How Affordability and Remote Work Are Changing Where People Live

There’s an interesting trend happening in the housing market. People are increasingly moving to more affordable areas, and remote or hybrid work is helping them do it.

Consider Moving to a More Affordable Area

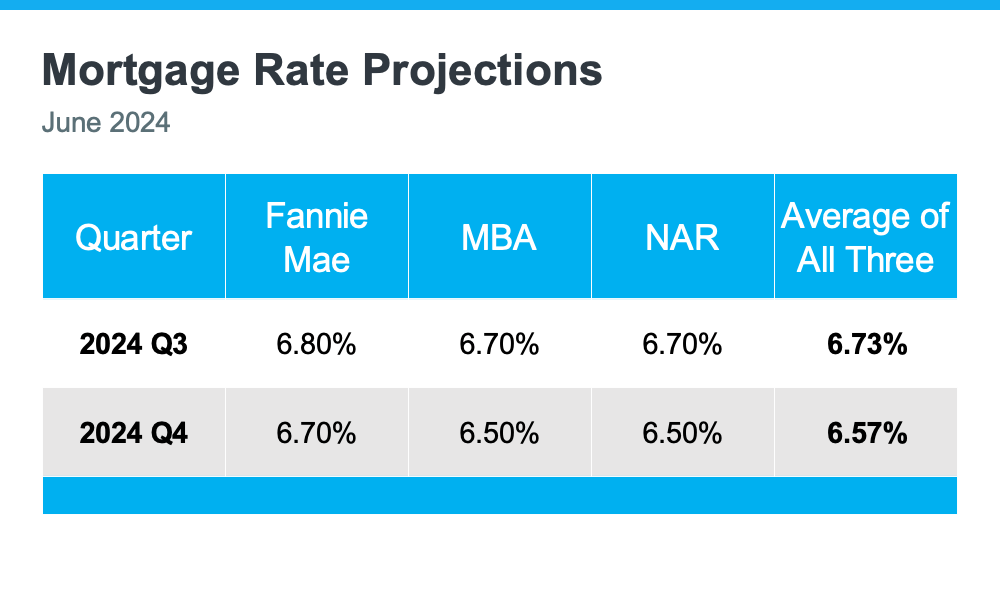

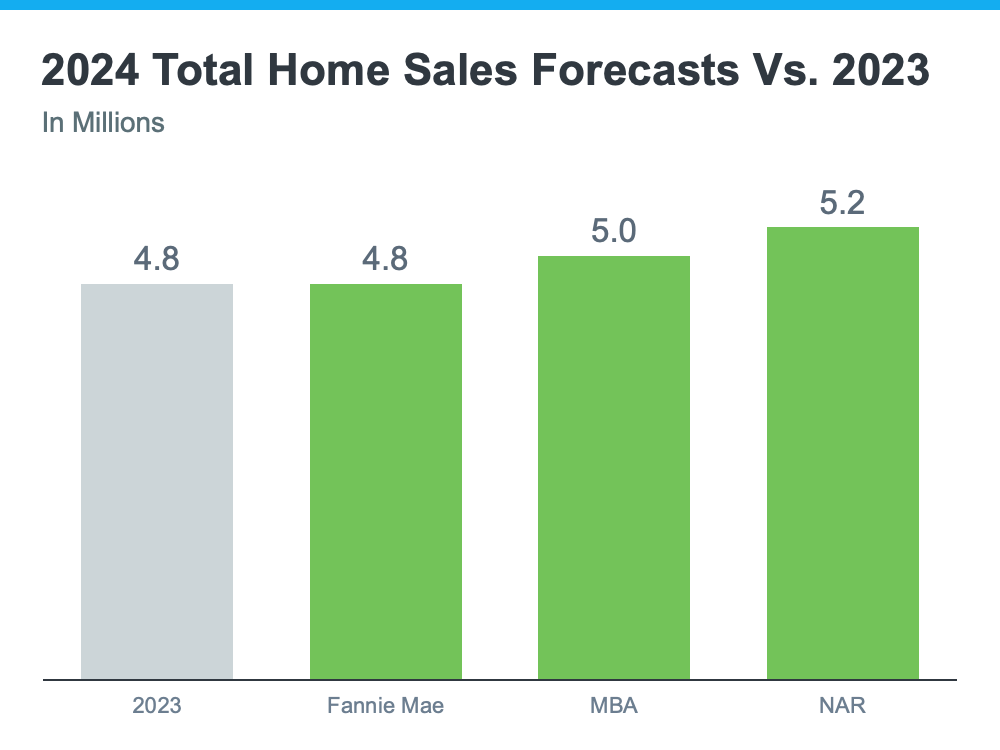

Today’s high mortgage rates combined with continually rising home prices mean it’s tough for a lot of people to afford a home right now. That’s why many interested buyers are moving to places where homes are less expensive, and the cost of living is lower. As Orphe Divounguy, Senior Economist at Zillow, explains:

“Housing affordability has always mattered . . . and you’re seeing it across the country. Housing affordability is reshaping migration trends.”

If you’re hoping to buy a home soon, it might make sense to broaden your search area to include places where homes that fit your needs are more affordable. That’s what a lot of other people are doing right now to find a home within their budget. Extra Space Storage explains:

“55% of American adults are looking to relocate to a different state or city for more affordable homes and lower costs of living. . . Specifically, states with a strong economy, lower costs of living, and remote work options continue to be the ideal places to live in the U.S.”

Remote Work Opens Up More Home Options

If you work remotely or drive into the office only a few times each week, you have many more possibilities when looking for your next home. That’s because you can cast a broader net and include more suburban or rural areas nearby. As Market Place Homes says:

“People start to reconsider where they want to live when commute times are slashed in half or eliminated altogether. If they have a longer commute but don’t have to do it daily, they may feel like they can tolerate living farther away from their job. Or, if someone works entirely remotely, they can move to a cheaper area and get a lot of house for their dollar.”

How a Real Estate Agent Can Help

A real estate agent can help you find the perfect home for your budget. They’re especially valuable if you’re moving to a new, unfamiliar area. Bankrate says:

“If you’re moving far away, you may not have a good idea about which neighborhoods or towns will be the best fit. An experienced local agent can help you find the lifestyle you’re looking for in a home you can afford.”

So, if you’re thinking about relocating to somewhere with more affordable homes, what are you waiting for? With the added flexibility of remote work, you might have more options than before.

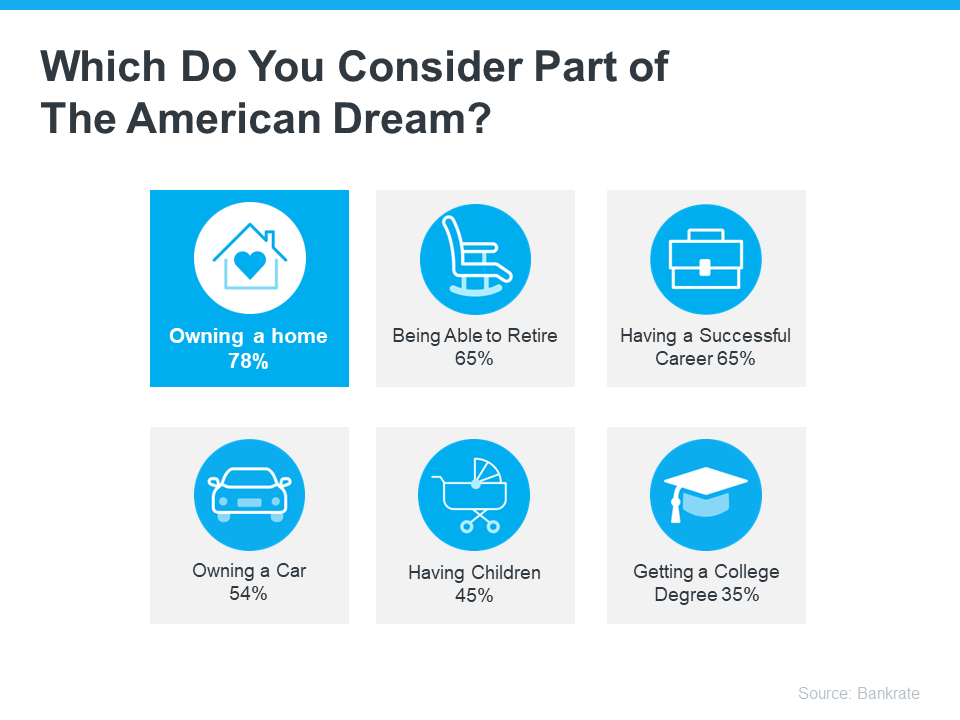

Bottom Line

Dreaming of a place where your money goes further? Let’s connect so you have someone to help you find your next home. Together, we’ll make your dream of homeownership a reality.