Savings Strategies Every First-Time Homebuyer Needs To Know

If homeownership is on your goal sheet for your future, you’re probably working on your savings. And a big priority is making sure you’ve got a plan in place for things like your closing costs, down payment, and more.

Here are a few strategies that can help speed up that process.

Budget and Track Your Expenses: To start, create a detailed budget that tracks the money you’ve got coming in and the money going out. This’ll give you a better look at your finances as a whole.

Cut Down on Unnecessary Spending: Now that you have your budget sheet done and you know how you’re spending your money, look for any line items that aren’t absolutely essential. If you cut down on those, you can re-allocate that cash toward buying a home. Even the little things can add up. As the National Association of Realtors (NAR) says:

“The majority of first-time buyers did make financial sacrifices to purchase a home. For those who did, the most common sacrifices buyers reported were cutting spending on luxury goods, entertainment, and clothes.”

Automate Your Savings: Once you know how much you want to set aside for your homebuying budget, look for ways to make it easy. If you have to transfer money manually, you may forget to do it. But getting some automatic transfers set up helps drive consistency and removes the temptation to spend it elsewhere. Realtor.com explains:

“If you’re struggling to put enough money away because of the constant temptations to blow your paycheck, consider automating the process. Ask your employer if you can have your paycheck deposited into multiple accounts—if so, instruct it to send a certain percentage of your salary directly into your savings account. Or go through your bank . . .”

Lean into Any Side Hustles You Have: Do you have a gig you do (or have done before) to net some extra cash? Taking on part-time work, freelance jobs, or picking up a side hustle can help give your savings a boost.

Put any Unexpected Cash To Good Use: If you get any sudden windfalls, like a tax refund, bonus, inheritance, or cash gift from family, put it toward your house fund.

By using these strategies and focusing on your savings over time, you can make sure you’re well on the path to having what you need to buy your first home. As Ramsey Solutions says:

“Budgeting shows your money who’s in charge (that’s you). It gives you the power to tell your money where to go instead of having to wonder where it went. It’s how you make any money goals happen—like saving for a down payment.”

Bottom Line

If you need more strategies for getting ready to buy, let’s connect.

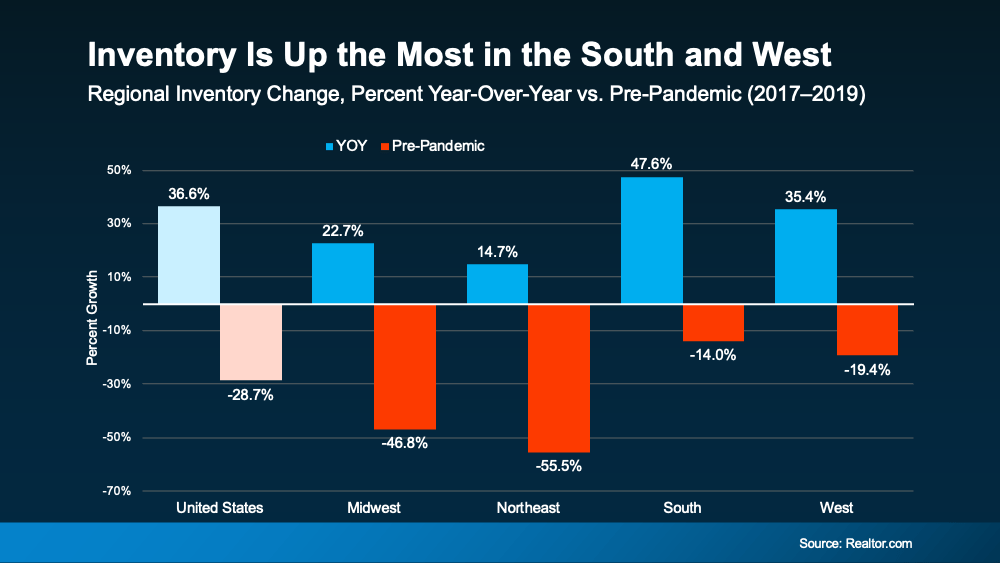

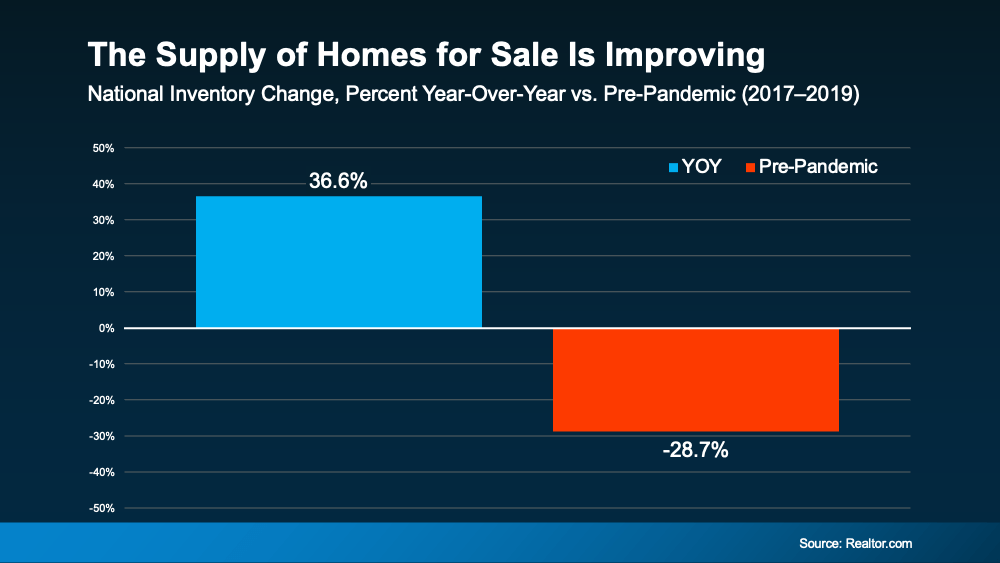

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.