Buying a Home May Help Shield You from Inflation

It feels like everything is getting more expensive these days. That’s because inflation has remained higher than normal for longer than expected – and that’s impacting the costs of goods, services, and more. And with rising costs all around you, you’re probably questioning: is now really the right time to buy a home?

Here’s the good news. Owning a home is actually one of the best ways to protect yourself from the rising costs that come with inflation.

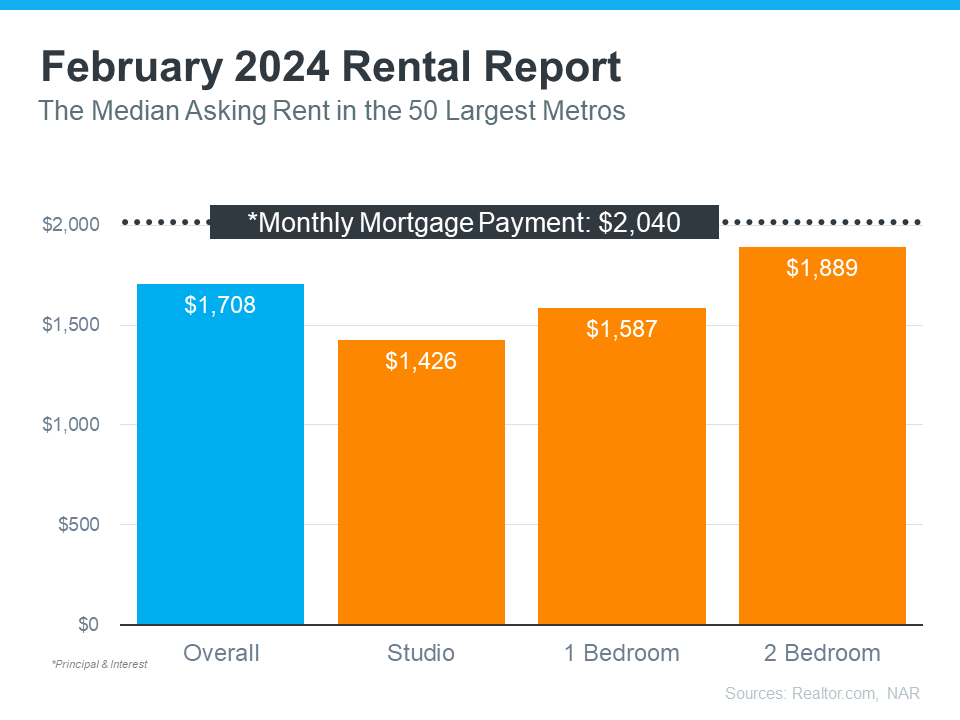

A Fixed Mortgage Protects You from Rising Housing Costs

One of the key benefits of homeownership is that when you buy a home with a fixed-rate mortgage, your biggest monthly expense — your mortgage payment — stabilizes. Sure, your payment could rise slightly as your homeowner’s insurance and property taxes shift. But no matter what happens with inflation, your principal and interest payments won’t change.

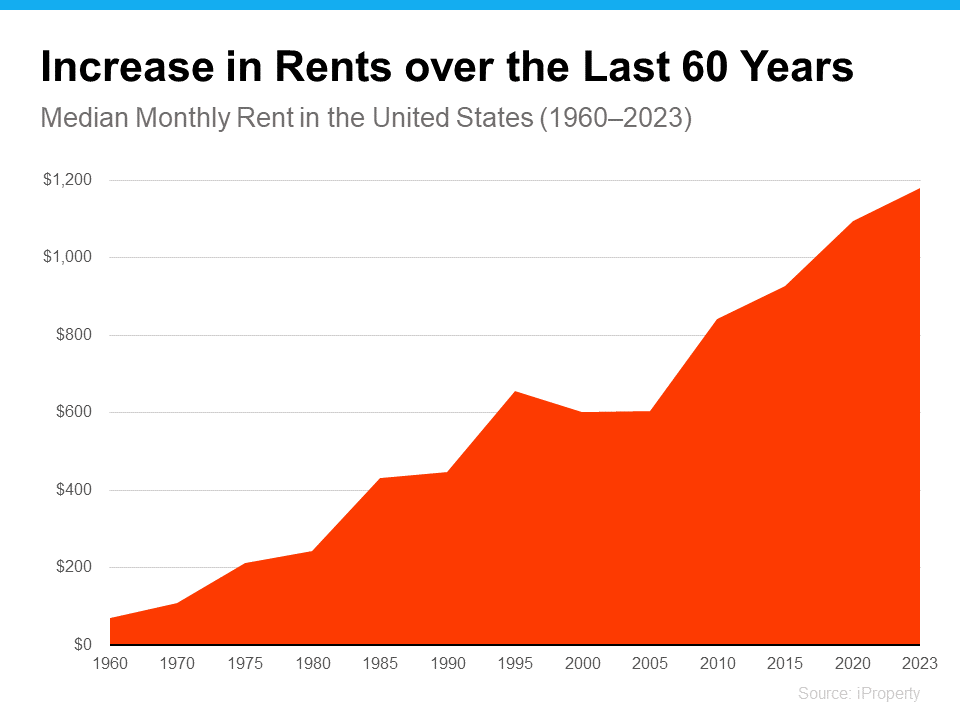

That’s not the case if you rent. Rent tends to rise over time, and it usually goes up even faster than the rate of inflation. Just look at the data from the Bureau of Economic Analysis (BEA) and the Census Bureau (see graph below):

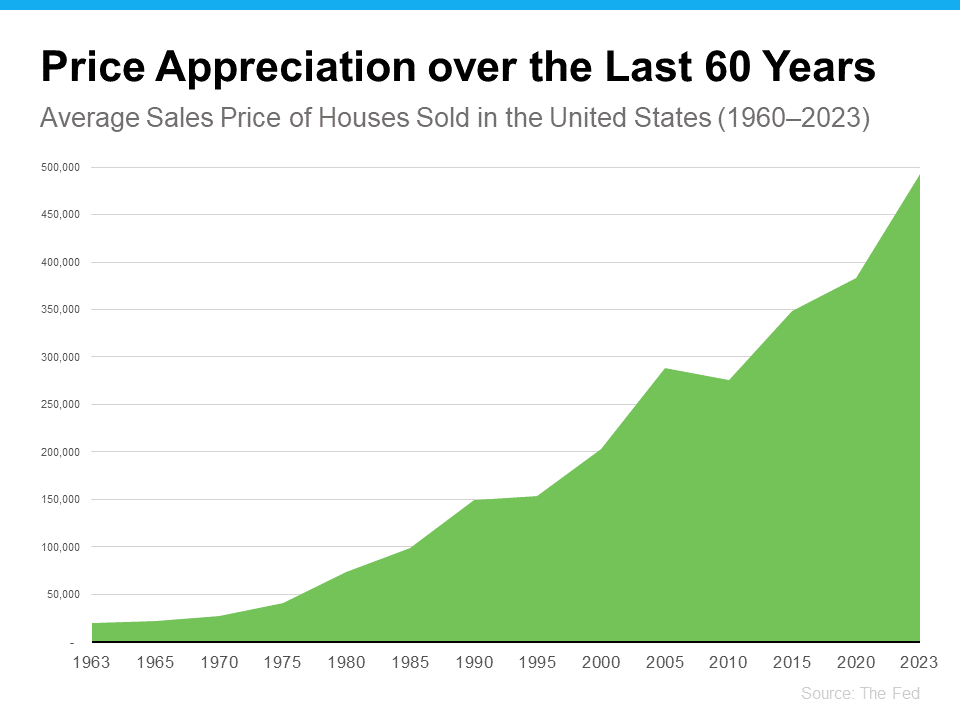

Home Prices Typically Rise Faster Than Inflation

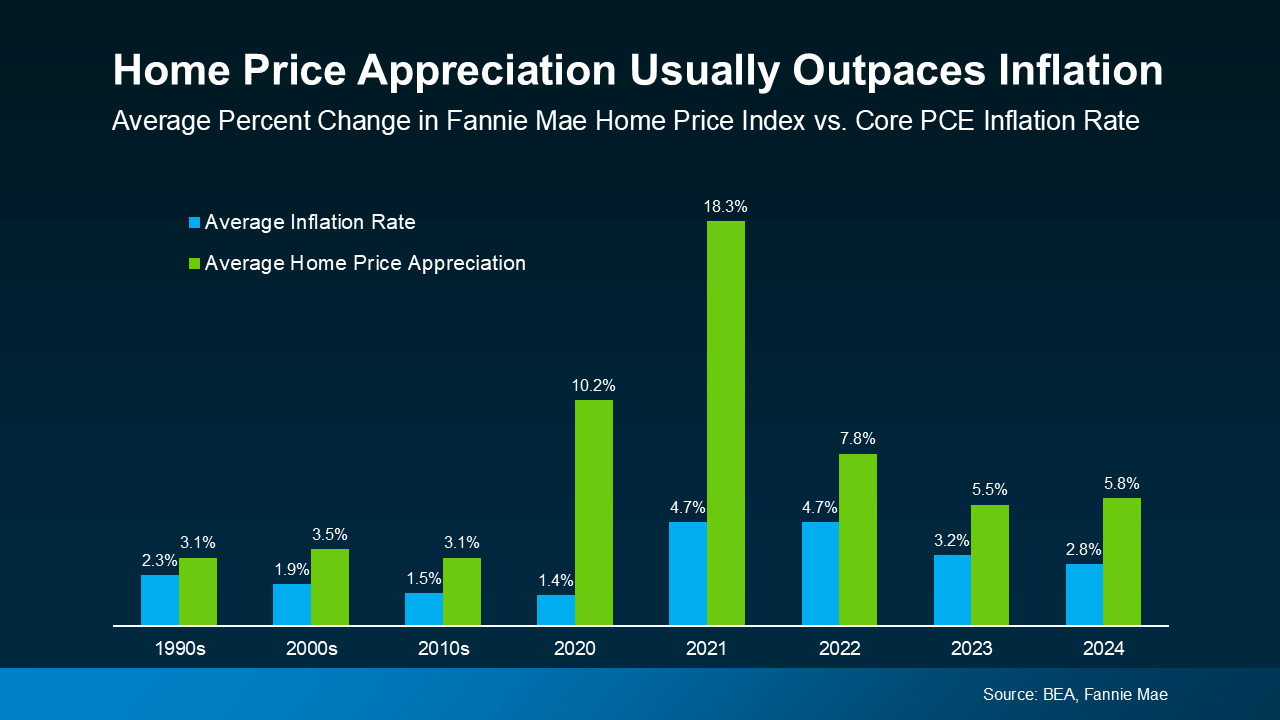

Another big reason homeownership is a great hedge against inflation is that home values tend to appreciate over time — often at a higher rate than inflation, according to data from the BEA and Fannie Mae (see graph below):

On the other hand, renting offers no protection against inflation. In fact, it does the opposite — when inflation drives up costs, landlords often pass those increases onto tenants through higher rents.

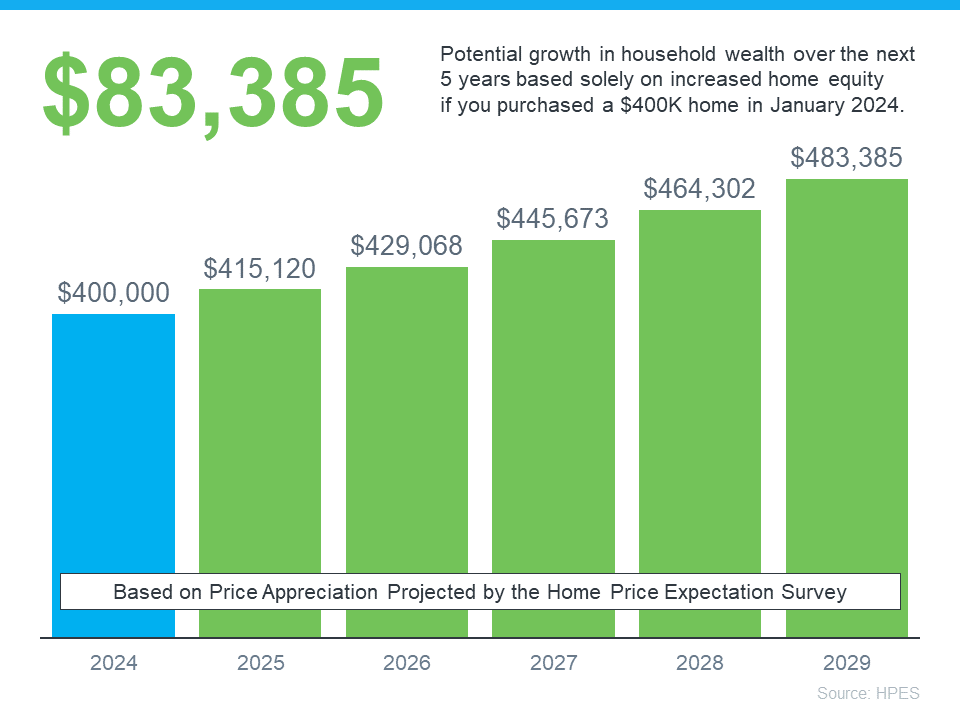

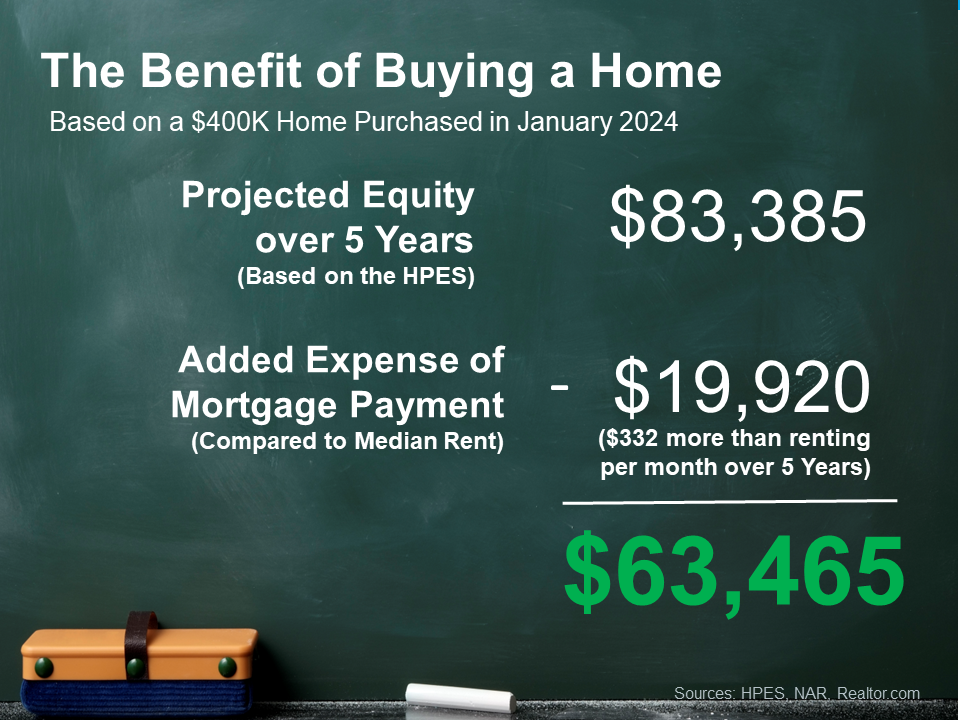

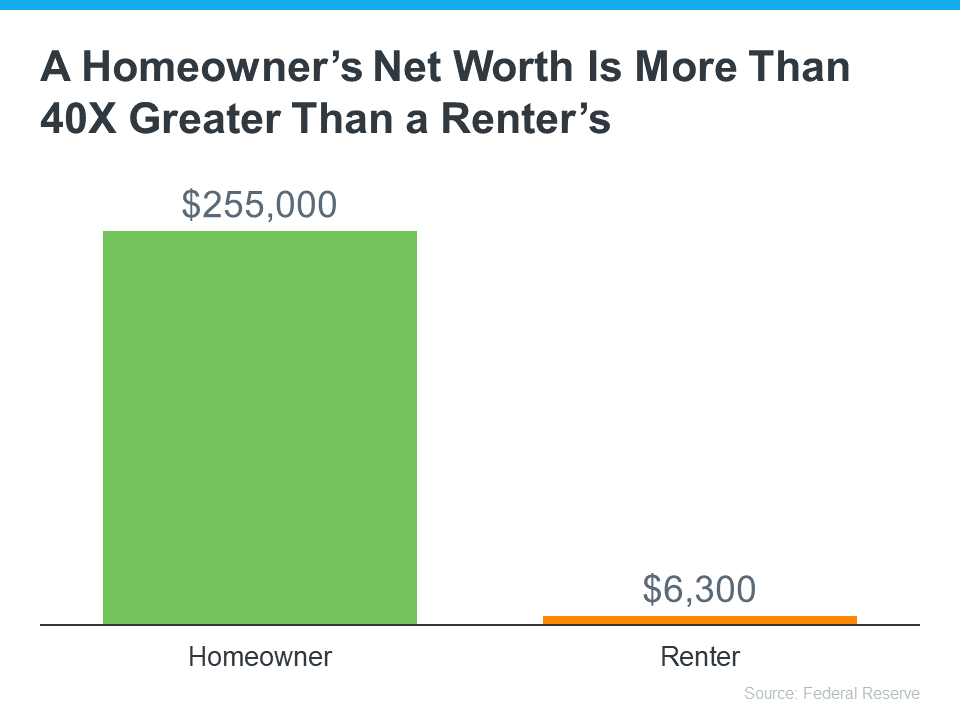

That means as a renter, you’re continually paying more without gaining any financial benefit. But as a homeowner, rising prices work in your favor by increasing the value of your home and growing your equity over time.

And with experts forecasting continued home price growth, that means you’re making an investment that usually grows in value and should outperform inflation in the years ahead.

In short, a fixed-rate mortgage protects your budget, and home price appreciation grows your net worth. That’s why homeownership is a strong hedge against inflation.

Bottom Line

Inflation can make everyday expenses unpredictable, but owning a home gives you stability. Unlike rent, your monthly mortgage payment stays pretty much the same over time. Plus, the value of your home is likely to increase after you buy.

How would having a fixed housing payment change the way you budget for the future?