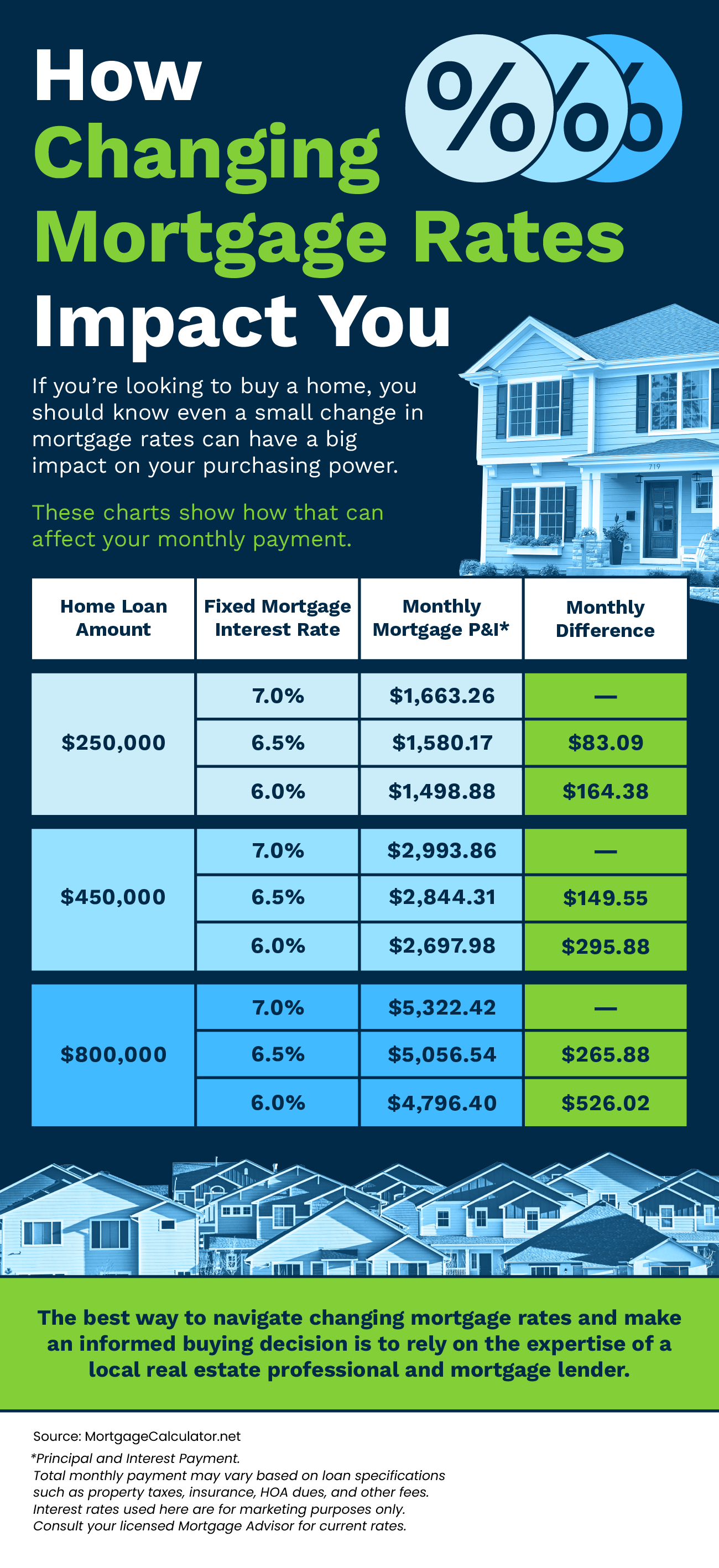

How Changing Mortgage Rates Impact You [INFOGRAPHIC]

Some Highlights

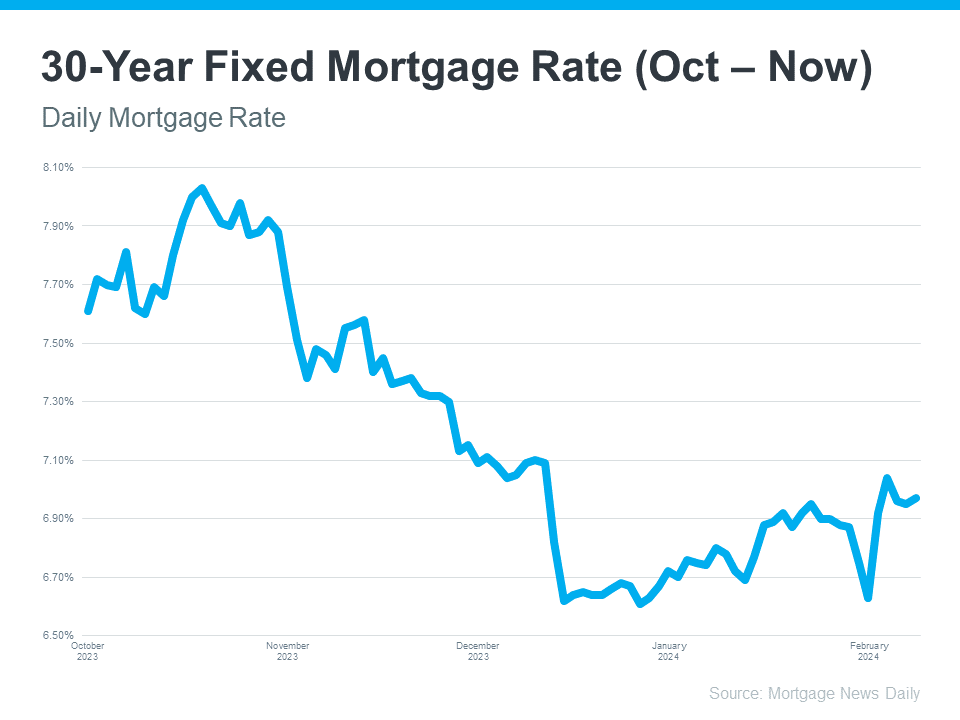

- If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month.

- That’s because even a small change in mortgage rates can have a big impact on your purchasing power.

- The best way to navigate changing mortgage rates and make an informed buying decision is to rely on the expertise of a local real estate professional and mortgage lender.