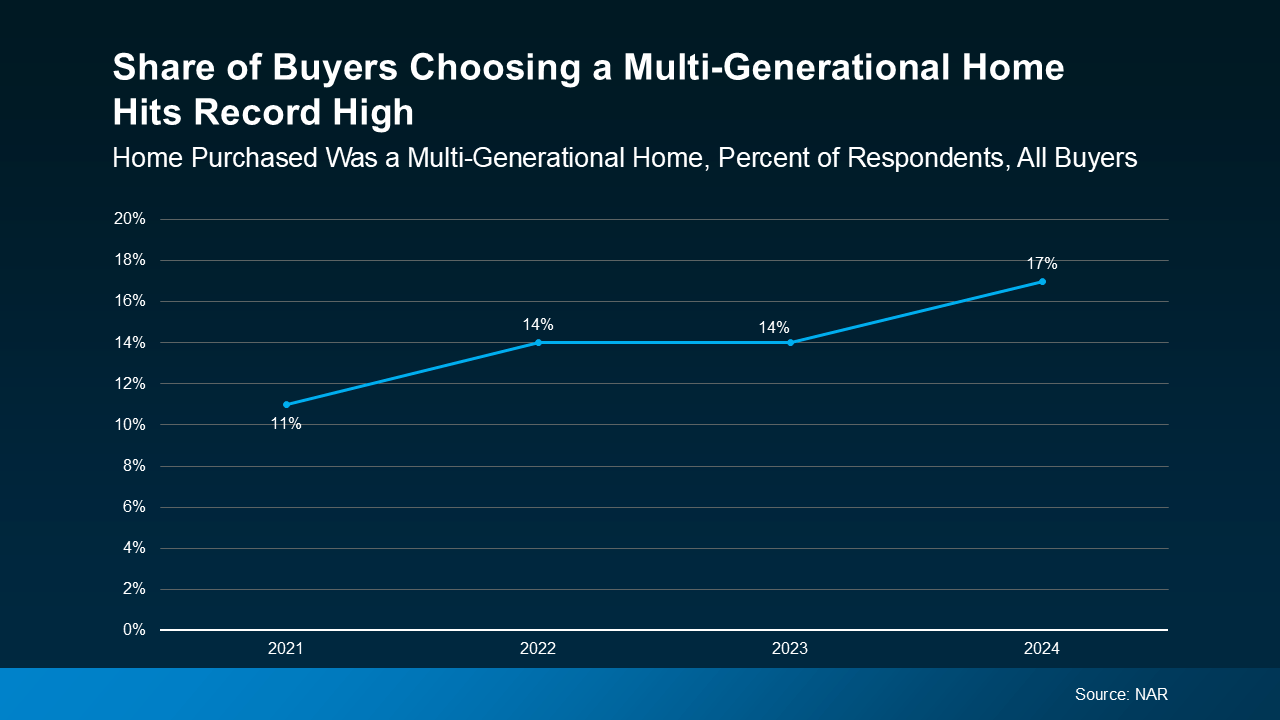

Why More People Are Buying Multi-Generational Homes Today

Today, 17% of homebuyers are choosing multi-generational homes — that’s when you buy a house with your parents, adult children, or even distant relatives. What makes that noteworthy is that 17% is actually the highest level ever recorded by the National Association of Realtors (NAR). But what’s driving the recent rise in multi-generational living?

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home

In the past, homebuyers often opted for multi-generational homes to make it easier to care for their parents. And while that’s still a key reason, it’s not the only one. Right now, there’s another powerful motivator: affordability.

According to the latest data from NAR, cost savings are the main reason more people are choosing to live with family today.

The rising cost of homeownership is making it harder for many people to afford a home on their own. This has led to more families pooling their resources to make buying a home possible.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

“There are a few ways to improve affordability, at least marginally. . . purchase a property with a family member — there are a growing number of multi-generational households across the country today, and affordability is one of the reasons for this.”

You may even find it helps you afford a bigger home than you would have been able to on your own. So, if you need more room, but can’t afford it with today’s rates and prices, this could be an option to still get the space you need.

On top of the financial benefits, it could also bring your family closer together and strengthen your bonds by getting more quality time together.

Bottom Line

If you’re considering a move, buying a multi-generational home might be worth exploring – especially if your budget is stretched too thin on your own.

Let’s discuss your needs and find a home that fits your family’s unique situation.

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home