The Number One Mistake Sellers Are Making: Overpricing Their House

In today’s housing market, many sellers are making a critical mistake: overpricing their houses. This common error can lead to a home sitting on the market for a long time without any offers. And when that happens, the homeowner may have to drop their asking price to try to re-ignite buyer interest.

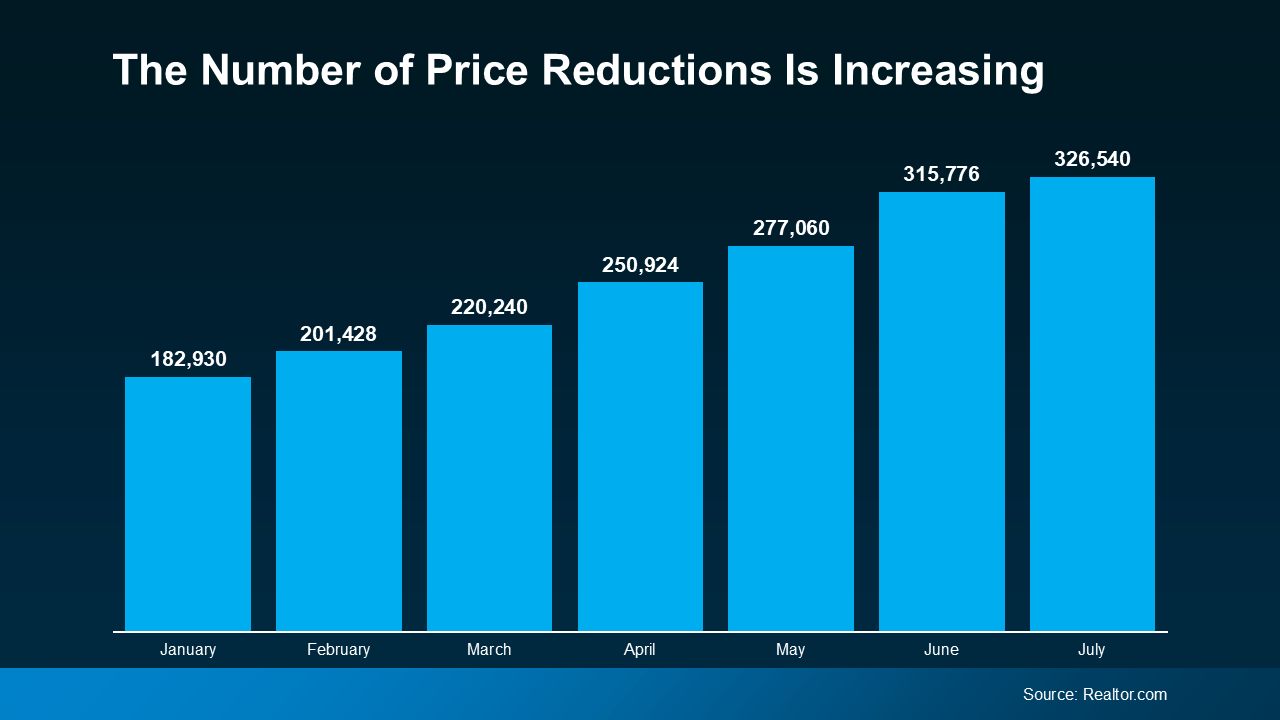

Data from Realtor.com shows the number of homeowners realizing this mistake and doing a price reduction is climbing (see graph below):

Not Paying Attention To Current Market Conditions

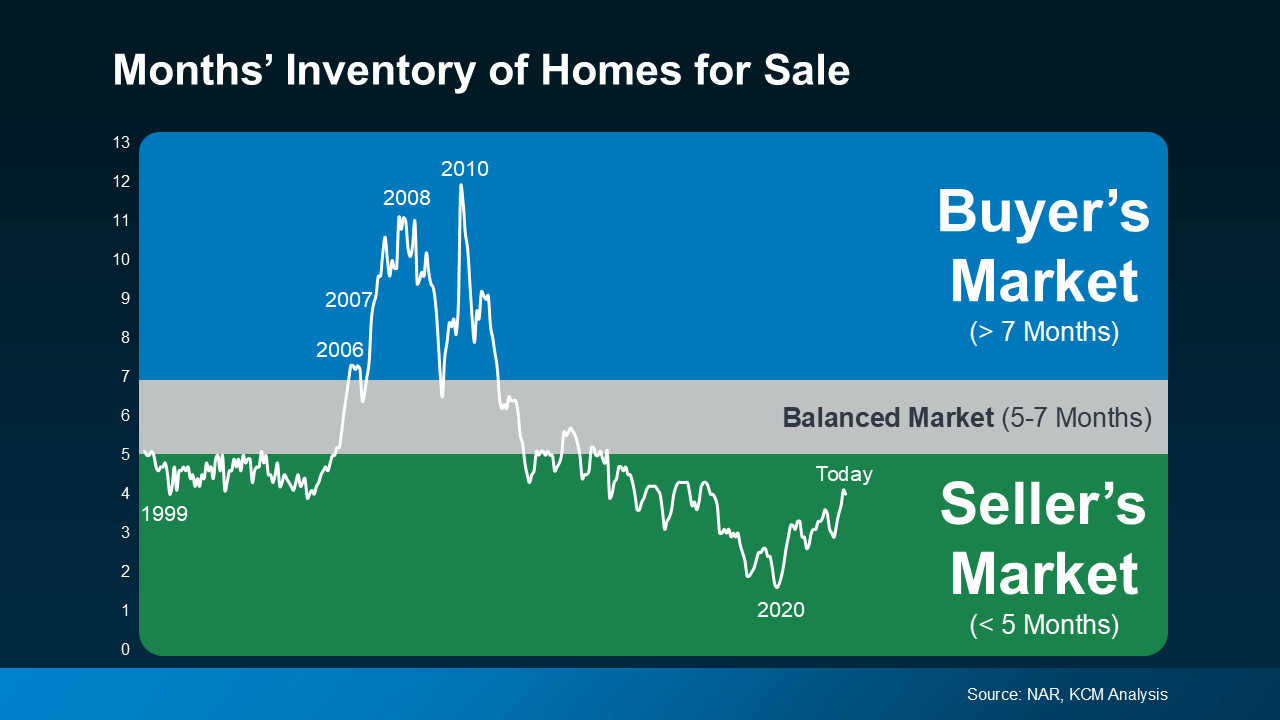

Understanding current market conditions is key to accurate pricing. You don’t want to set your asking price based on what happened during the pandemic. The market has moderated a lot since then, so it’s far better to align your price with today’s reality.

Real estate agents stay updated on market trends and how they impact the pricing strategy for your house.

Pricing It Based on What You Want To Make (Not What It’s Worth)

Another misstep is pricing it based on what you want to make on the sale, and not necessarily current market value. You may see other homes in your neighborhood selling for top dollar and assume yours can do the same. But you may not be considering differences in size, condition, and features. For example, maybe that other house is waterfront or has a finished basement. To sum it up, Bankrate explains:

“How do you find that sweet spot of pricing for profit but not overpricing? The expertise of your agent can be truly valuable here. A knowledgeable agent will understand fair market value in your area, how much your house is worth and how much you might reasonably expect to get for it in the current market.”

An agent will do a comparative market analysis (CMA) to make sure your house is compared with truly similar properties to get an accurate look at how it should be priced.

Pricing High to Leave Room for Negotiation

Another common, yet misguided strategy is to price your house high on purpose, so you have more room to negotiate down during the sale. But this can backfire. A price that seems too high often deters potential buyers from even considering the home. So rather than leaving room for negotiation, what you’ll actually be doing is turning buyers away. U.S. News Real Estate explains:

“You want to sell your house for top dollar, but be realistic about the value of the property and how buyers will see it. If you’ve overpriced your home, chances are you’ll eventually need to lower the number, but the peak period of activity that a new listing experiences is already gone.”

An agent can help you set a fair price that attracts buyers and encourages more competitive offers.

Bottom Line

Overpricing your home can have serious consequences. A knowledgeable real estate agent brings an objective perspective, in-depth market knowledge, and a strategic approach to pricing.

Let’s connect so you can avoid making a pricing mistake that’ll cost you.

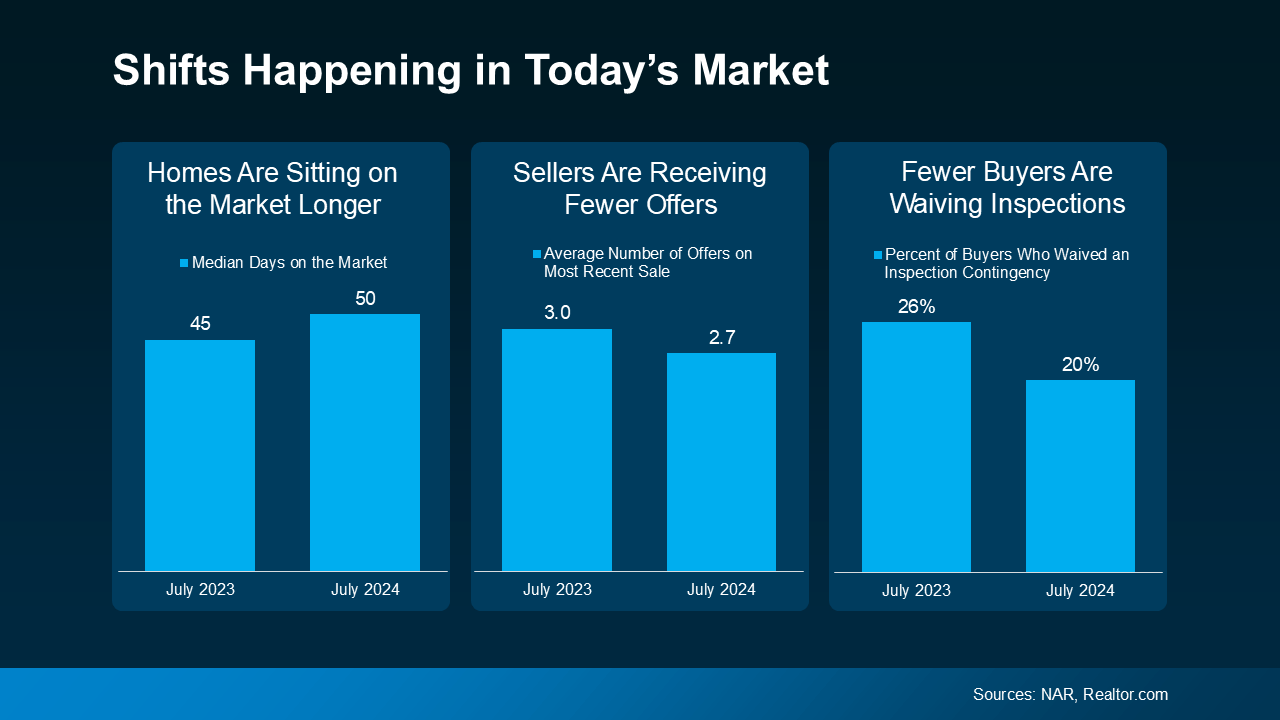

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to

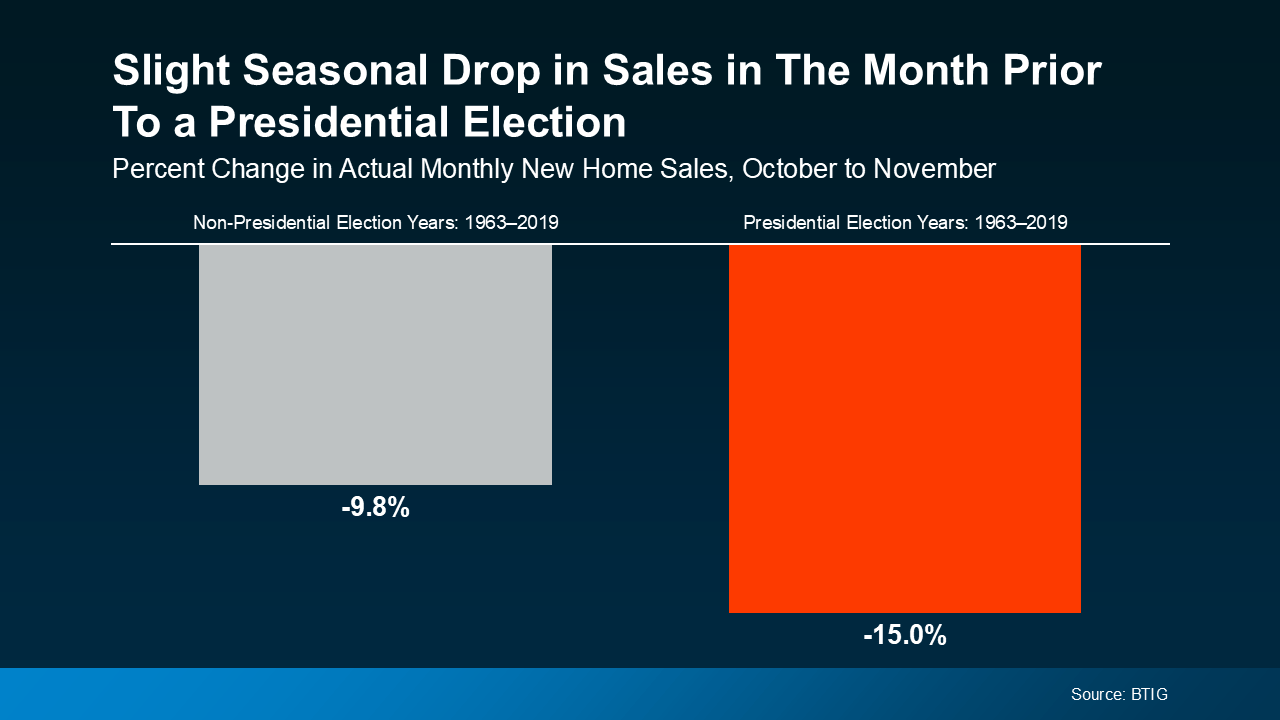

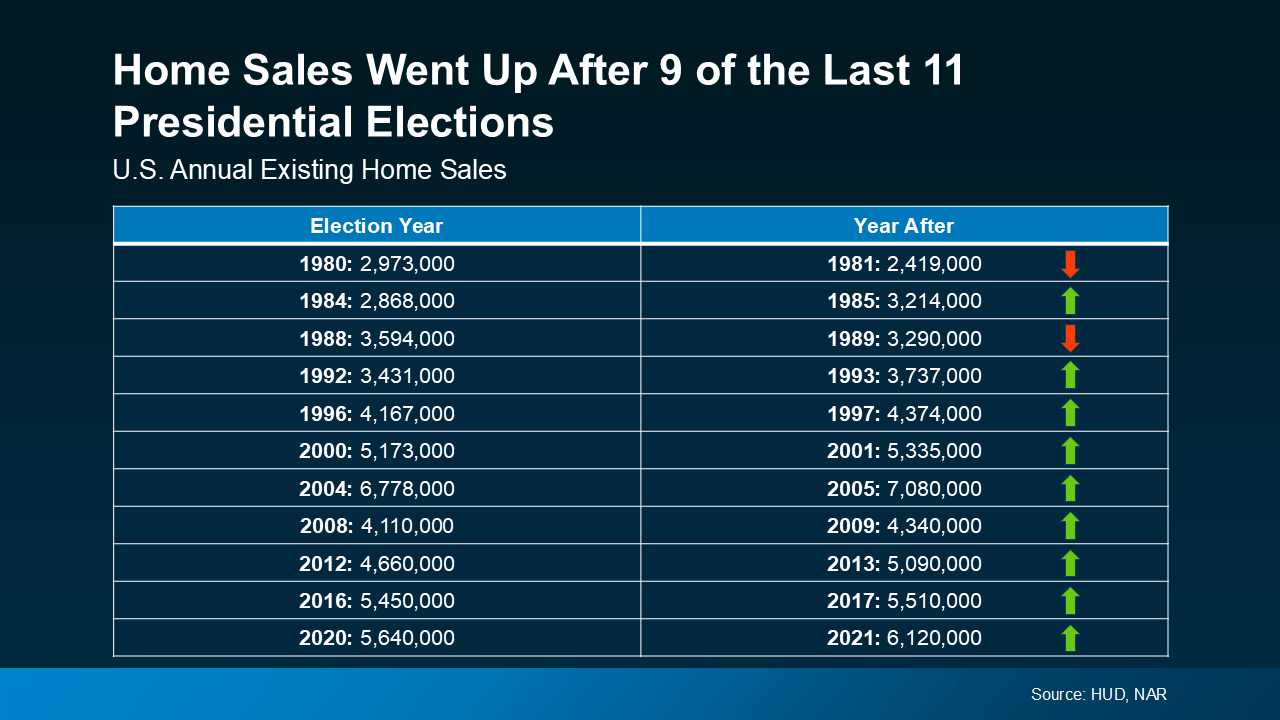

Some consumers will simply wait it out before they make their purchase decision. However, it’s important to know this slowdown is small and temporary.

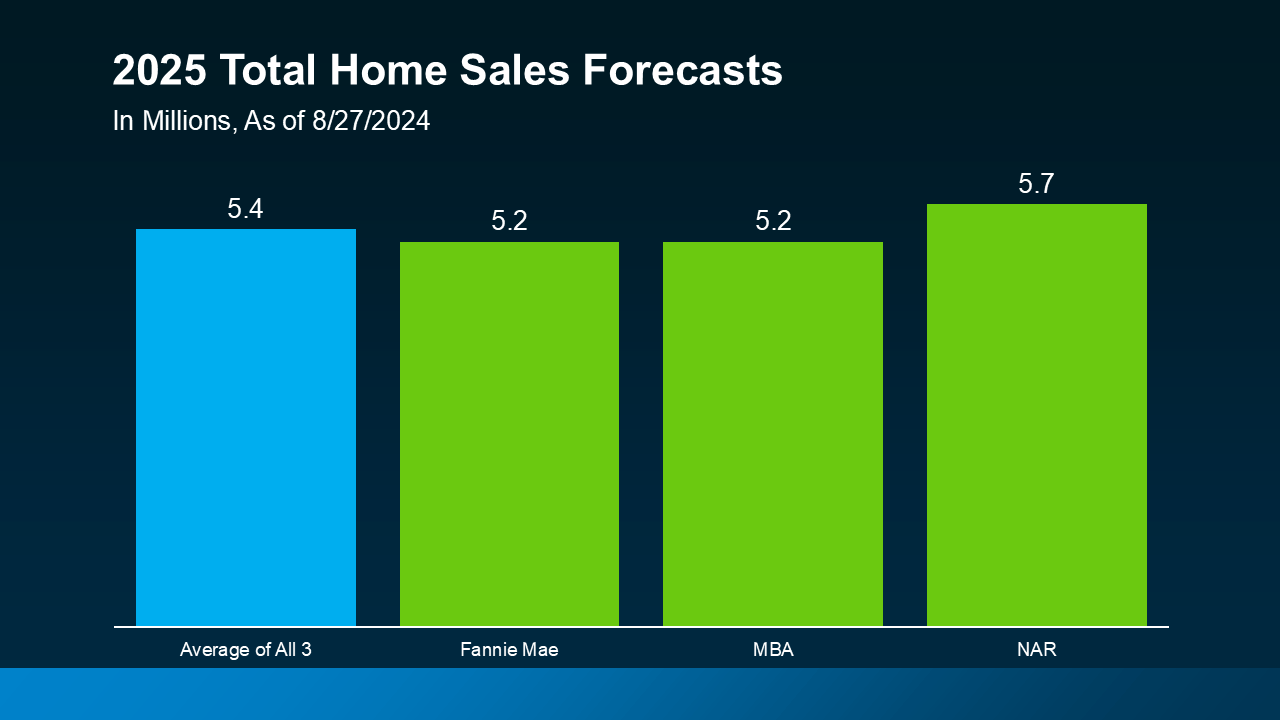

Some consumers will simply wait it out before they make their purchase decision. However, it’s important to know this slowdown is small and temporary. Home Prices

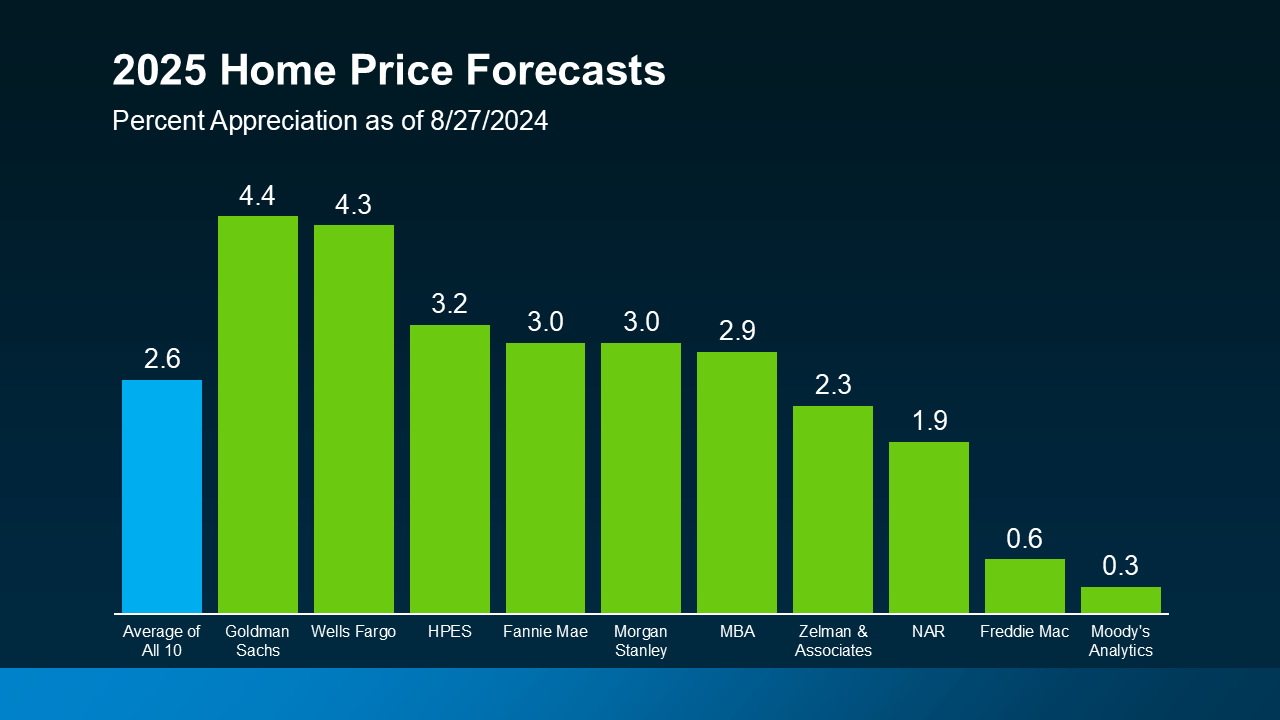

Home Prices