Strategic Tips for Buying Your First Home

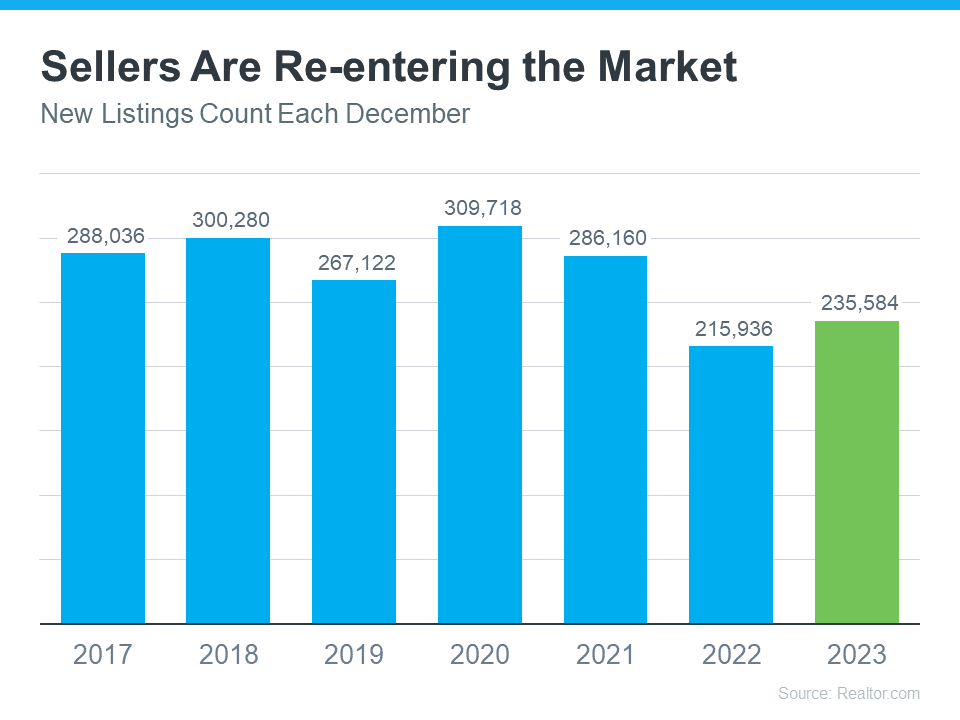

Buying your first home is a big, exciting step and a major milestone that has the power to improve your life. As a first-time homebuyer, it’s a dream you can make come true, but there are some hurdles you’ll need to overcome in today’s housing market – specifically the limited supply of homes for sale and ongoing affordability challenges.

So, if you’re ready, willing, and able to buy your first home, here are three tips to help you turn your dream into a reality.

Save Money with First-Time Homebuyer Programs

Paying the initial costs of homeownership, like your down payment and closing costs, can feel a bit daunting. But there are many assistance programs for first-time homebuyers that can help you get a loan with little or no money upfront. According to Bankrate:

“. . . you might qualify for a first-time homebuyer loan or assistance. First-time buyer loans typically have more flexible requirements, such as a lower down payment and credit score. Many help buyers with closing costs and the down payment through grants and low-interest loans.”

To find out more, talk to your state’s housing authority or check out websites like Down Payment Resource.

Expand Your Options by Looking at Condos and Townhomes

Right now, there aren’t enough homes for sale for everyone who wants to buy one. That’s pushing home prices up and making affordability tight for buyers. One way to deal with that issue and find a home right now is to consider condos and townhomes. Realtor.com explains:

“For many newbies, it might just be a matter of making a shift toward something they can better afford—like a condo or townhome. These lower-cost homes have historically been a stepping stone for buyers looking for a less expensive alternative to a single-family home.”

One reason why they may be more affordable is because they’re often smaller. But they still give you the chance to get your foot in the door and achieve your goal of owning a home and building equity. And that equity can help fuel your move into a larger home later on if you decide you need something bigger in the future. Hannah Jones, Senior Economic Analyst at Realtor.com, says:

“Condos can help prospective homebuyers who perhaps have a smaller budget, but who are really determined to get a foothold in the market and start to accumulate some equity. It can be a really great entry point.”

Consider Pooling Your Resources To Buy a Multi-Generational Home

Another way to break into the market is by purchasing a home with friends or loved ones. That way you can split the cost of things like the mortgage and bills, to make it easier to afford a home. According to Money.com:

“Buying a home with another person has some obvious advantages in the mortgage department. With two incomes in the mix, buyers can likely qualify for a larger mortgage — a big help in today’s high-cost market.”

Bottom Line

By exploring first-time homebuyer assistance, condos, townhomes, and multi-generational living, it can be easier to find and buy your first home. When you’re ready, let’s connect.