even faster by using your tax refund to help.

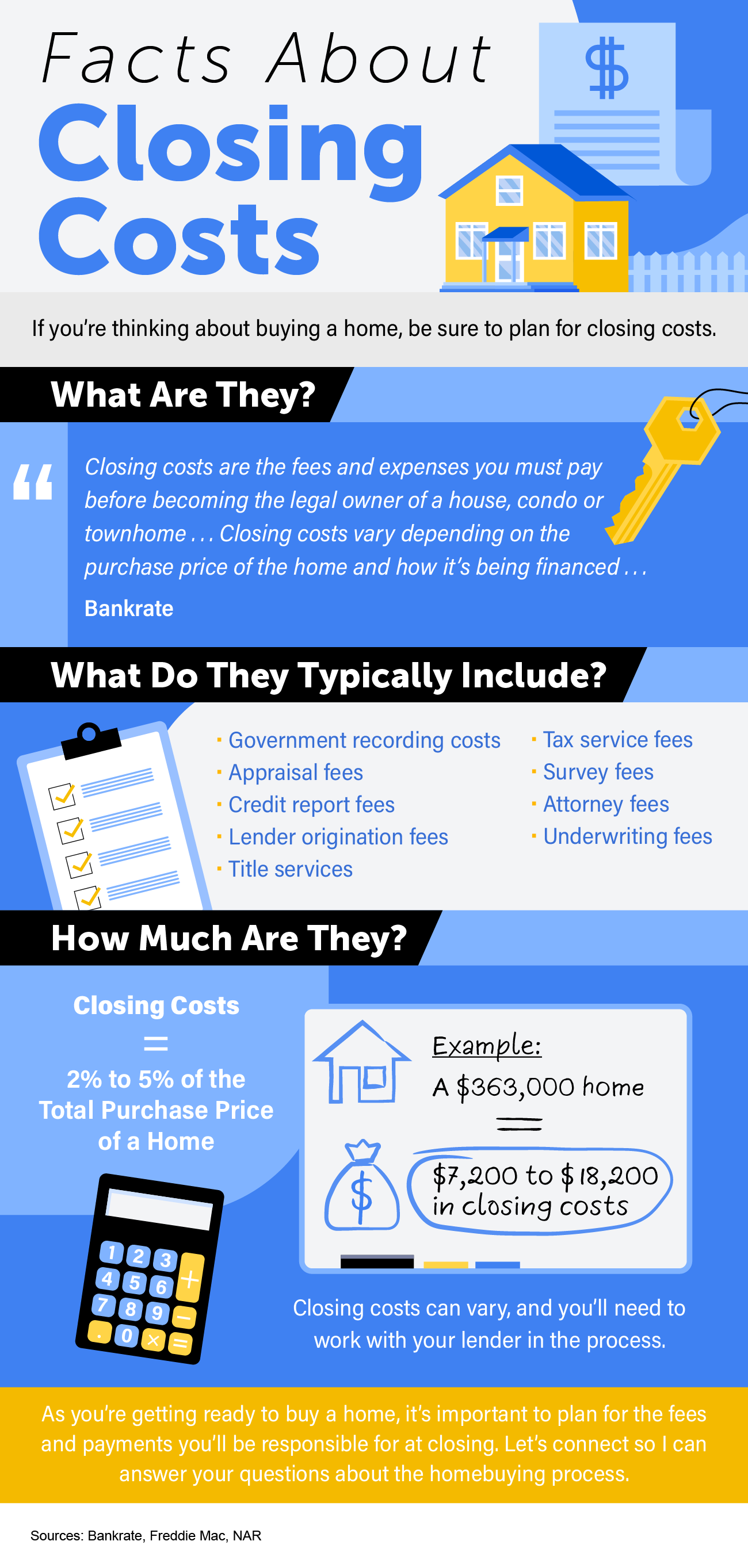

- Paying for closing costs – Closing costs cover some of the payments you’ll make at closing. They’re generally between 2% and 5% of the total purchase price of the home. You could direct your tax refund toward these closing costs.

- Lowering your mortgage rate – Your lender might give you the option to buy down your mortgage rate. If affordability is tight for you at today’s rates and home prices, this option may be worth exploring. If you qualify for this option, you could pay upfront to have a lower rate on your mortgage.

The best way to get ready to buy a home is to work with a team of trusted real estate professionals who understand the process and what you’ll need to do to be ready to buy.

Bottom Line

Your tax refund can help you reach your savings goal for buying a home. Let’s talk about what you’re looking for, because your home may be more within reach than you think.