Why You May Still Want To Sell Your House After All

Even though you may feel reluctant to sell your house because you don’t want to take on a mortgage rate that’s higher than the one you have now, there’s more to consider. While the financial side of things does matter, your personal needs may actually matter just as much. As an article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal decision. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market.”

So, ask yourself this: why did I want to move in the first place?

Chances are your primary motivation wasn’t just financial in nature. Why you’re really thinking about selling likely has more to do with something changing in your life or a shift in what you need out of your house.

Reasons Homeowners Still Need To Sell Today

Let’s explore some of the most common reasons sellers are moving today. A recent article from Builder Online helps shed light on this. In this research, they identified the following categories:

- Marriage – If you just got married, you may find you either need more space than you currently have, or the two of you want to find a new place you picked out together.

- Divorce – If you’re getting separated or are divorcing your partner, chances are it’ll be difficult to live under the same roof. Selling the place you have, so you can own get your own spot, may be necessary.

- Births – If your household is growing, you may need more square footage, including more bedrooms. If you’re running out of room for everyone, you may not be able to wait to move.

- Deaths – If you’ve recently lost a loved one, it can be hard to spend time in that home. You may need to move for financial reasons or because you no longer need all the space.

- Retirement – If you’re in the process of retiring, or you just did, you may be looking to downsize to cut costs, relocate to be closer to loved ones, or move to a dream location. In this new phase of life, your current home may not be able to deliver what you need.

You may find you share one of these top motivators. If any of these resonate with you, it may be time to move so you can find a house better suited to your changing needs. A survey from Realtor.com finds other sellers are in the same boat. It says, 1 in 4 sellers are choosing to move for personal reasons, even with current mortgage rates:

“. . . more than half of seller-buyers (56%) who are planning to sell in the next 12 months said they are waiting for rates to come down, while 25% need to sell soon for personal reasons.”

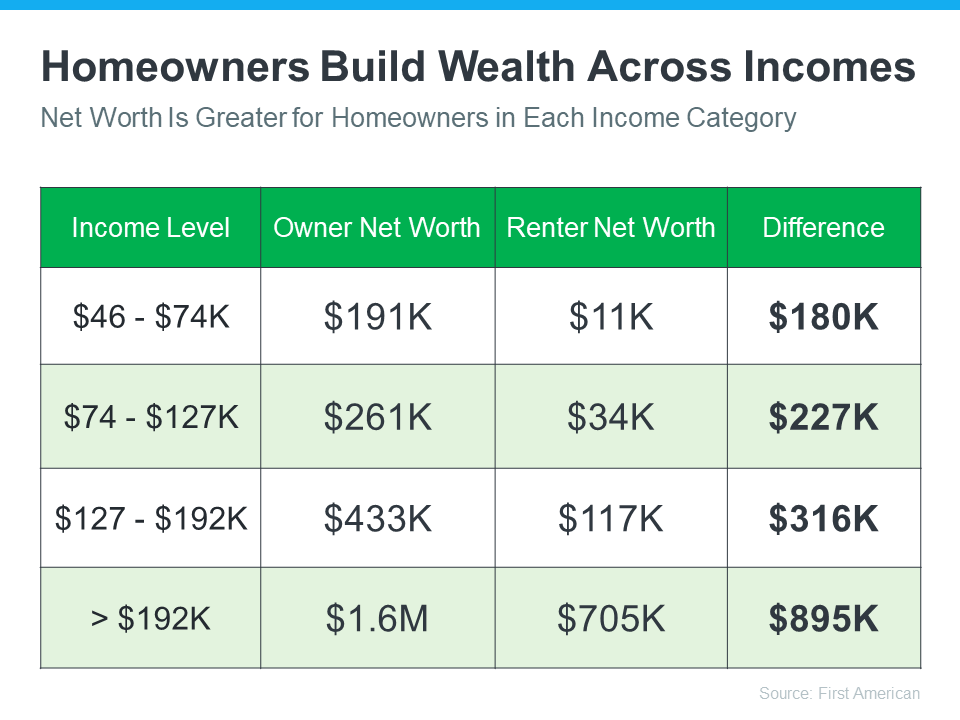

If you need to sell now because something in your own life has changed, don’t let rates hold you back from what you want. You have options to help make that move possible. You can use the equity you already have in your current home toward your next purchase. And with how much equity homeowners have right now, you may be able to finance less than you’d expect, or pay all cash to avoid borrowing at all.

Bottom Line

When you’re ready to prioritize your changing needs, let’s connect. You need an expert on your side to help you list your house and find a home that delivers on everything you’re looking for.