The Top 2 Reasons To Consider a Newly Built Home

When you’re planning a move, it’s normal to wonder where you’ll end up and what your future home is going to look like. Maybe you’ve got a specific picture of that house in your mind. But unless you came into this process knowing you want to buy a newly built home, you may not have pictured new home construction.

A trusted real estate agent can help walk you through these two reasons you may want to reconsider that.

1. Adding Newly Built Homes Could Give You More Options

There are two types of homes on the market: new and existing. A newly built home refers to a house that was just built or is under construction. An existing home is one a previous homeowner has already lived in. Right now, the inventory of existing homes is tight. But there may be options for you on the new home side of things.

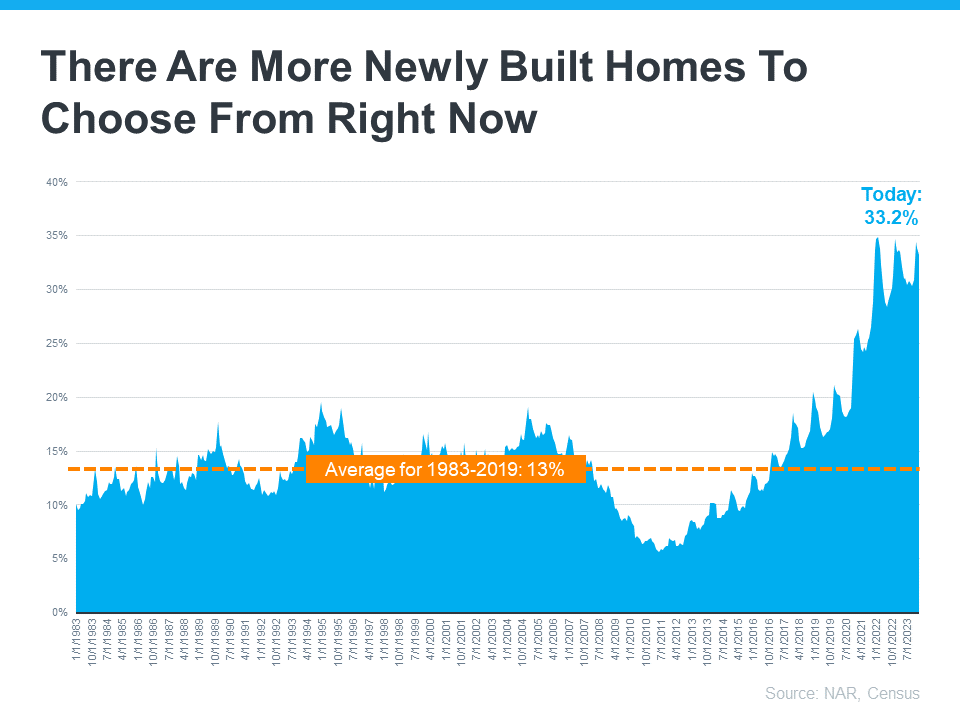

Data from the Census and the National Association of Realtors (NAR) shows that newly built homes are a bigger part of today’s housing inventory than the norm (see graph below):

From 1983 to 2019 (the last normal year in the market), newly built homes made up only 13% of the total inventory of homes for sale. But today that number has climbed to over 33%.

Rest assured, after over a decade of underbuilding, builders aren’t overdoing it today. Even with an increase in new construction today, there’s still a significant housing shortage overall. But for you, the uptick in new builds can be a game changer because it gives you more options for your search.

2. Newly Built Homes May Be More Affordable Than You’d Think

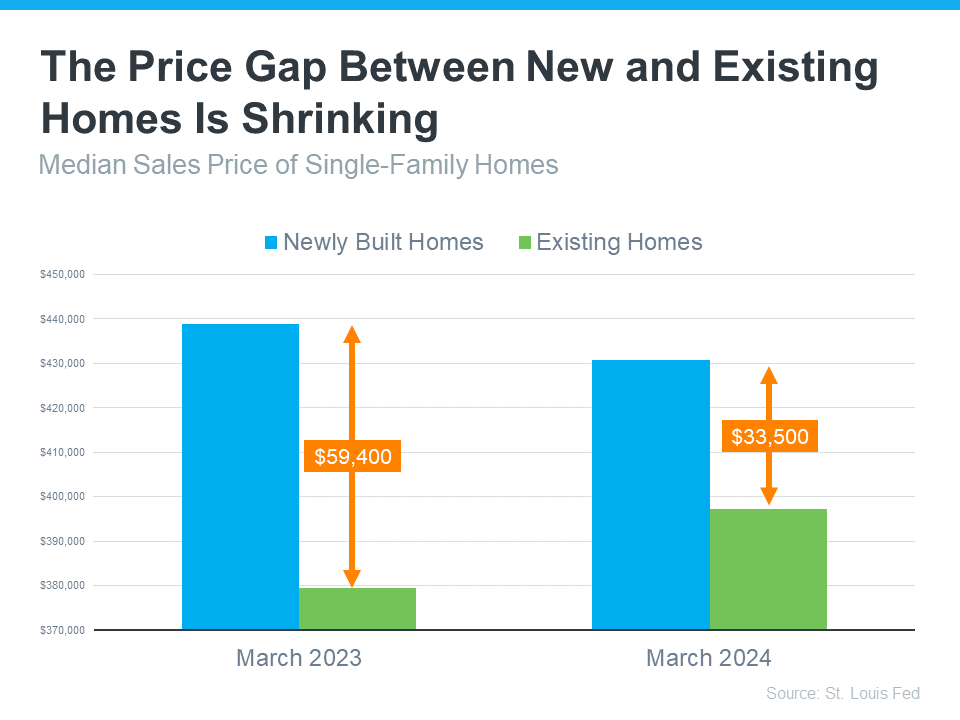

You may still be wondering if a new build could really be an option for you. If you’ve previously written them off because you thought they would be out of your budget, consider this. The price gap between a newly built home and an existing house is shrinking. Here’s why.

Builders are going to build what’s in demand. And they know people need more options right now, especially ones that are smaller and potentially more affordable. So, they’re focusing on building smaller homes at lower price points. The graph below shows the price difference between new and existing homes is shrinking as that happens:

As LendingTree explains:

“In the past, newly built homes have been much more expensive than existing homes — but that gap has been getting smaller recently. In some places today, you may find that the cost to build versus buy is roughly the same.”

And an article from CNBC says:

“While new builds are still sold for slightly more than existing homes, the price gap has significantly narrowed . . .”

Not to mention, some builders are even offering price cuts and mortgage rate buy-downs right now to sweeten the deal. Today there are many reasons new builds may be worth considering. Other buyers sure seem to think so. As Freddie Mac says:

“As the supply of existing homes for sale remains low and home prices continue to rise, more buyers are choosing to purchase new homes than in previous years.”

Just know that buying a newly built home isn’t the same as buying an existing one. Builder contracts have different fine print. So, partner with a local agent who knows the market, builder reputations, and what to look for in those contracts so you have an expert on your side to help you explore this option.

Bottom Line

If you want to find out what builders are doing in our area, let’s connect and check it out together. And if you’re willing to cast a wider net to open up your options even more, we can talk about broadening your search to include other towns nearby.