The Price of Perfection: Don’t Wait for the Perfect Home

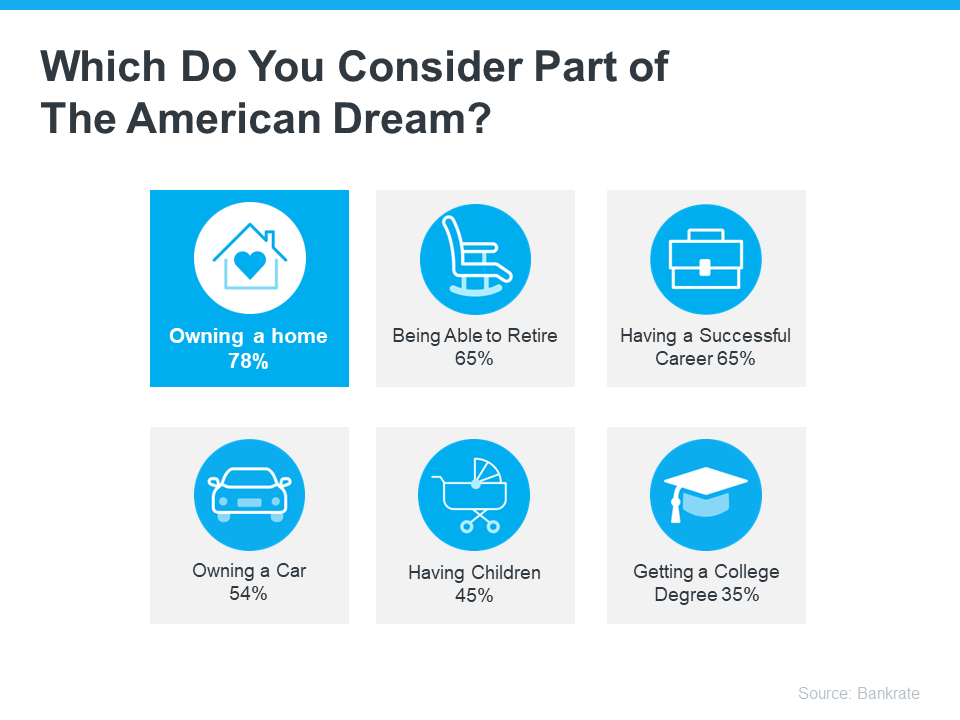

In life, patience is a virtue – but in the world of homebuying, waiting too long in hopes of finding the perfect home actually isn’t wise. That’s because the pursuit of perfection comes at a cost. And in this case, that cost may be delaying your dream of homeownership. As Bankrate explains:

“One of the most common first-time homebuyer mistakes is looking for a home that checks each of your boxes. Looking for perfection can narrow your choices and lead you to pass over good, suitable options for starter homes in the hopes that something better will come along.”

The Cost of Holding Out for Perfection

Nothing in life is ever perfect – and that’s true when you search for a home too. Unless you’re building a brand-new home from the ground up, chances are there are going to be some features or finishes you wouldn’t have picked yourself. It may be as simple as paint colors, a light fixture, or the tile in the bathrooms or kitchen. Or even that the backyard isn’t fenced in. It could also be that the home itself is great, but it’s not the ideal location you were hoping for.

But here’s the trade-off you’d be making without even realizing it. In all that time you’d spend searching for the perfect place, you’d overlook a lot of homes that would’ve worked for you. U.S. News explains:

“. . . you may miss opportunities if you enter the process with blinders on and aren’t open-minded . . . Countless potential buyers never buy because of this, and thus miss great investments or never move on to the next chapter of their lives.”

It’s Time To Redefine Perfection

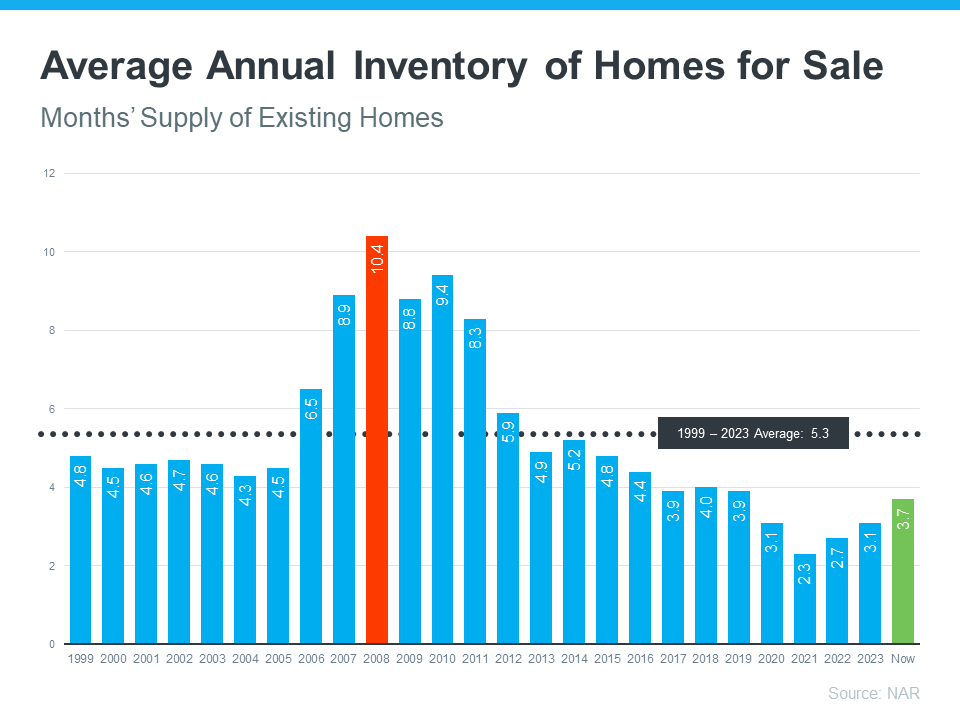

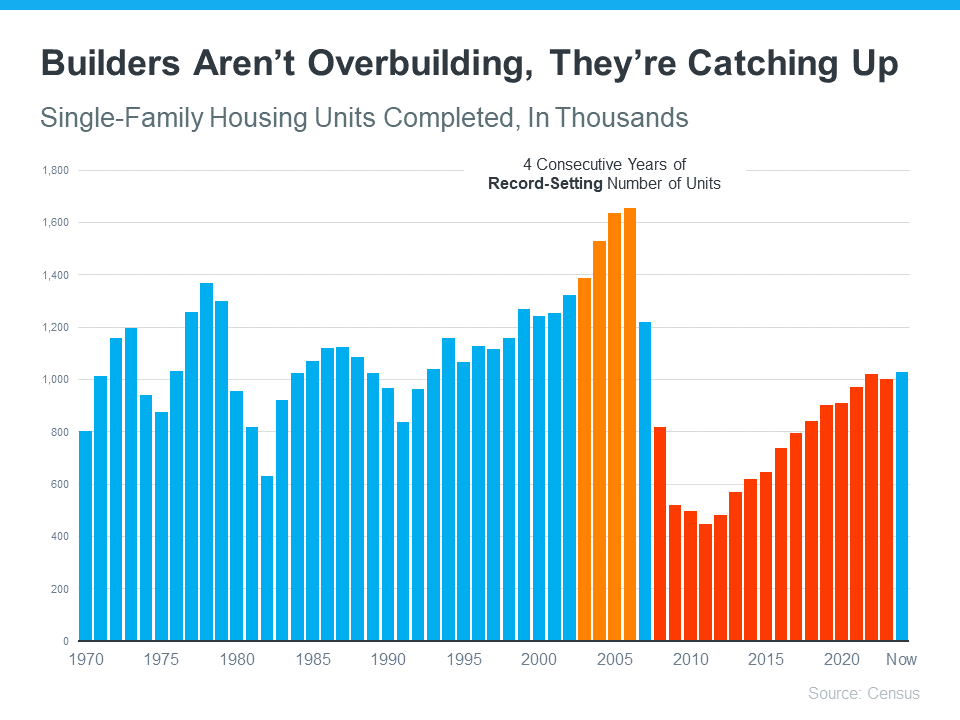

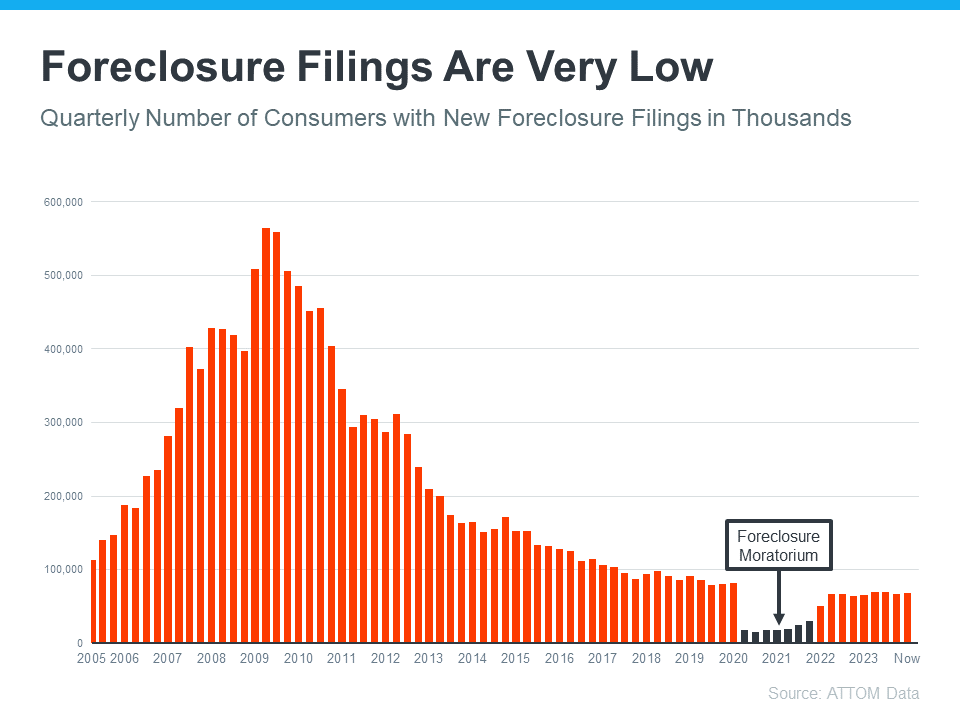

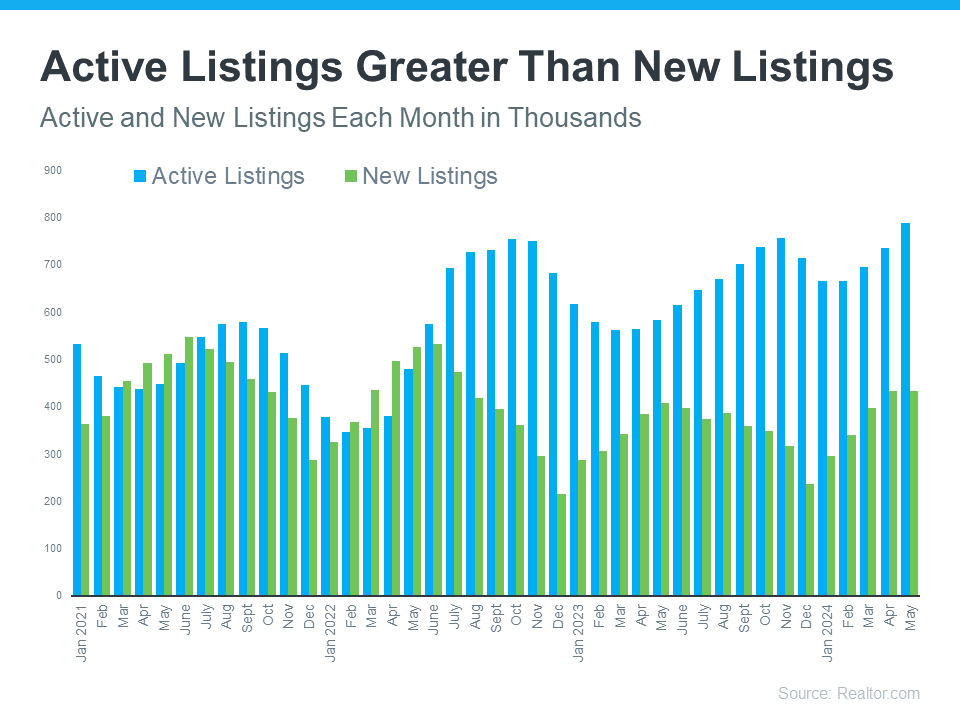

Especially with affordability and inventory where they are today, buying a home that needs some updates, is a few neighborhoods away from your ideal location, or doesn’t have all your desired features can be a smart move. Here’s why.

For starters, these homes are usually more affordable, which is important at a time when some buyers are struggling to find options in their budget.

And they give you a chance to make the space your own or discover a whole new area of town. You may find out you actually love that neighborhood. Or, swapping out a feature here or there after move-in isn’t such a big deal. So, look past the green shag carpet and see the bones of the house. With a little vision and creativity, you can turn a good house into a fantastic home.

How an Agent Helps You Explore Your Options

If you’re open to a home that needs a little elbow grease or is a bit further out, let your agent know. They’ll be happy to show you how this can really open up your pool of homes to pick from. They’ll also help coach you through this process by:

1. Prioritizing Your Must-Haves: Your agent will want to revisit your wish list and separate your non-negotiables from your nice-to-haves. From there, they’ll focus on what’s really most important to you as they come up with a bigger list of options for you to choose from.

2. Coaching You To See the Potential: As you tour these added options, your agent will help you look beyond cosmetic flaws and imagine what the home could be with a little work. Simple updates like a fresh coat of paint or new flooring can make a big difference.

3. Connecting You with Local Pros: And an agent’s support goes one step further. If they know what you’re hoping to change after you move in, they can connect you with local pros who can get the job done. That way it’s less work for you, and you don’t have to worry about tracking down contractors.

Bottom Line

Remember, there is no perfect home. But with expert help and an open mind, we can find you the right home – even in today’s market. Let’s connect to see what’s out there.