If Your House Hasn’t Sold Yet, It May Be Overpriced

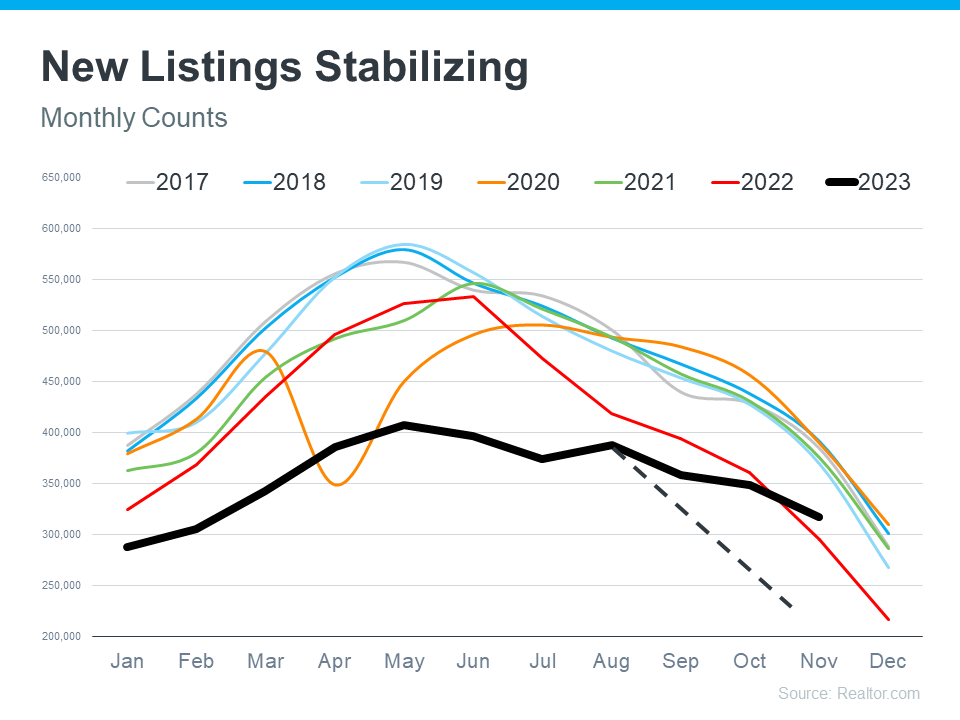

Has your house been sitting on the market a while without selling? If so, you should know that’s pretty unusual, especially right now. That’s because the supply of homes available for sale is still far lower than what we’d see in a normal year. That means buyers have fewer options than they usually would, so your house should be an oasis in an inventory desert.

So, if homebuyers have limited choices and your house still hasn’t sold, there’s a reason why. Let’s break one potential sticking point that may be turning buyers away: your asking price.

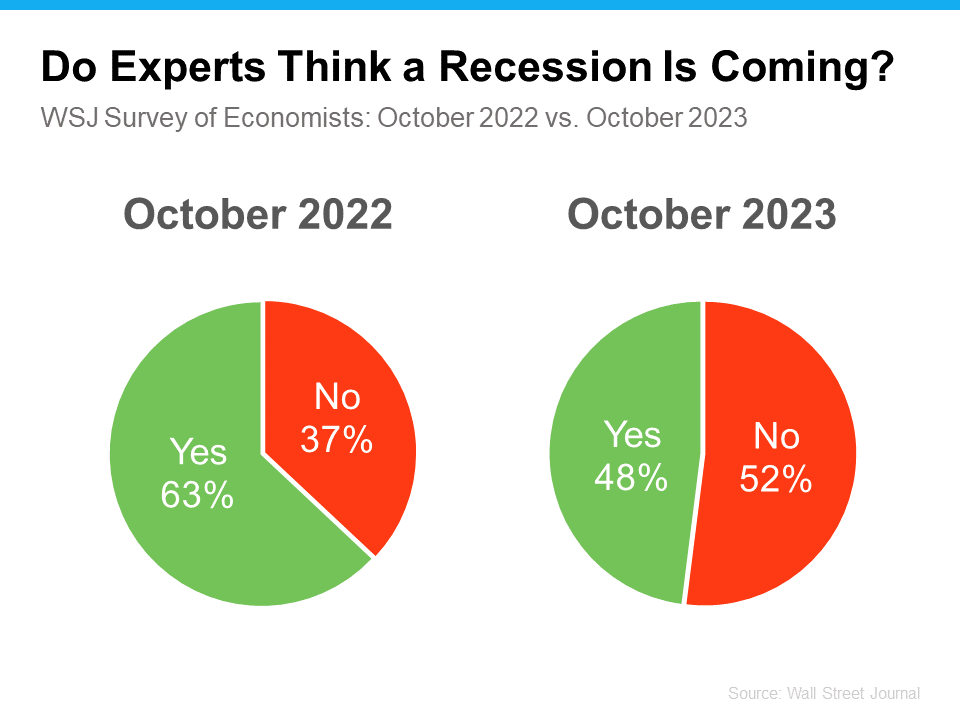

Especially with today’s higher mortgage rates already putting a stretch on their budget, buyers are being a bit more sensitive about price. As a recent article from the Wall Street Journal (WSJ) says:

“If you are serious about selling your home now, don’t get greedy with the asking price. This is still a seller’s home market as there simply aren’t enough affordable homes for sale in many parts of the country. But with average 30-year mortgage rates above 6%, buyers are much more price-sensitive than they were a year ago.”

Why Setting the Right Price Matters

While you want to maximize the return on your investment when you sell your house, you also need to be realistic based on current market conditions. The simple truth is your house is only going to sell for what people are willing to pay right now.

This can be a hard thing to accept. Especially since emotions can run high during the selling process, which only complicates matters more. After all, you may have lived in this house for years, so it’s only natural you’re emotionally tied to it – and those heartstrings can make it harder to be objective.

But it’s important to acknowledge that a bigger-than-expected price tag deters buyers and may make them dismiss your house as a possibility before even seeing it. And if no one’s looking at it, how will it sell?

If you want to get your house sold, you’ll need to do something to spark interest in your home again. That’s where a local real estate agent comes in. They’ll help use data to find out if it’s priced too high for your local market. They balance the value of homes in your neighborhood, current market trends and buyer demand, the condition of your house, and more to find the right price for your house, so you can close this chapter and start your next one.

Bottom Line

While it’s true there aren’t that many homes available for sale right now, your home’s asking price still matters. And, if it’s not selling, it may be priced too high.