Don’t Believe Everything You Read About Home Prices

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way?

It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. You may be hearing people in your own life saying they’re worried about home prices or see on social media that some influencers are saying prices are going to come tumbling down.

If you’re someone who still thinks prices are going to fall, ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market?

The answer is simple. Listen to the professionals who specialize in residential real estate.

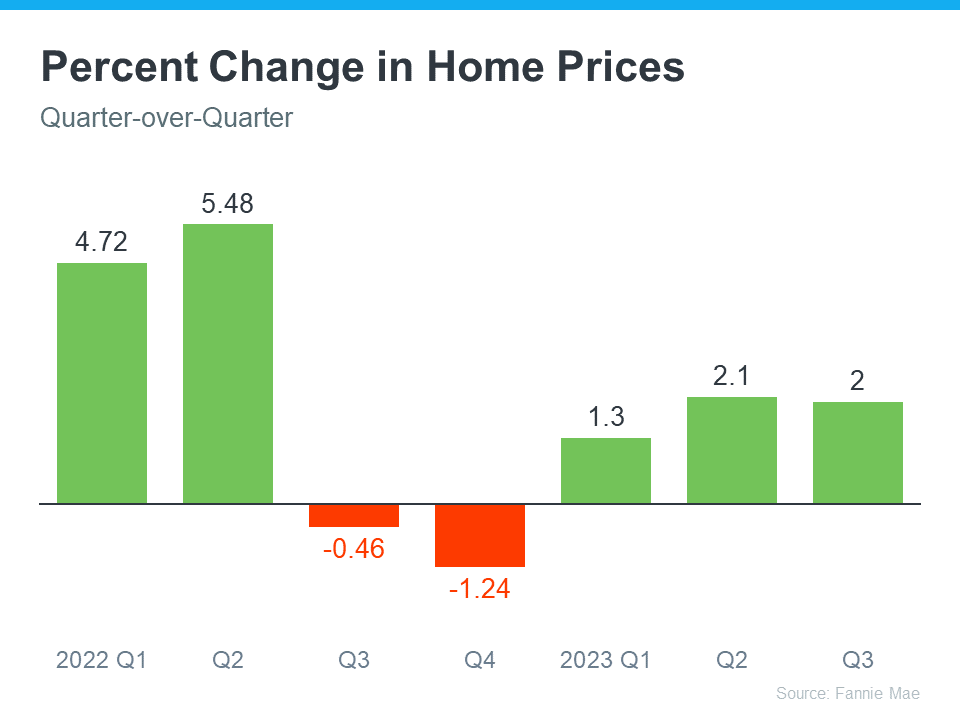

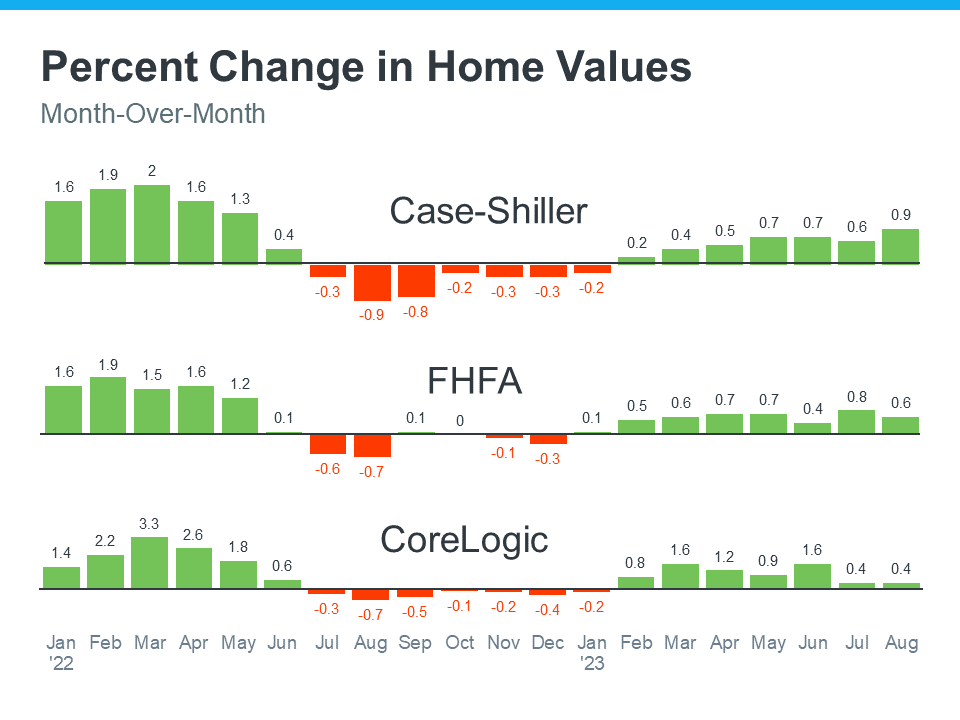

Here’s the latest data you can actually trust. Housing market experts acknowledge that nationally, prices did dip down slightly late last year, but that was short-lived. Data shows prices have already rebounded this year after that slight decline in 2022 (see graph below):

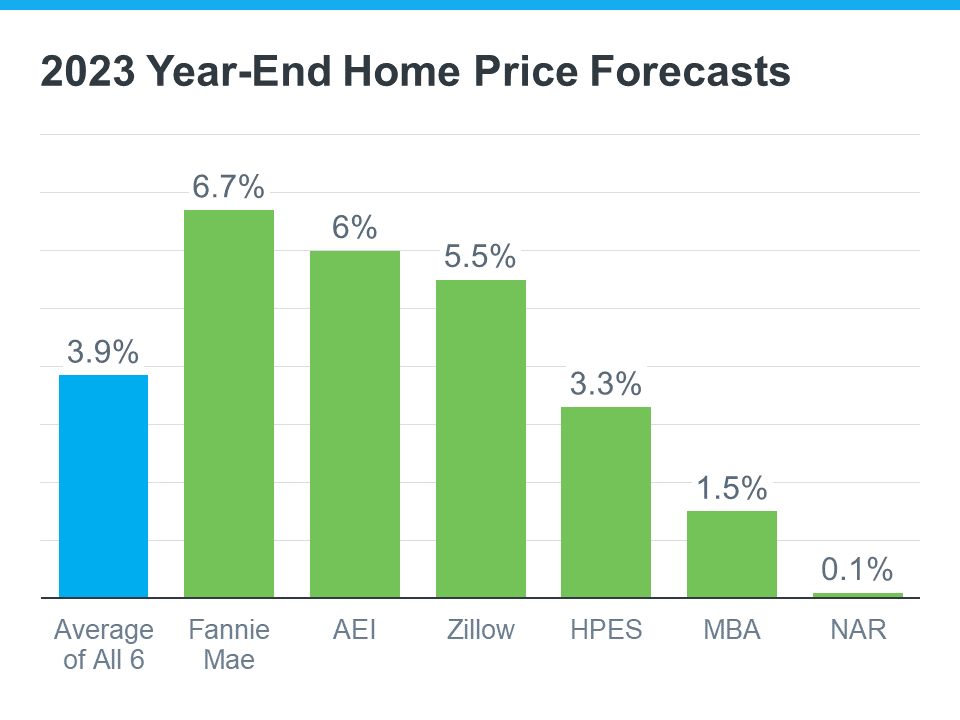

But it’s not just Fannie Mae that’s reporting this bounce back. Experts from across the industry are showing it in their data too. And that’s why so many forecasts now project home prices will net positive this year – not negative. The graph below helps prove this point with the latest forecasts from each organization:

What’s worth noting is that, just a few short weeks ago, the Fannie Mae forecast was for 3.9% appreciation in 2023. In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will net positive this year.

So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing.

Bottom Line

There’s been a lot of misleading information about home prices over the past year. And that’s still having an impact on how people are feeling about the housing market today. But it’s best not to believe everything you hear or read.

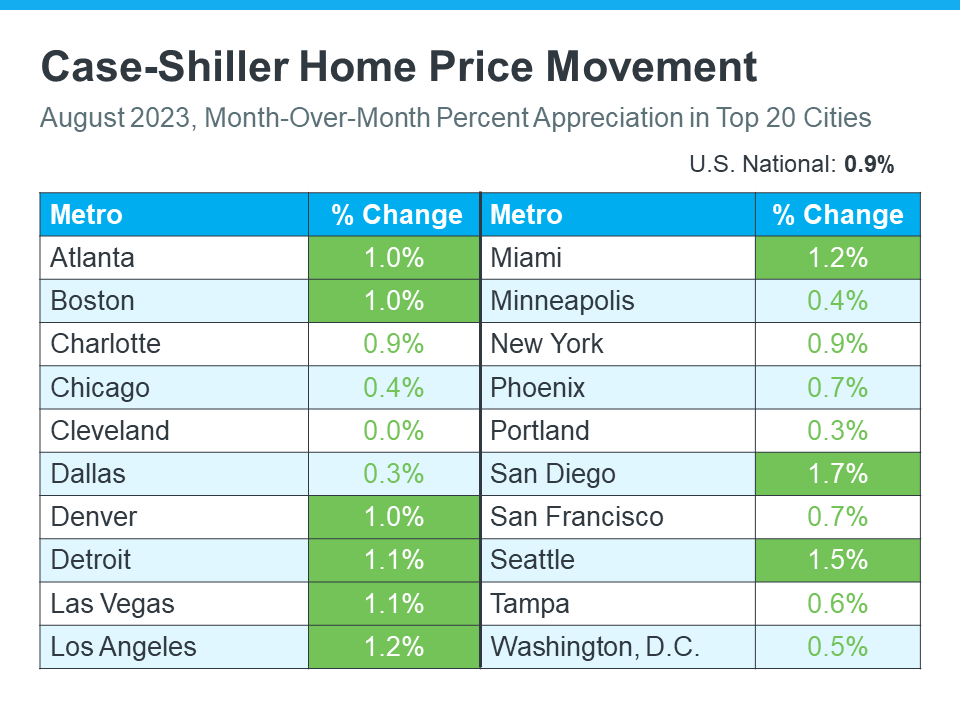

If you want information you can trust, turn to the real estate experts. Their data shows home prices are on the way back up and will net positive for the year. If you have questions about what’s happening in our local area, let’s connect.