Home Prices Still Growing – Just at a More Normal Pace

If you’re feeling a bit muddy on what’s happening with home prices, that’s no surprise. Some people are still saying prices are falling, even though data proves otherwise. Part of that misconception is because people are getting their information from unreliable sources. But it’s also coming from some media coverage misrepresenting what the data really shows.

So, to keep things simple, here’s what you really need to know using real data you can trust.

Normal Home Price Seasonality Explained

In the housing market, there are predictable ebbs and flows that happen each year. It’s called seasonality. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach.

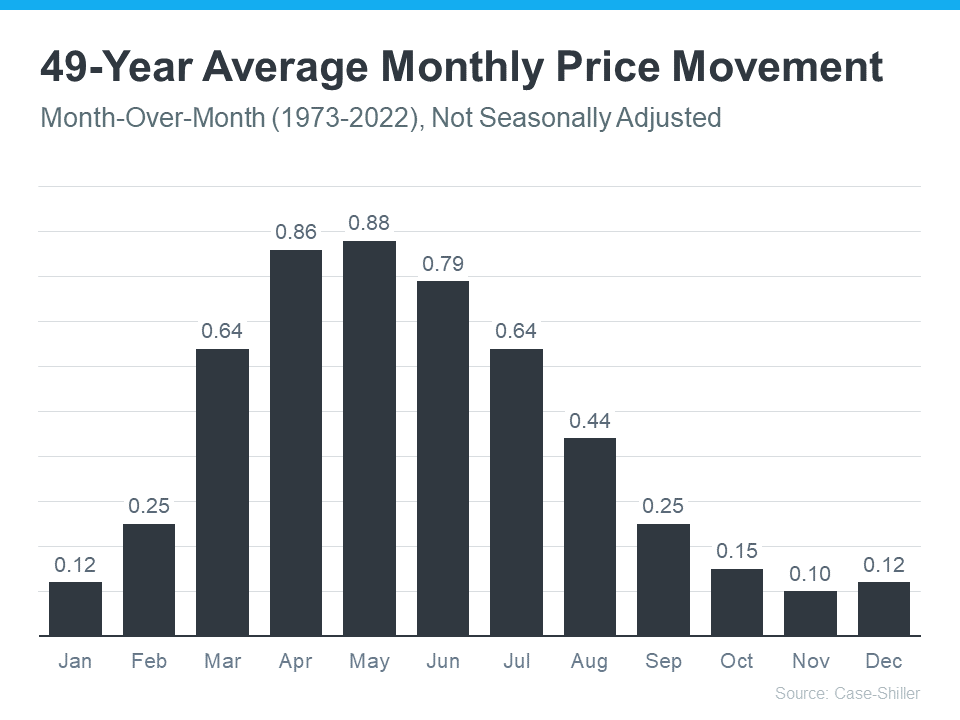

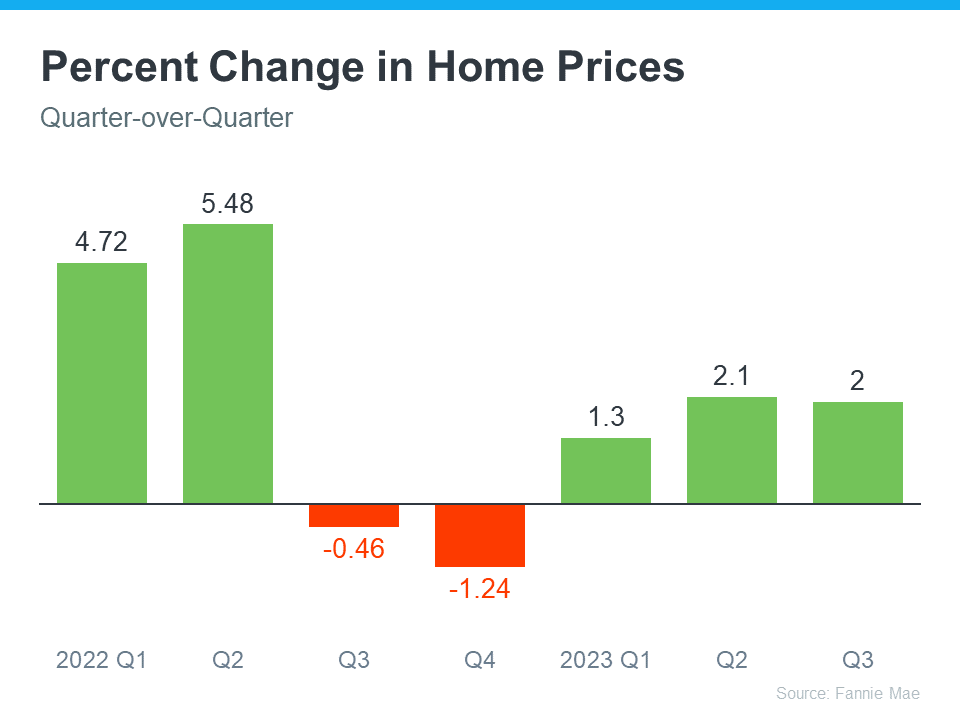

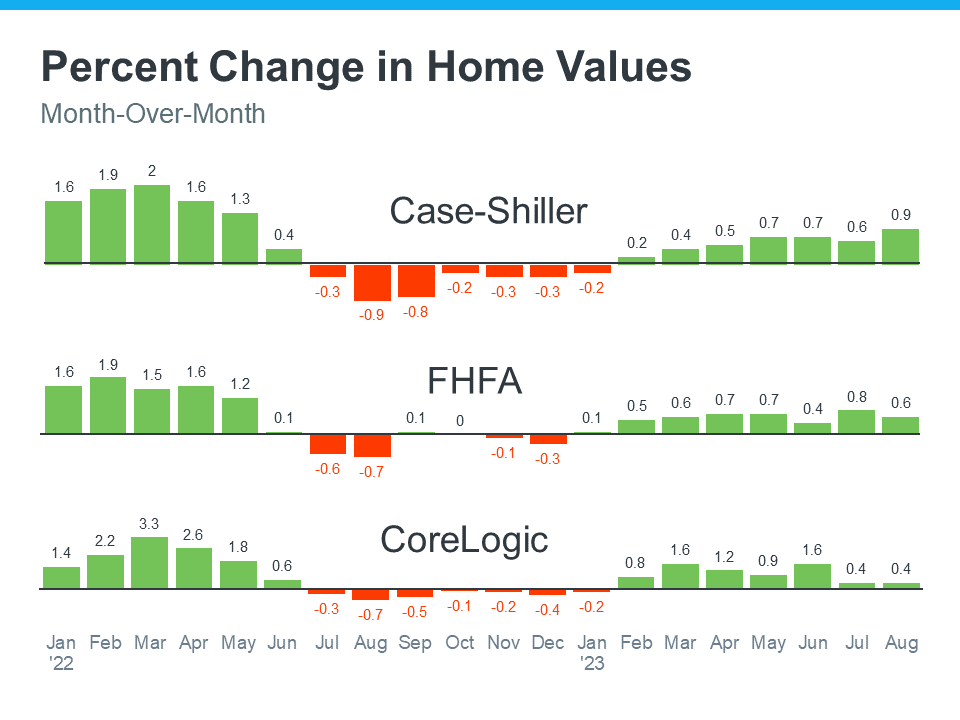

Home prices follow along with seasonality because prices appreciate most when something is in high demand. That’s why there’s a reliable long-term home price trend. The graph below uses data from Case-Shiller to show the typical percent change for monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do when entering the spring and summer markets. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, prices still grow, just at a slower pace as activity eases again.

This Year, Seasonality Has Returned

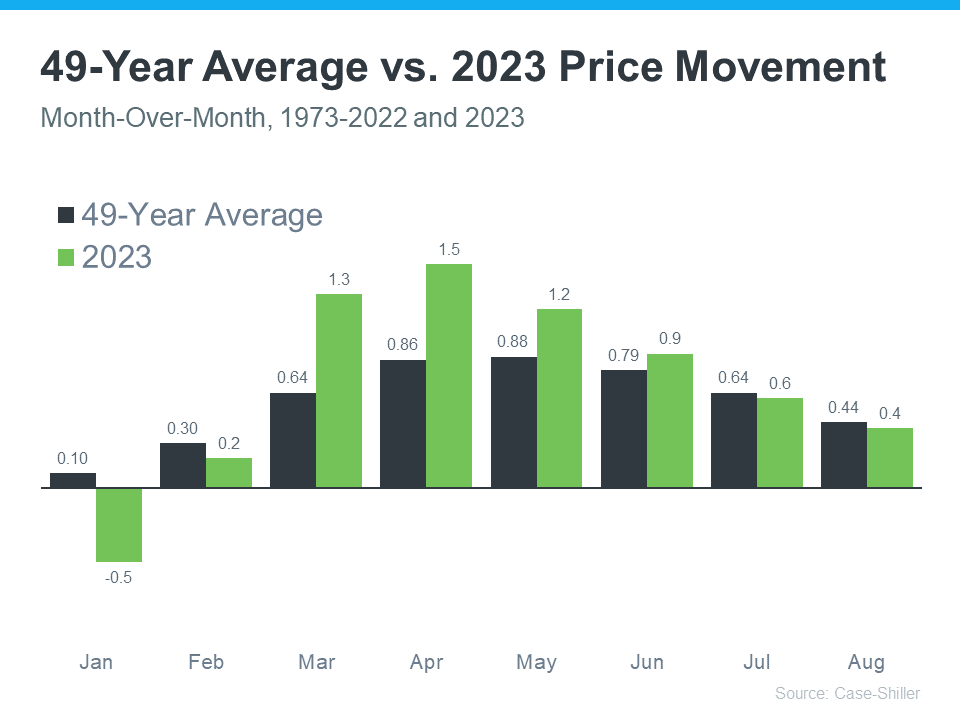

Now, let’s look at how this year compares to that long-term trend (see graph below):

Here’s the latest data for this year from that same source. Just like before, the dark bars are the long-standing trend. The green bars represent what’s happened this year. As you can see, the green bars are beginning to fall in line with what’s normal for the market. That’s a good thing because it’s more sustainable price growth than we’ve seen in recent years.

In a nutshell, nationally prices aren’t falling, it’s just that price growth is beginning to normalize. Moving forward, there’s a chance the media will misrepresent this slowing of home price growth as prices falling. So don’t believe everything you see in the headlines. The data included here gives you the context you need to really understand what’s happening. So, if you see something in the headlines that’s confusing, don’t just take it at face value. Ask a trusted real estate professional for more information.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Bottom Line

Home price appreciation is returning to normal seasonality and that’s a good thing. If you have questions about what’s happening with prices in our local area, let’s connect.