Why a Vacation Home Is the Ultimate Summer Upgrade

Summer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season. If you’re excited about getting away and having some fun in the sun, it might make sense to consider if owning your own vacation home is right for you.

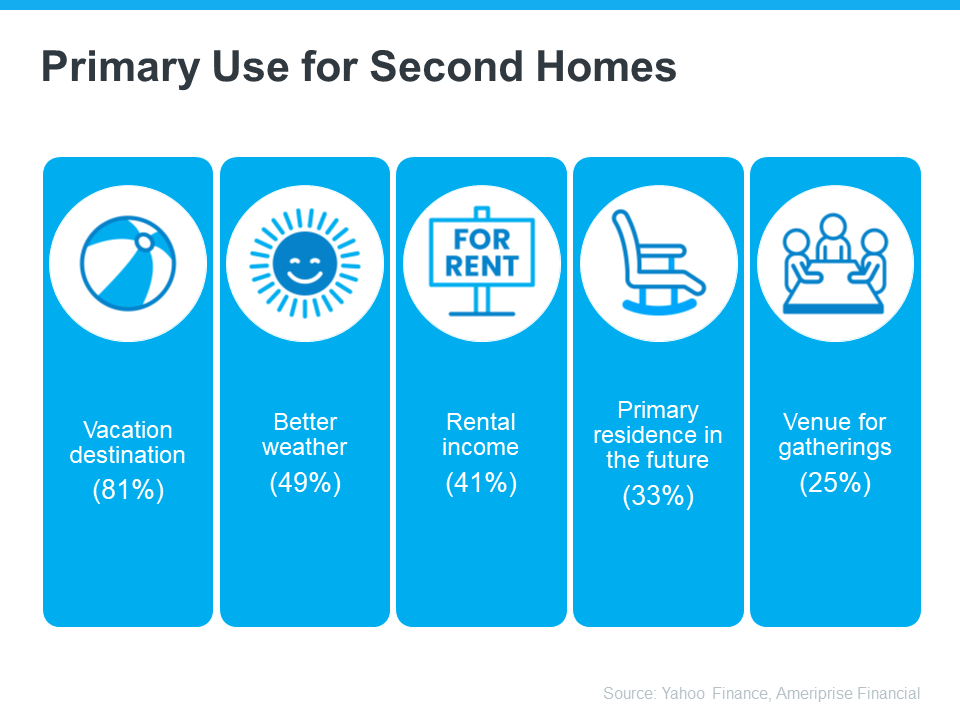

An Ameriprise Financial survey sheds light on why people buy a second, or vacation, home (see below):

- Vacation destination or a place to get away from the stresses of everyday life (81%) – Having a second home to use as a vacation spot can be a special place where you go to relax and take a break from your daily routines and stressors. It also means you won’t have to worry about finding somewhere to stay when you go there.

- Better weather (49%) – Buying in a place where there may be nicer weather can be a great escape, especially if it’s cold or rainy where you usually live. It lets you enjoy sunny days and warm temperatures, even when it’s not so nice back home.

- Rental income (41%) – You can rent it out to other people when you’re not using it, which can help you make some extra money.

- Primary residence in the future (33%) – You can eventually move into the home full-time during retirement. That means you can enjoy vacations there now and have a getaway ready for your future.

- Having a venue for gatherings with family and friends (25%) – It would be a special spot where you can have parties, regular family trips, and create fun memories.

Ways To Buy Your Vacation Home

And you don’t have to be wealthy to buy a vacation home. Bankrate shares two tips for how to make this dream more achievable for anyone who’s interested:

- Buy with loved ones or friends: If you’re okay with sharing the vacation home, you can go in on the purchase price together and pool your resources to make it more affordable.

- Put a savings plan in place: This will require patience and persistence but consider adding a vacation home savings plan to your budget and contributing to it monthly.

Finding Your Dream Spot with a Little Help from an Agent

If the idea of basking in the sun at your very own vacation home sounds appealing, you might want to start looking now. Summer’s when everyone’s trying to buy their slice of paradise, so it’s best to start early.

Your first move is to team up with a real estate agent. They know all the ins and outs of the area you want to be in, and which homes you should look at. Plus, they can give you the lowdown on everything you need to know about having a second home and how it can benefit you. The same article from Bankrate says:

“Buying real estate in a new area — or even one you’ve vacationed in for many years — requires expert guidance. That makes it a good idea to work with an experienced local lender who specializes in loans for vacation homes and a local real estate professional. Local lenders and Realtors will understand the required rules and specifics for the area you are buying, and a local Realtor will know what properties are available.”

Bottom Line

If the idea of owning your own vacation home appeals to you, let’s chat.