What Are the Real Reasons You Want To Move Right Now?

If you’re considering selling your house right now, it’s likely because something in your life has changed. And while things like mortgage rates play a big role in your decision, you don’t want that to overshadow why you thought about making a move in the first place.

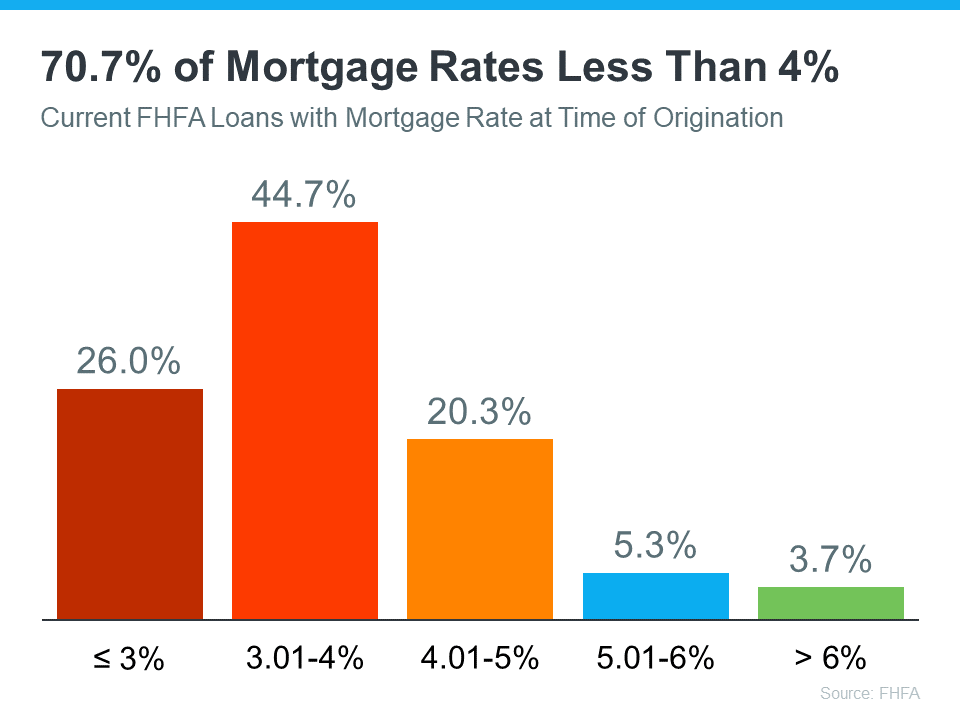

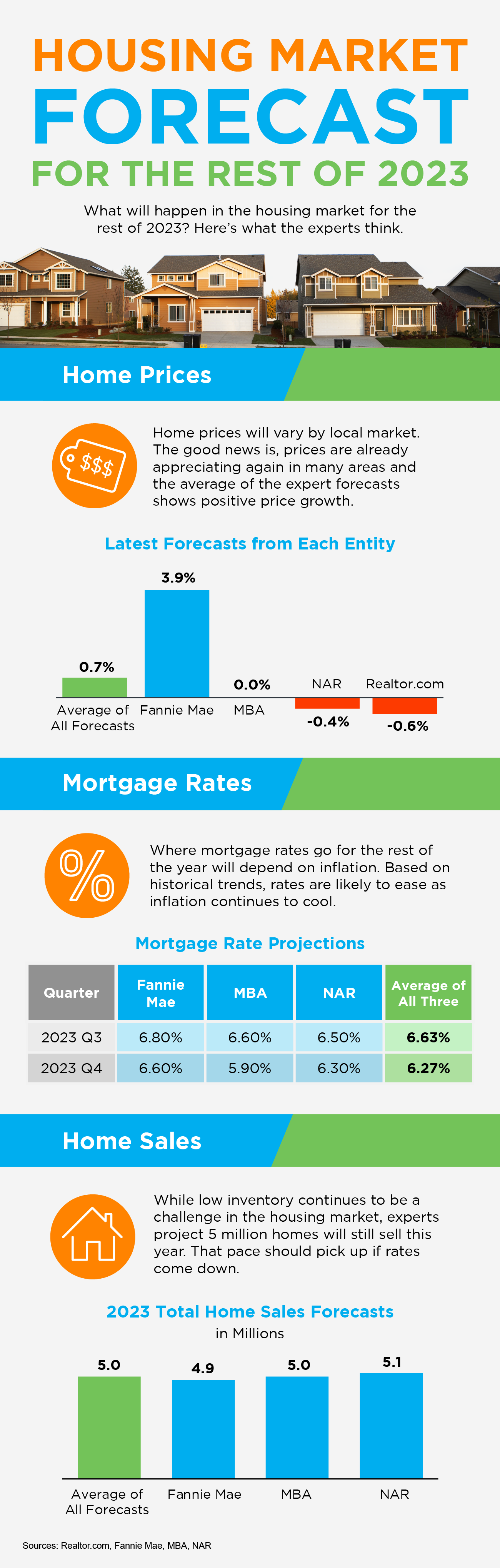

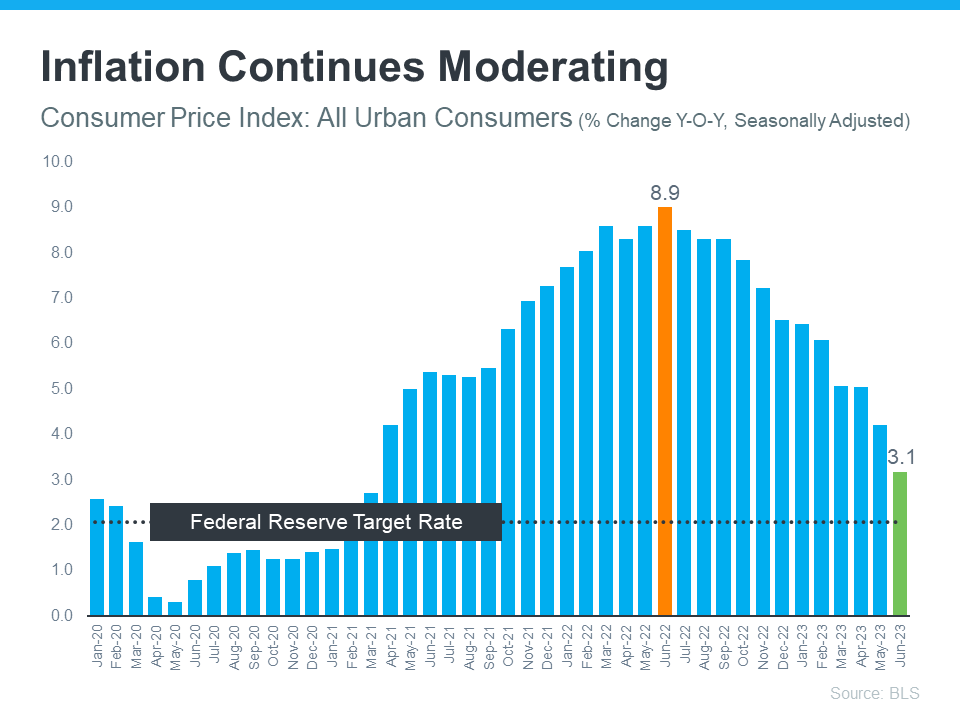

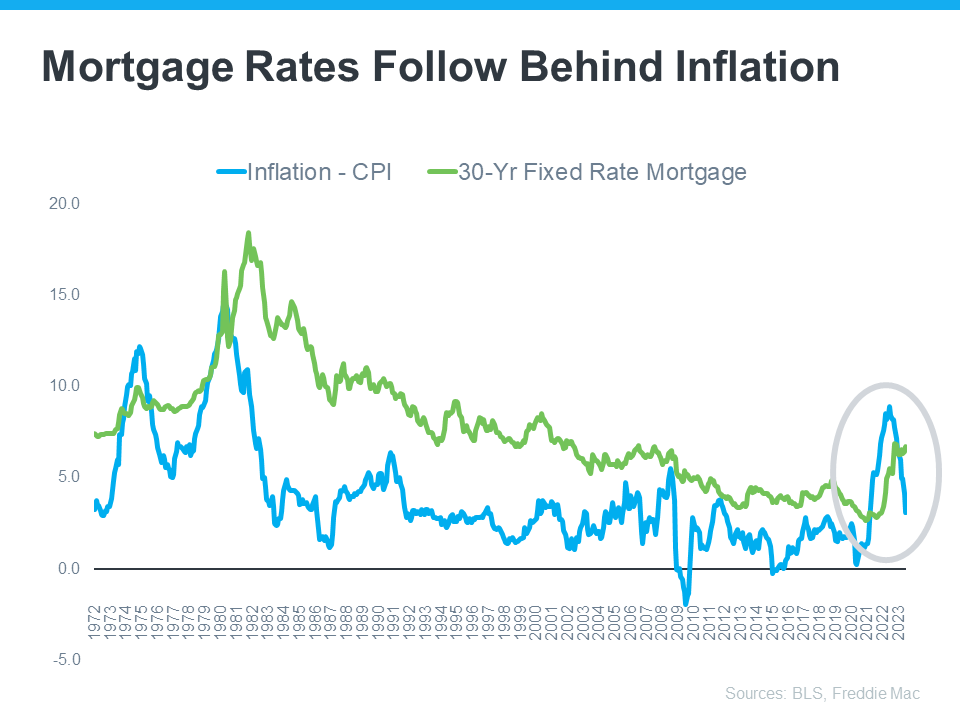

It’s true mortgage rates are higher right now, and that has an impact on affordability. As a result, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home.

But your lifestyle and your changing needs matter, too. As a recent article from Realtor.com says:

“No matter what interest rates and home prices do next, sometimes homeowners just have to move—due to a new job, new baby, divorce, death, or some other major life change.”

Here are a few of the most common reasons people choose to sell today. You may find any one of these resonates with you and may be reason enough to move, even today.

Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in your ideal location, or just looking for a change in scenery.

For example, if you just landed your dream job in another state, you may be thinking about selling your current home and moving for work.

Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and your household is growing, it may be time to find a home that better fits those needs.

Downsizing

Homeowners may also decide to sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move somewhere warmer with less house to maintain. A different home may be better suited for your new lifestyle.

Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and getting a place of your own may be a better option.

Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their house to find one that works better for them.

For example, you may be looking to sell your house and use the proceeds to help pay for a unit in an assisted-living facility.

With higher mortgage rates and rising prices, there are some affordability challenges right now – but your needs and your lifestyle matter too. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you want to sell your house and find a new one that better fits your needs, let’s connect. That way, you’ll have someone to guide you through the process and help you find a home that works for you.