What Mortgage Rate Are You Waiting For?

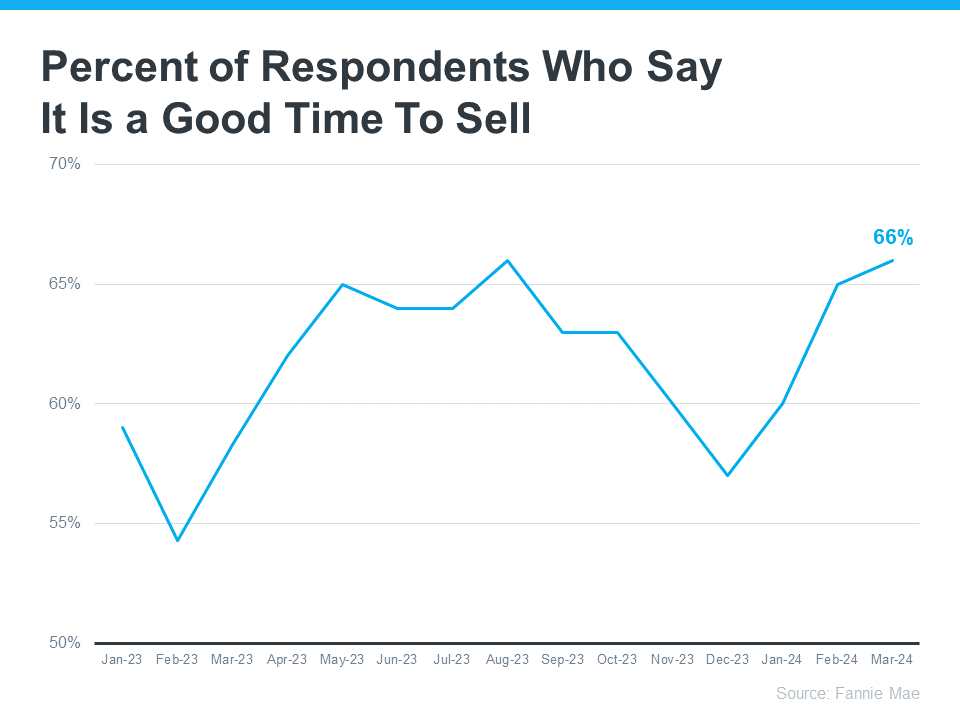

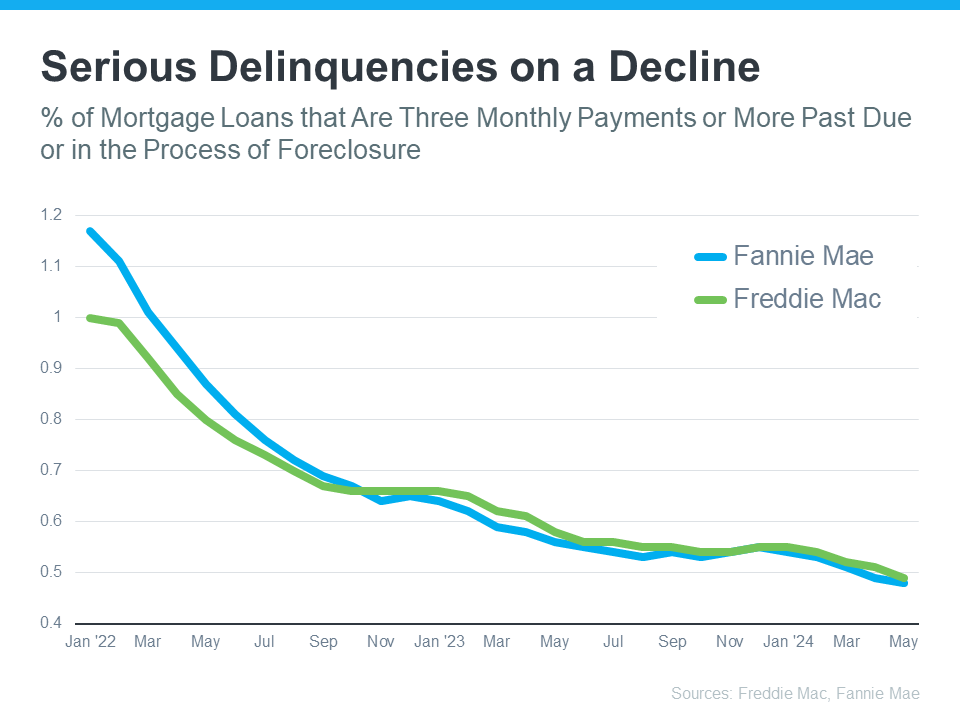

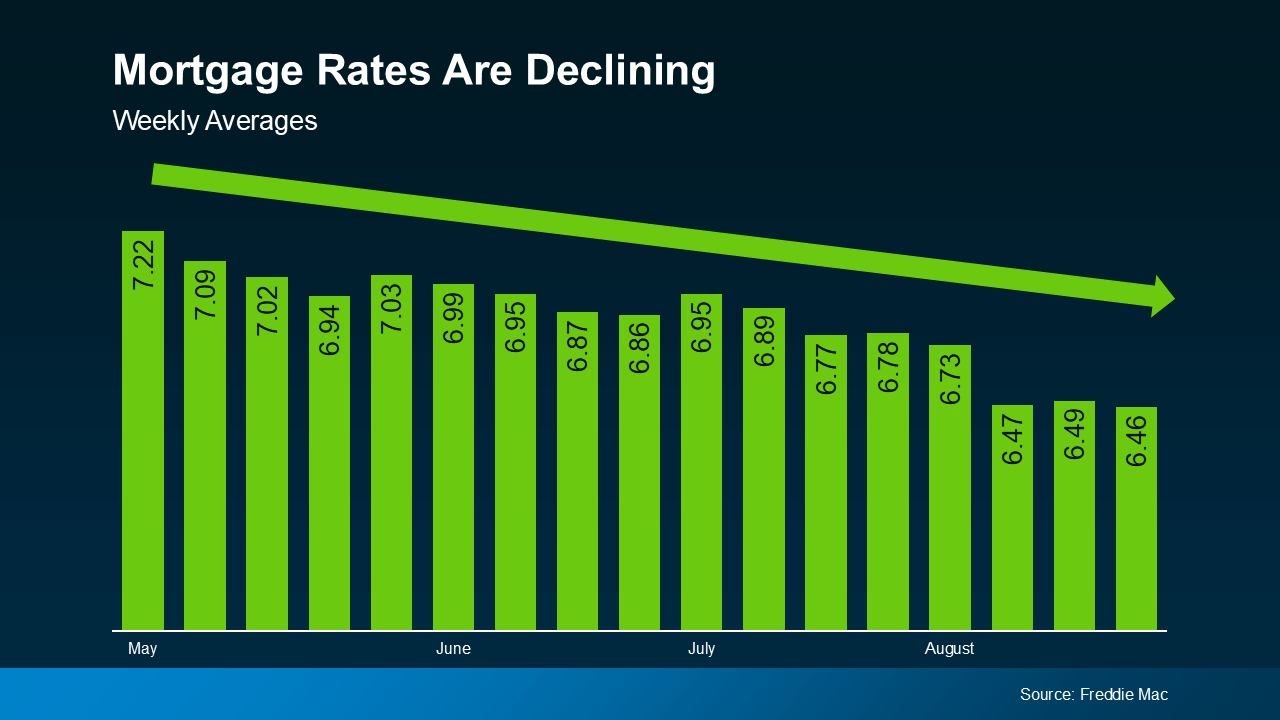

You won’t find anyone who’s going to argue that mortgage rates have had a big impact on housing affordability over the past couple of years. But there is hope on the horizon. Rates have actually started to come down. And, recently they hit the lowest point we’ve seen in 2024, according to Freddie Mac (see graph below):

Expert Projections for Mortgage Rates

Experts say the overall downward trend should continue as long as inflation and the economy keeps cooling. But as new reports come out on those key indicators, there’s going to be some volatility here and there.

What you need to remember is it’s not wise to let those blips distract you from the larger trend. Rates are still down roughly a full percentage point from the recent peak compared to May.

And the general consensus is that rates in the low 6s are possible in the months ahead, it just depends on what happens with the economy and what the Federal Reserve decides to do moving forward.

Most experts are already starting to revise their 2024 mortgage rate forecasts to be more optimistic that lower rates are ahead. For example, Realtor.com says:

“Mortgage rates have been revised slightly lower as signals from the economy suggest that it will be appropriate for the Fed to begin to cut its Federal Funds rate in 2024. Our yearly mortgage rate average forecast is down to 6.7%, and we revised our year-end forecast to 6.3% from 6.5%.”

Know Your Number for Mortgage Rates

So, what does this mean for you and your plans to move? If you’ve been holding out and waiting for rates to come down, know that it’s already happening. You just have to decide, based on the expert projections and your own budget, when you’ll be willing to jump back in. As Sam Khater, Chief Economist at Freddie Mac, says:

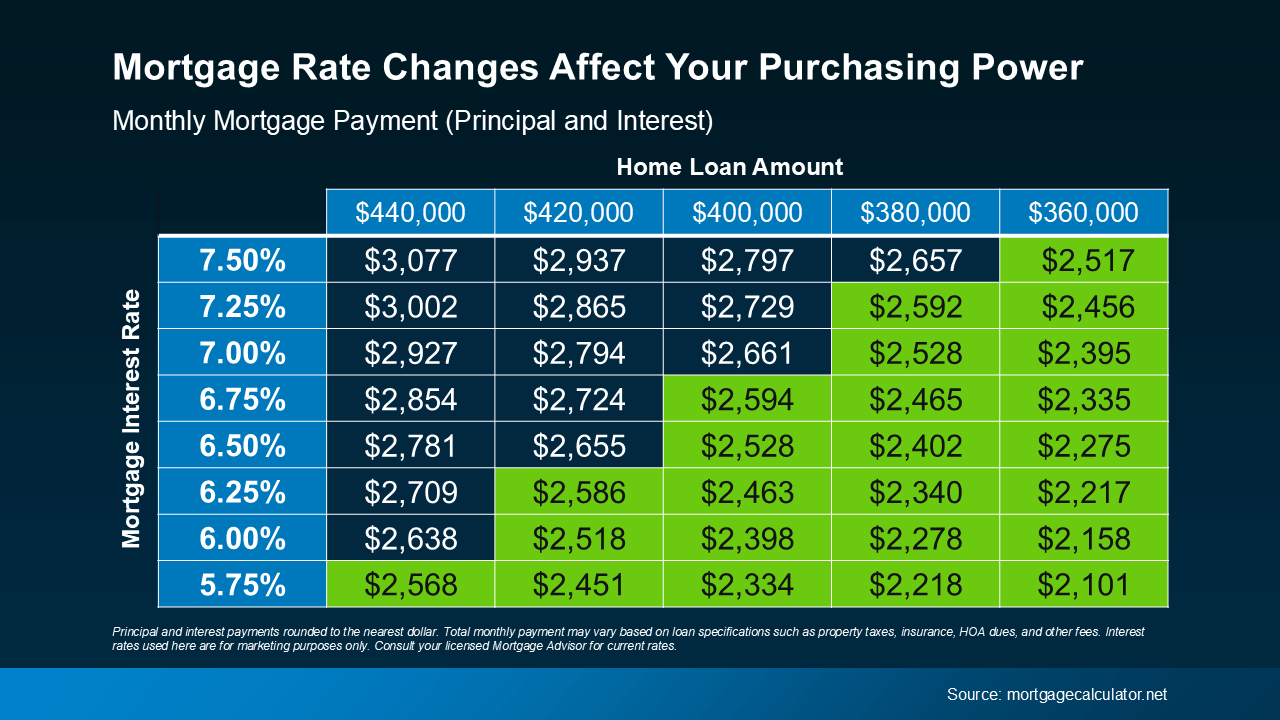

“The decline in mortgage rates does increase prospective homebuyers’ purchasing power and should begin to pique their interest in making a move.”

As a next step, ask yourself this: what number do I want to see rates hit before I’m ready to move?

Maybe it’s 6.25%. Maybe it’s 6.0%. Or maybe it’s once they hit 5.99%. The exact percentage where you feel comfortable kicking off your search again is personal. Once you have that number in mind, you don’t need to follow rates yourself and wait for it to become a reality.

Instead, connect with a local real estate professional. They’ll help you stay up to date on what’s happening and have a conversation about when to make your move. And once rates hit your target, they’ll be the first to let you know.

Bottom Line

If you’ve put your moving plans on hold because of higher mortgage rates, think about the number you want to see rates hit that would make you re-enter the market.

Once you have that number in mind, let’s connect so you have someone on your side to let you know when we get there.