What’s Motivating Your Move?

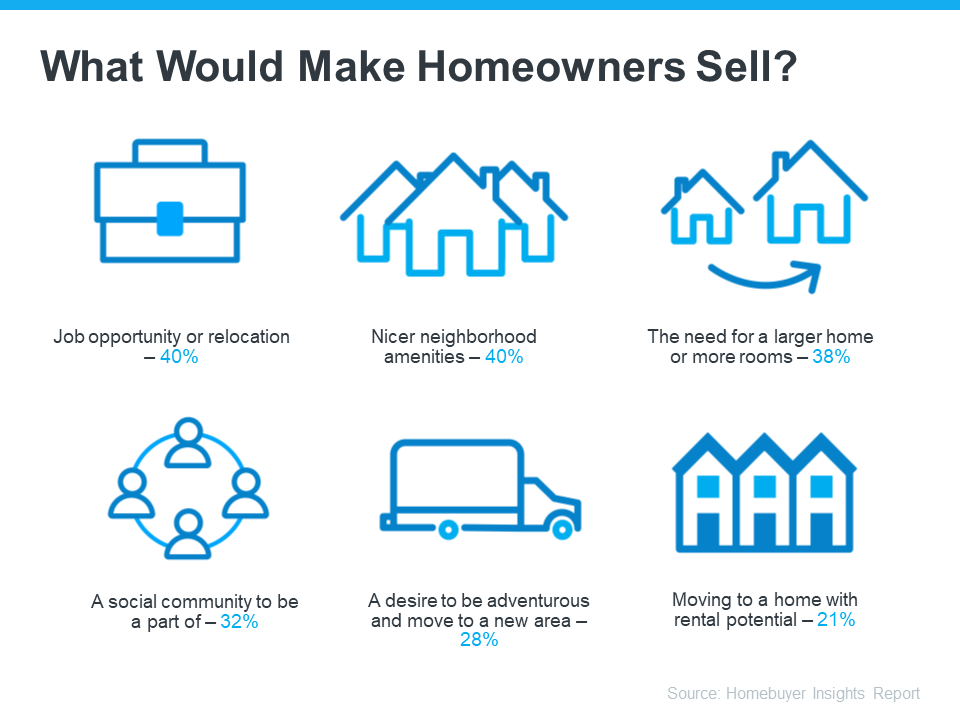

Thinking about selling your house? As you make your decision, consider what’s pushing you to think about moving. A recent survey from Realtor.com looked into why people want to sell their homes this year. Here are the top two reasons (see graphic below):

Let’s take a closer look and see if they’re motivating you to make a change too.

1. To Make a Profit

If you’re thinking about selling your house, you probably have a lot of questions on your mind. Well, here’s some good news – the latest data shows most sellers get a great return on their investment when they sell. ATTOM, a property data provider, explains:

“. . . home sellers made a $121,000 profit on the typical sale in 2023, generating a 56.5 percent return on investment.”

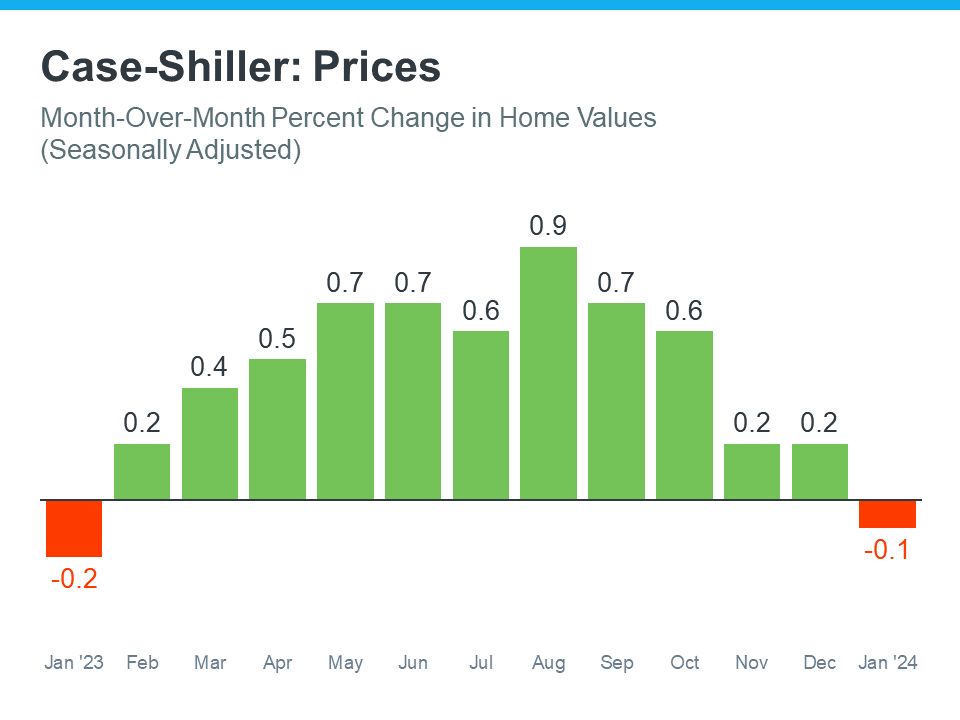

That’s significant. And here’s one contributing factor. During the pandemic, home prices skyrocketed. There was way more buyer demand than homes available for sale and that combination pushed prices up.

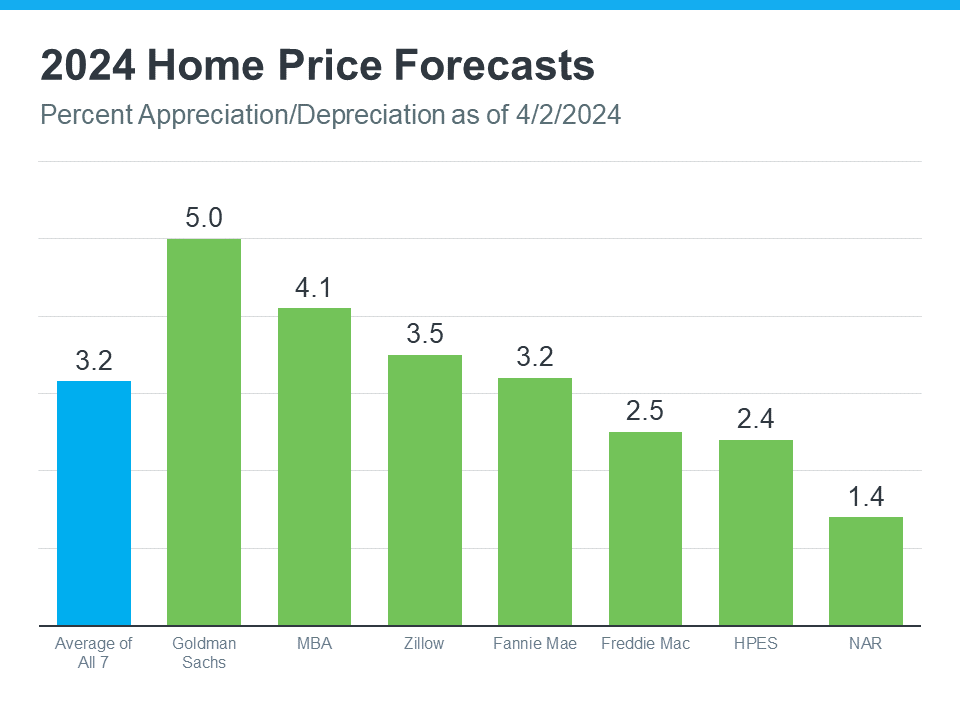

Now, home prices are still rising, just not as fast. That ongoing appreciation is good news for your bottom line. Any profit you make can help offset some of today’s affordability challenges when you buy your next home.

If you want to know how much your house is worth now and what’s going on with prices in your area, talk to a local real estate agent.

2. For Family Reasons

Maybe you want to be near relatives to help take care of older family members or to have more support nearby. Or maybe you’re just eager to spend time together on special occasions like birthdays and holidays.

Selling a house and moving closer to the people who matter the most to you helps keep you connected. If the distance is making you miss out on some big milestones in their lives, it might be time to talk to a local real estate agent to find a place close by. The National Association of Realtors (NAR) says:

“A great real estate agent will guide you through the home search with an unbiased eye, helping you meet your buying objectives while staying within your budget.”

Bottom Line

If you’re thinking about selling your house, there’s probably a good reason for it. Let’s talk so you have help making the right move to reach your goals this year.