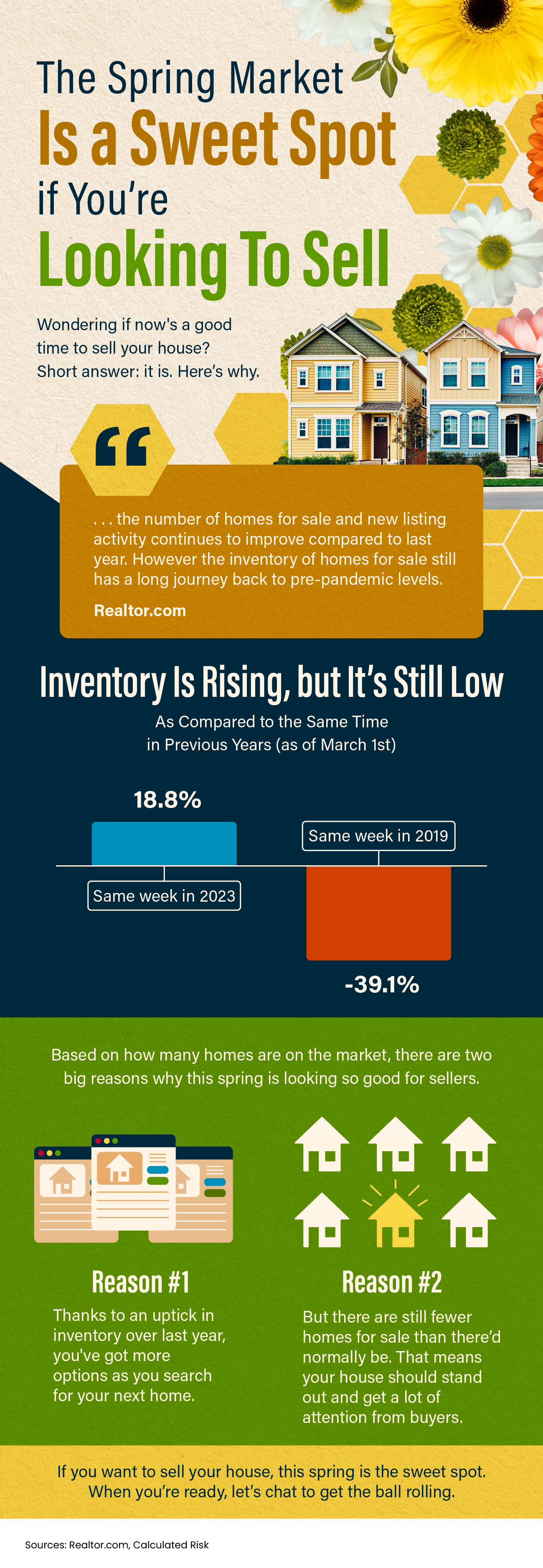

The Spring Market Is a Sweet Spot if You’re Looking To Sell [INFOGRAPHIC]

Some Highlights

- Wondering if now’s a good time to sell your house? Based on how many homes are on the market, there are two big reasons why this spring is looking so good for sellers.

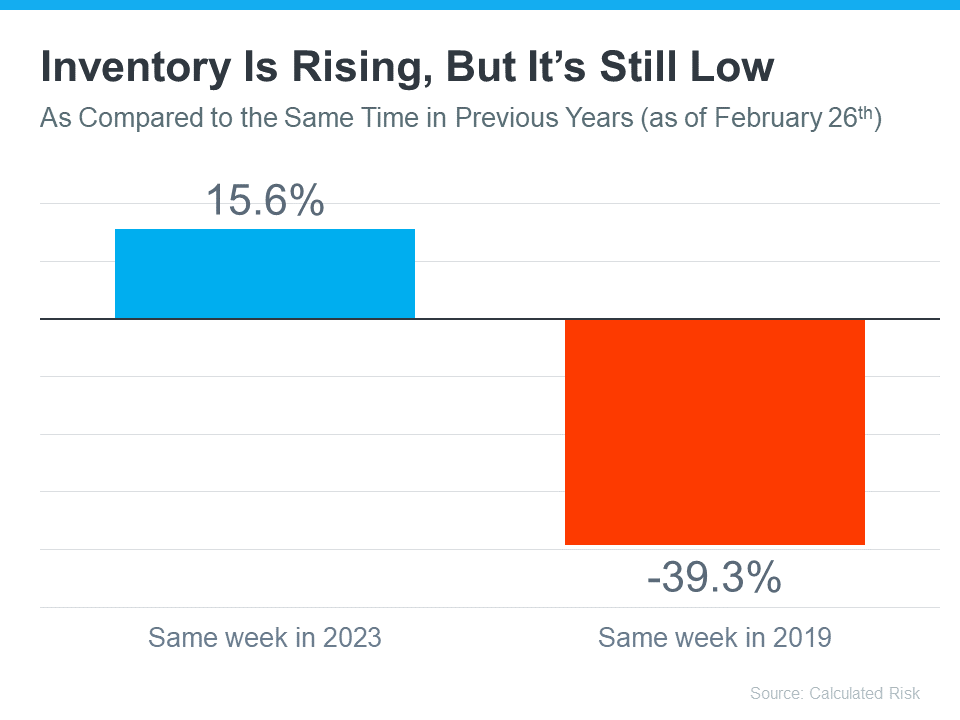

- Thanks to an uptick in inventory over last year, you’ve got more options for your next home. But there are still fewer homes for sale than there’d normally be, meaning your house should stand out and get a lot of attention from buyers.

- If you want to sell your house, this spring is the sweet spot. When you’re ready, let’s chat to get the ball rolling.