The Benefits of Downsizing When You Retire

If you’re taking a look at your expenses as you retire, saving money where you can has a lot of appeal. One long-standing, popular way to do that is by downsizing to a smaller home.

When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:

“A smaller home typically means lower bills and less upkeep. Then there’s the potential windfall that comes from selling your larger home and buying something smaller.”

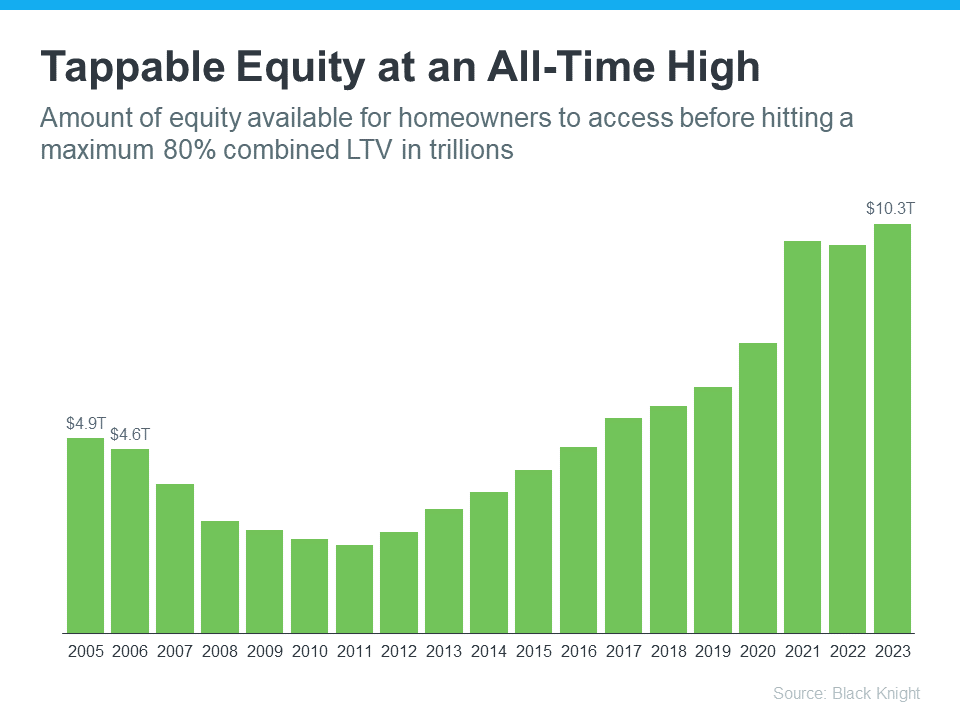

That windfall is thanks to your home equity. If you’ve been in your house for a while, odds are you’ve built up a considerable amount of equity. And that equity is something you can use to help you buy a home that better fits your needs today. Daniel Hunt, CFA at Morgan Stanley, explains:

“Home equity can be a significant source of wealth for retirees, often representing a large portion of their net worth. . . . Retirement planning can be complex, but your home equity shouldn’t be overlooked.”

And when you’re ready to use that equity to fuel your next move, your real estate agent will be your guide through every step of the process. That includes setting the right price for your current house when you sell, finding the home that best fits your evolving needs, and understanding what you can afford at today’s mortgage rate.

What This Means for You

If you’re thinking about downsizing, ask yourself these questions:

- Do the original reasons I bought my current house still stand, or have my needs changed since then?

- Do I really need and want the space I have right now, or could somewhere smaller be a better fit?

- What are my housing expenses right now, and how much do I want to try to save by downsizing?

Then, meet with a real estate agent to get an answer to this one: What are my options in the market right now? A local real estate agent can walk you through how much equity you have in your house and how it positions you to win when you downsize.

Bottom Line

Want to save money in retirement? Consider downsizing – it could really help you out. When you’re ready, let’s connect about your goals in the housing market this year.