Homeownership: The Heart of the American Dream

Homeownership: The Heart of the American Dream

Everyone’s vision for the future is personal and unique. But for many, common goals include success, freedom, and prosperity — values closely tied to having your own home and the iconic feeling of achieving the American Dream.

A recent survey by Bankrate reveals exactly that: homeownership is still a part of the American Dream. The results show, at 78%, that owning a home tops the list, surpassing other significant milestones such as retirement, having a successful career, and more (see below):

So, why is buying a home important to so many today? One reason is the financial and physical security it provides. Many people see homeownership as a way to reduce stress because owning a home with a fixed-rate mortgage stabilizes what is likely their largest monthly expense.

Another factor is the potential for building wealth. That’s because, over time, homeowners gain equity as they pay down their mortgage and as home prices appreciate, leading to longer-term financial stability.

But what about the responsibilities that come with owning and maintaining a home? According to a survey by Entrata, only 23% of renters feel homeownership is too much work, indicating the majority are open to the commitments and obligations that come with being a homeowner.

What Does This Mean for You?

While buying a home today might seem daunting due to higher mortgage rates and rising home prices, the long-term benefits can make it worthwhile. If you’re considering homeownership, remember that it’s more than just a financial investment — it’s a step toward securing your future.

Bottom Line

Owning a home is a significant and powerful decision that represents a big part of the American Dream. If you’re ready to take this step, let’s connect so you have someone who can guide you through the process and help you make your homeownership goals a reality.

Real Estate Still Holds the Title of Best Long-Term Investment in Oxnard, California

Real Estate Still Holds the Title of Best Long-Term Investment

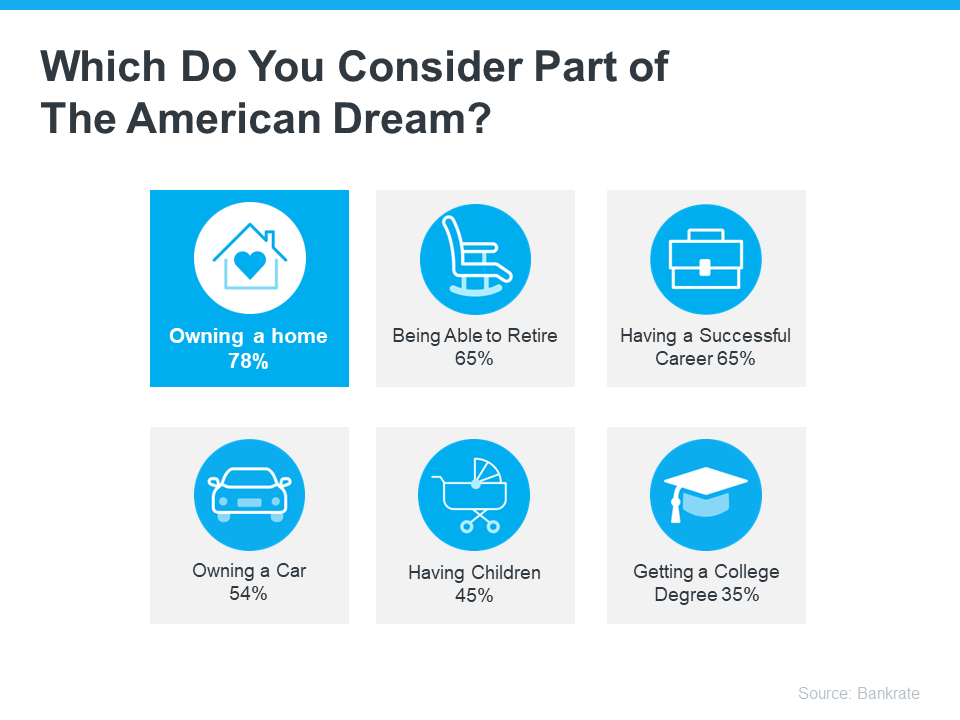

With all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now, or if it’s better to keep renting. Here’s some information that could help put your mind at ease by showing that investing in a home is still a powerful decision.

According to the experts at Gallup, real estate has been crowned the top long-term investment for a whopping 12 years in a row. It has consistently beat out other investment types like gold, stocks, and bonds. Just take a look at the graph below – it speaks volumes:

But why does real estate continue to reign supreme as a top-notch long-term investment? It’s because, even today, buying a home can be your golden ticket to building wealth over time.

Unlike other investments that can feel a bit like riding a rollercoaster with all the ups and downs and ongoing risk factors, real estate follows a more predictable and positive pattern.

History shows home values usually rise. And while prices may vary by market, that means as time goes by, your house is likely to appreciate in value. And that helps you grow your net worth in a big way. As an article from Realtor.com explains:

“Homeownership has long been tied to building wealth—and for good reason. Instead of throwing rent money out the window each month, owning a home allows you to build home equity. And over time, equity can turn your mortgage debt into a sizeable asset.”

So, if you’re on the fence about whether to rent or buy, remember that real estate was consistently voted the best long-term investment for a reason. And if you want to get in on that action, it may make sense to go ahead and buy (if you’re ready and able).

Bottom Line

When it comes to building wealth that stands the test of time, real estate is the name of the game. If you’re ready to start on your own journey toward homeownership, let’s connect today.

Housing Market Forecast for the 2nd Half of 2024 in Simi Valley, California [INFOGRAPHIC]

The Difference Between an Inspection and an Appraisal in Phoenix, Arizona

The Difference Between an Inspection and an Appraisal

When you decide to buy your first home, you may come across a number of terms and conditions you’re not familiar with. While you may have a general idea of what an inspection is, maybe you’re not sure why you need one or how it’s different from an appraisal. To keep it simple, here’s an explainer of each one and what they mean for you as a homebuyer.

Home Inspection

Once you’re under contract on a home you’d like to buy, getting an inspection is a key part of the process. An inspection gives you a clear idea of the safety and overall condition of the home – which is important for such a big transaction. As a recent Realtor.com article explains:

“A home inspection is something that protects your financial interest in what will likely be the largest purchase you make in your life—one in which you need as much information as possible.”

If anything is questionable in the inspection process – like the age of the roof, the state of the HVAC system, or just about anything else – you have the option to discuss and negotiate any potential issues or repairs with the seller before the transaction is final. And don’t worry – you don’t have to go through that process alone. Your real estate agent will be your advocate and negotiate with the seller for you.

Home Appraisal

While the inspection tells you about the current state of the house, an appraisal gives you its value. Bankrate explains:

“When buying or selling a home, an appraisal verifies that the sale price of the home is in line with fair market value. This ensures the homebuyer doesn’t pay more than the home is worth, and the mortgage lender doesn’t lend more than it is worth.”

Regardless of what you’re willing to pay for a house, if you’ll be using a mortgage to fund your purchase, the appraisal protects you from overpaying and the bank from lending you more than the home is worth.

And if there’s ever any confusion or discrepancy between the appraisal and the agreed-upon price in your contract, your trusted real estate professional will help you navigate any additional negotiations to try to close the gap.

Bottom Line

The inspection and the appraisal are different but equally important steps when buying a home – and you don’t need to manage them by yourself. Let’s connect today so you have expert guidance from start to finish.

Focus on Time in the Market, Not Timing the Market in Scottsdale, Arizona

Focus on Time in the Market, Not Timing the Market

Should you buy a home now or should you wait? That’s a big question on many people’s minds today. And while what timing is right for you will depend on a lot of other personal factors, here’s something you may not have considered.

If you’re able to buy at today’s rates and prices, it may be better to focus on time in the market, rather than timing the market.

The Downside of Trying To Time the Market

Trying to time the market isn’t a good strategy because things can change. Here’s an example. For the better part of this year, projections have said mortgage rates will come down. And while experts agree that’s still what’s ahead, shifts in various market and economic factors have pushed back the timing of when that’ll happen. Here’s how that’s impacted homebuyers who’ve been sitting on the sidelines. As U.S. News says:

“Those who put off buying a home during the past few years as they were holding out for lower mortgage rates have been left out of the market . . . mortgage rates have stayed higher for longer than previously expected, keeping monthly housing payments elevated. In other words, affordability didn’t improve for those who chose to wait.”

This is why timing the market may not pay off if you’re ready and able to buy now.

The Proof Is in the Pudding: How Homeowners Benefit from Rising Home Prices

Delaying your plans also means missing out on the equity you’d gain if you went ahead with your purchase today. And the potential equity gains that are at stake may surprise you.

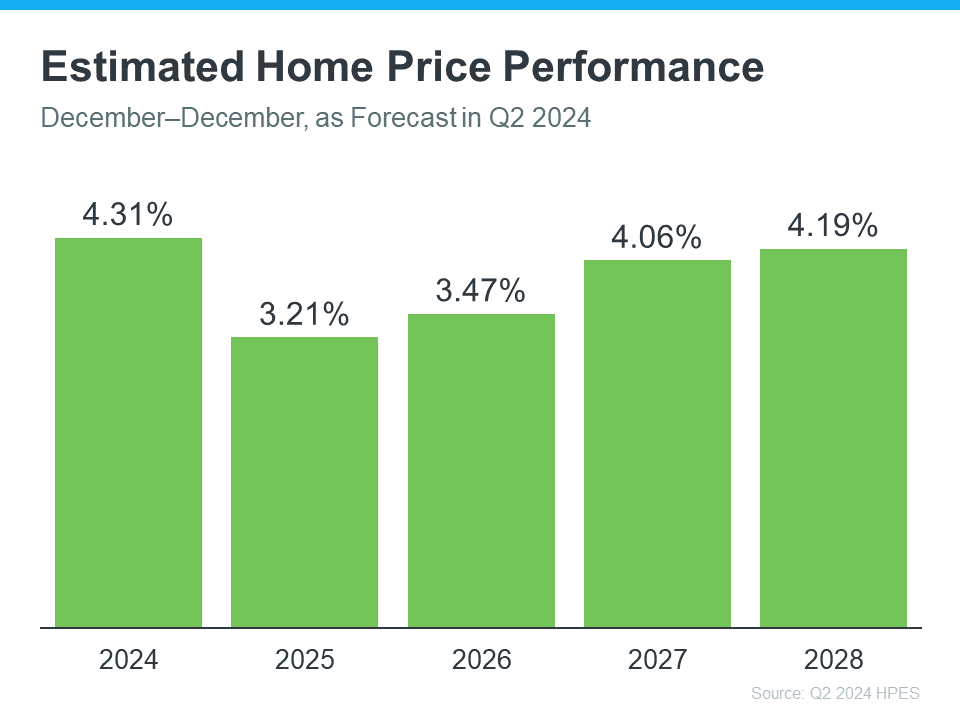

Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts are projecting home prices will continue to rise through at least 2028 (see the graph below):

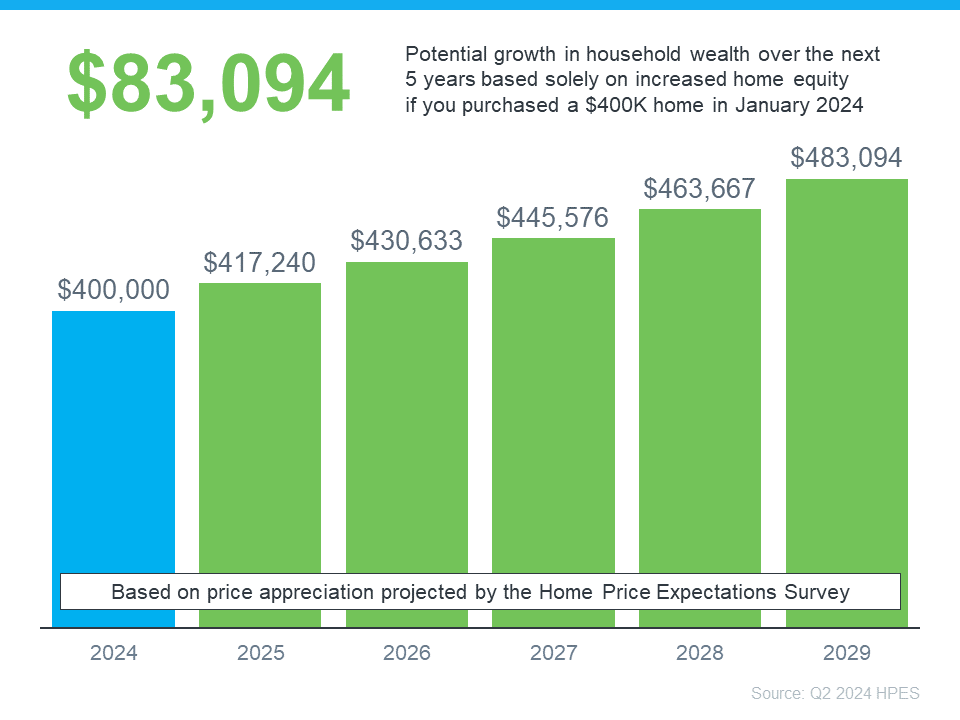

To give these numbers context, let’s take a look at a breakdown of what you stand to gain once you buy. The graph below uses a typical home’s value to show how a home could appreciate over the next few years using those HPES projections:

In this example, let’s say you went ahead and bought a $400,000 home at the beginning of this year. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number.

This data helps paint the picture of why time in the market really matters.

The Advice You Need To Hear If You’re Ready and Able To Buy Now

Right now, you may be focused on what’s happening with mortgage rates and how those impact your monthly payment, but don’t forget to factor in home prices.

Prices are expected to continue climbing, just at a more moderate pace. And while a moderate rise in prices may not be fun for you now, once you own a home, that growth will be a huge perk. That’s the time in the market piece.

Sure, you could try timing the market, but the equity you’ll be missing out on in the meantime is something to seriously consider. If you’re ready and able to buy now, you have to decide: is it really worth waiting?

Rather than focusing on timing the market. It’s better to have time in the market.

As U.S. News Real Estate sums up:

“There’s never a one-size-fits-all answer to whether now is the right time to buy a home. . . . There’s also no way to predict precisely what the market will do in the near future . . . Perfectly timing the market shouldn’t be the goal. This decision should be determined by your personal needs, financial means and the time you have to find the right home.”

Bottom Line

If you’re debating whether to buy now or wait, remember it’s time in the market, not timing the market. And if you want to get the ball rolling and set yourself up for those big equity gains, let’s connect to make it happen.

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 in Prescott, Arizona

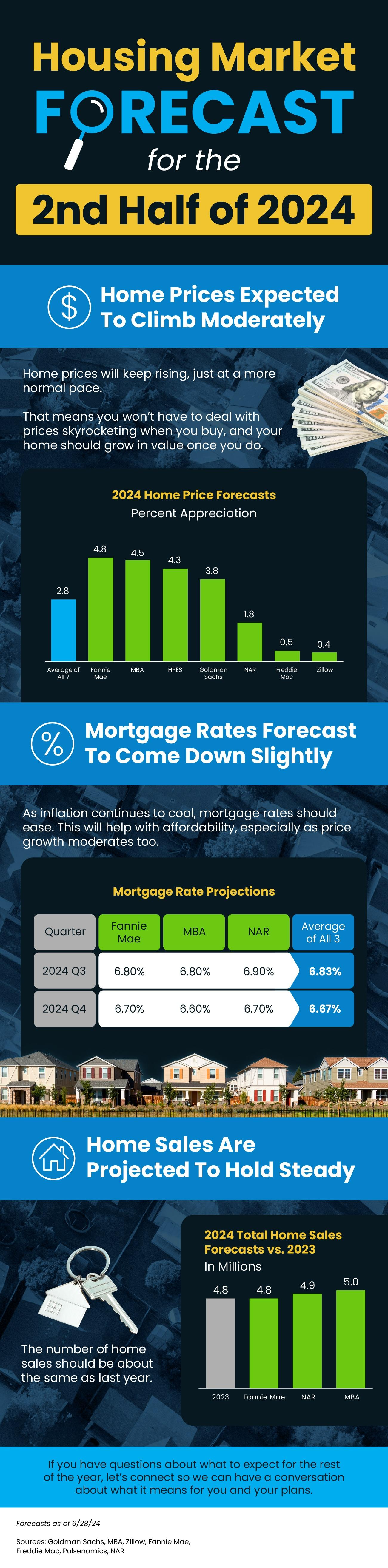

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

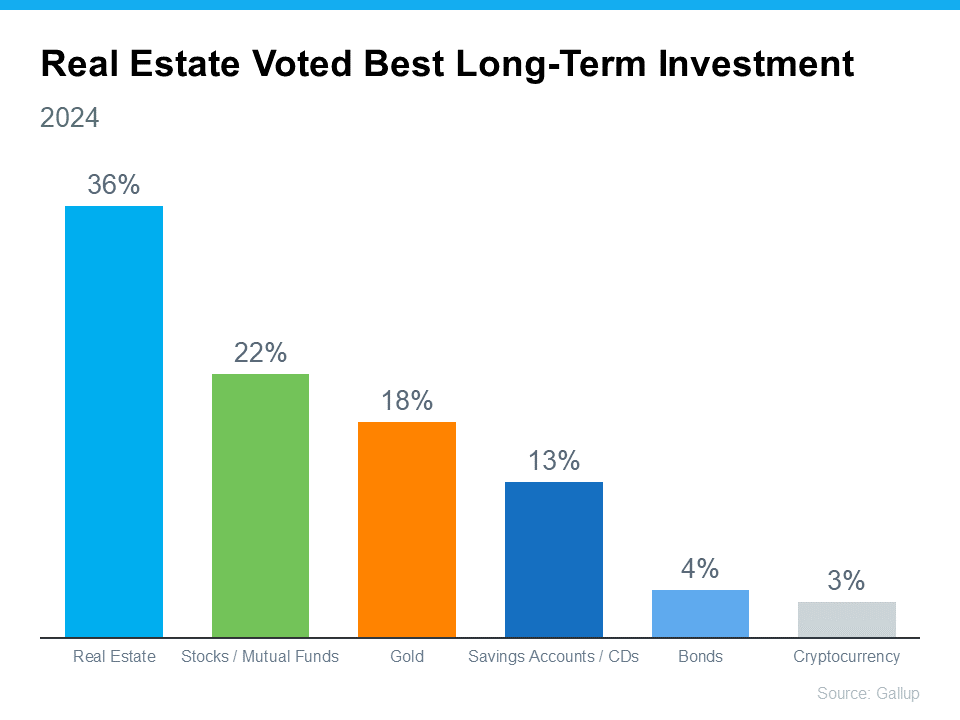

As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

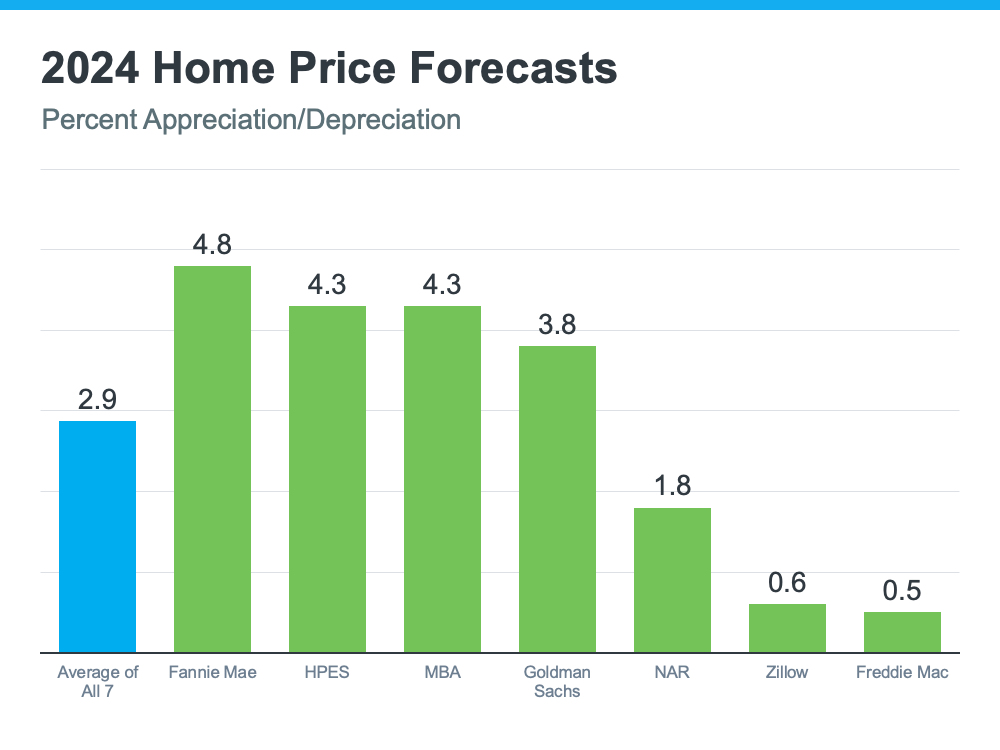

Home Prices Are Expected To Climb Moderately

Home prices are forecasted to rise at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the industry:

The reason for continued appreciation? The supply of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), explains:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

While inventory is up compared to the last couple of years, it’s still low overall. And because there still aren’t enough homes to go around, that’ll keep upward pressure on prices.

If you’re thinking of buying, the good news is you won’t have to deal with prices skyrocketing like they did during the pandemic. Just remember, prices aren’t expected to drop. They’ll continue climbing, just at a slower pace.

So, getting into the market sooner rather than later could still save you money in the long run. Plus, you can feel confident experts say your home will grow in value after you buy it.

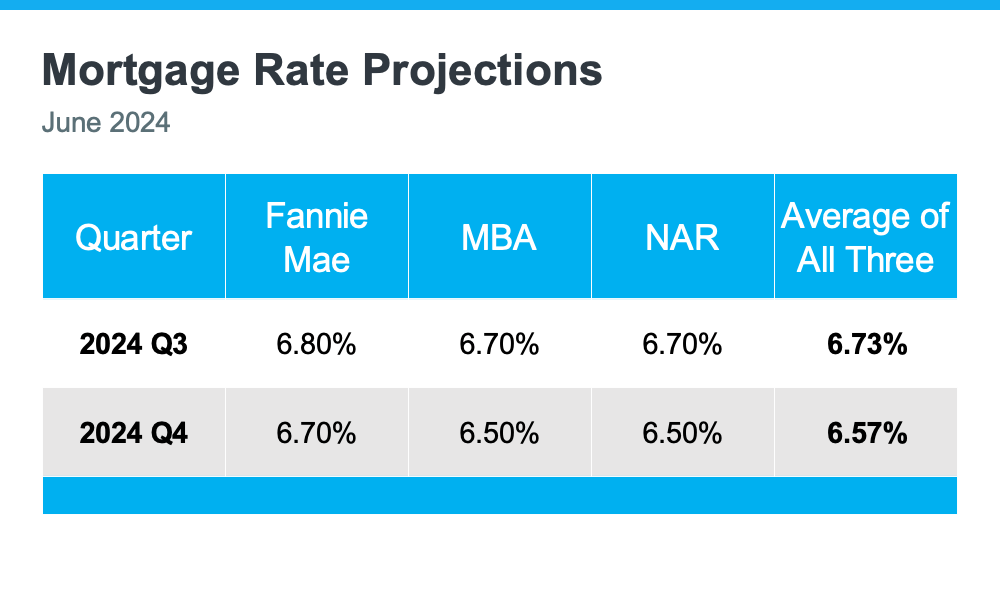

Mortgage Rates Are Forecast To Come Down Slightly

One of the best pieces of news for both buyers and sellers is that mortgage rates are expected to come down a bit, according to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR (see chart below):

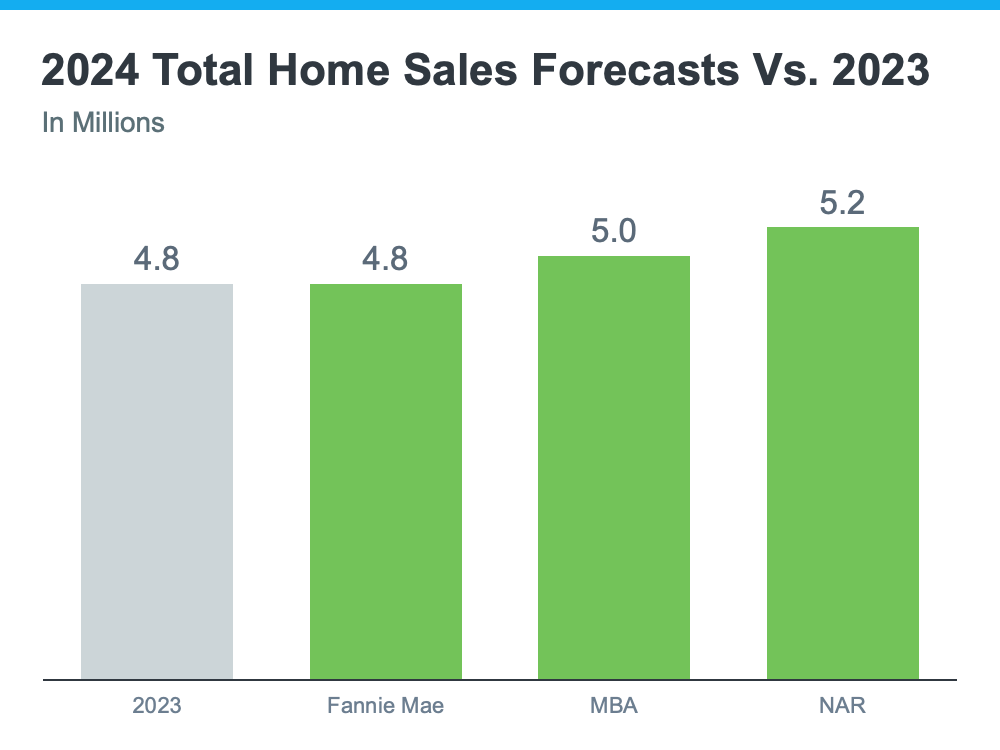

Home Sales Are Projected To Hold Steady

For 2024, the number of home sales will be about the same as last year and may even rise slightly. The graph below compares the 2024 home sales forecasts from Fannie Mae, MBA, and NAR to the 4.8 million homes that sold last year:

The average of the three forecasts is about 5 million sales in 2024 – a small increase from 2023. Lawrence Yun, Chief Economist at NAR, explains why:

“Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more inventory available and mortgage rates expected to go down, a few more homes are expected to be sold this year compared to last year. This means more people will be able to move. Let’s work together to make sure you’re one of them.

Bottom Line

If you have any questions or need help navigating the market, reach out.

Why a Vacation Home Is the Ultimate Summer Upgrade in Oxnard, California

Why a Vacation Home Is the Ultimate Summer Upgrade

Summer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season. If you’re excited about getting away and having some fun in the sun, it might make sense to consider if owning your own vacation home is right for you.

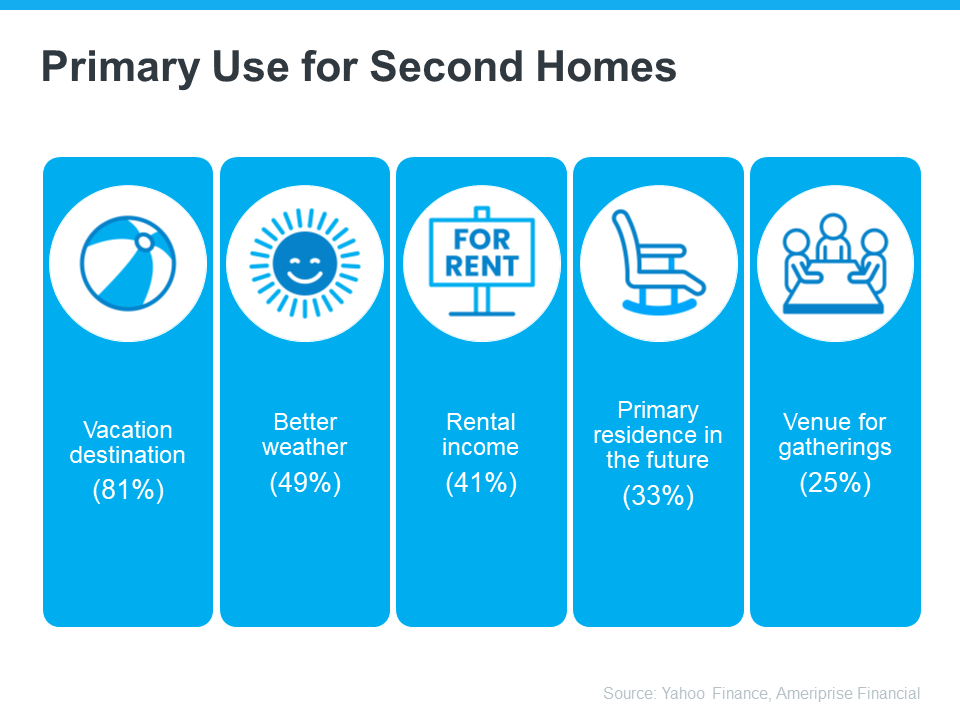

An Ameriprise Financial survey sheds light on why people buy a second, or vacation, home (see below):

- Vacation destination or a place to get away from the stresses of everyday life (81%) – Having a second home to use as a vacation spot can be a special place where you go to relax and take a break from your daily routines and stressors. It also means you won’t have to worry about finding somewhere to stay when you go there.

- Better weather (49%) – Buying in a place where there may be nicer weather can be a great escape, especially if it’s cold or rainy where you usually live. It lets you enjoy sunny days and warm temperatures, even when it’s not so nice back home.

- Rental income (41%) – You can rent it out to other people when you’re not using it, which can help you make some extra money.

- Primary residence in the future (33%) – You can eventually move into the home full-time during retirement. That means you can enjoy vacations there now and have a getaway ready for your future.

- Having a venue for gatherings with family and friends (25%) – It would be a special spot where you can have parties, regular family trips, and create fun memories.

Ways To Buy Your Vacation Home

And you don’t have to be wealthy to buy a vacation home. Bankrate shares two tips for how to make this dream more achievable for anyone who’s interested:

- Buy with loved ones or friends: If you’re okay with sharing the vacation home, you can go in on the purchase price together and pool your resources to make it more affordable.

- Put a savings plan in place: This will require patience and persistence but consider adding a vacation home savings plan to your budget and contributing to it monthly.

Finding Your Dream Spot with a Little Help from an Agent

If the idea of basking in the sun at your very own vacation home sounds appealing, you might want to start looking now. Summer’s when everyone’s trying to buy their slice of paradise, so it’s best to start early.

Your first move is to team up with a real estate agent. They know all the ins and outs of the area you want to be in, and which homes you should look at. Plus, they can give you the lowdown on everything you need to know about having a second home and how it can benefit you. The same article from Bankrate says:

“Buying real estate in a new area — or even one you’ve vacationed in for many years — requires expert guidance. That makes it a good idea to work with an experienced local lender who specializes in loans for vacation homes and a local real estate professional. Local lenders and Realtors will understand the required rules and specifics for the area you are buying, and a local Realtor will know what properties are available.”

Bottom Line

If the idea of owning your own vacation home appeals to you, let’s chat.

What You Need To Know About Today’s Down Payment Programs in Camarillo, California

What You Need To Know About Today’s Down Payment Programs

There’s no denying it’s gotten more challenging to buy a home, especially with today’s mortgage rates and home price appreciation. And that may be one of the big reasons you’re eager to look into grants and assistance programs to see if there’s anything you qualify for that can help. But unfortunately, many homebuyers feel like they don’t know where to start.

A recent Bank of America Institute study asked prospective buyers where they lack confidence in the process and need more information. And this is what topped the list:

53% said they need help understanding homebuying grant programs.

So, here’s some information that can help you close that gap.

What Is Down Payment Assistance?

As the Mortgage Reports explains:

“Down payment assistance (DPA) programs offer loans and grants that can cover part or all of a home buyer’s down payment and closing costs. More than 2,000 of these programs are available nationwide. . . DPA programs vary by location, but many home buyers could be in line for thousands of dollars in down payment assistance if they qualify.”

And here’s some more good news. On top of all of these programs, you probably don’t need to save as much for your down payment as you think. Contrary to what you may have heard, typically you don’t have to put 20% down unless it’s specified by your loan type or lender. So, you likely don’t need to save as much upfront, and there are programs designed to make your down payment more achievable. Sounds like a win-win.

First-Time and Repeat Buyers Are Often Eligible

It’s also worth mentioning, that it’s not just first-time homebuyers that are eligible for many of these programs. That means whether you’re looking to buy your first house or your fifth, there could be an option for you. As Down Payment Resource notes:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”

Additional Down Payment Resources That Can Help

Here are a few of the down payment assistance programs that are helping many buyers achieve their dream of homeownership, even now:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel, and Veterans reach their down payment goals.

- Fannie Mae provides down payment assistance to eligible first-time homebuyers living in majority-Latino communities.

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier to secure down payments and realize their dream of homeownership.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.

If you want more information on any of these, the best place to start is by contacting a trusted real estate professional.

They’ll be able to share more details about what may be available, including any other programs designed to serve specific professions or communities. And even if you don’t qualify for these types of programs, they can help see if there are any other federal, state, and local options available you should look into.

Bottom Line

Affordability is still a challenge, so if you’re looking to buy, you’re going to want to make sure you’re taking advantage of any and all resources available.

The best way to find out what’s out there is to connect with a team of real estate professionals, including a trusted lender and a local agent.

Worried About Mortgage Rates? Control the Controllables in Simi Valley, California

Worried About Mortgage Rates? Control the Controllables

Chances are you’re hearing a lot about mortgage rates right now. You may even see some headlines talking about last week’s Federal Reserve (the Fed) meeting and what it means for rates. But the Fed doesn’t determine mortgage rates, even if the headlines make it sound like they do.

The truth is, mortgage rates are impacted by a lot of factors: geo-political uncertainty, inflation and the economy, and more. And trying to pin down when all those factors will line up enough for rates to come down is tricky.

That’s why it’s generally not worth it to try to time the market. There’s too much at play that you can’t control. The best thing you can do is control the controllables.

And when it comes to rates, here’s what you can influence to make your moving plans a reality.

Your Credit Score

Credit scores can play a big role in your mortgage rate. As an article from CNET explains:

“You can’t control the economic factors influencing interest rates. But you can get the best rate for your situation, and improving your credit score is the right place to start. Lenders look at your credit score to decide whether to approve you for a loan and at what interest rate. A higher credit score can help you secure a lower interest rate, maybe even better than the average.”

That’s why it’s even more important to maintain a good credit score right now. With rates where they are, you want to do what you can to get the best rate possible. If you want to focus on improving your score, your trusted loan officer can give you expert advice to help.

Your Loan Type

There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose.”

When working with your team of real estate professionals, make sure you find out what’s available for your situation and which types of loans you may qualify for.

Your Loan Term

Another factor to consider is the term of your loan. Just like with loan types, you have options. Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Depending on your situation, the length of your loan can also change your mortgage rate.

Bottom Line

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Work with a trusted lender to go over the things you can do that’ll make a difference. By being strategic with these factors, you may be able to combat today’s higher rates and lock in the lowest one you can.