Does It Make Sense To Buy A Home Right Now in Simi Valley, California?

Does It Make Sense To Buy a Home Right Now?

Thinking about buying a home? If so, you’re probably wondering: should I buy now or wait? Nobody can make that decision for you, but here’s some information that can help you decide.

What’s Next for Home Prices?

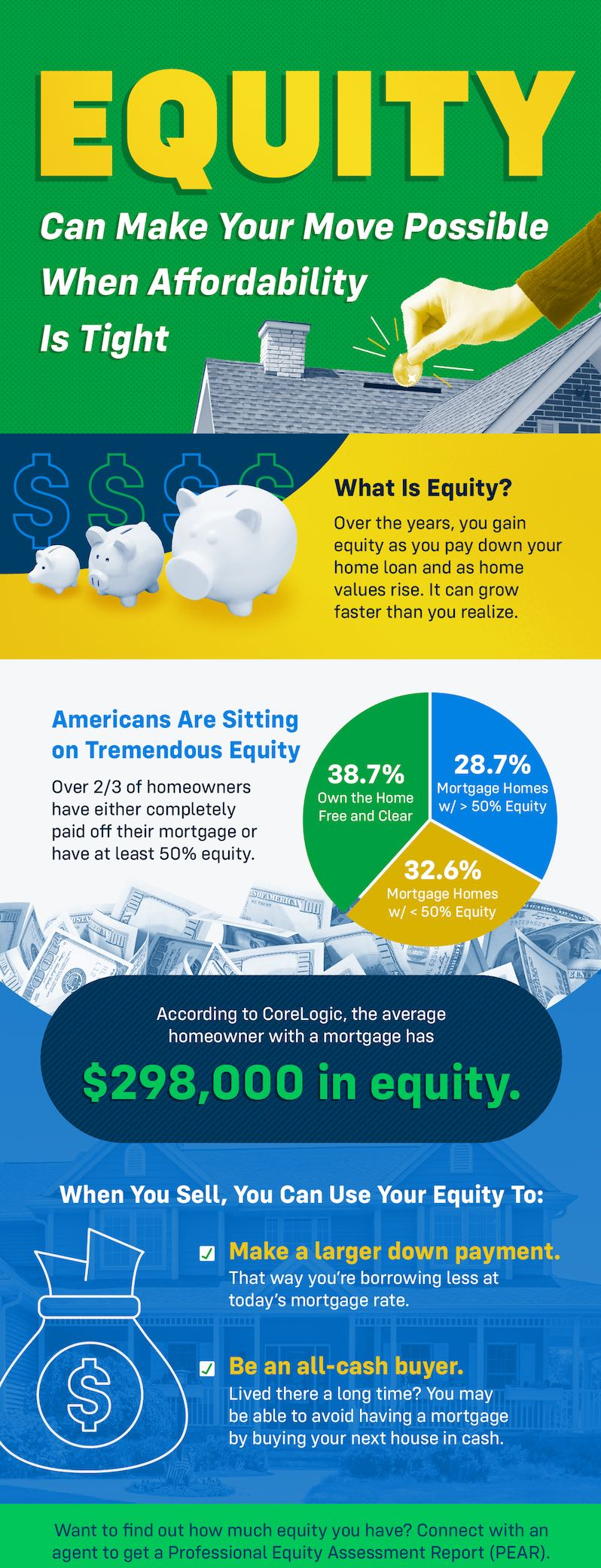

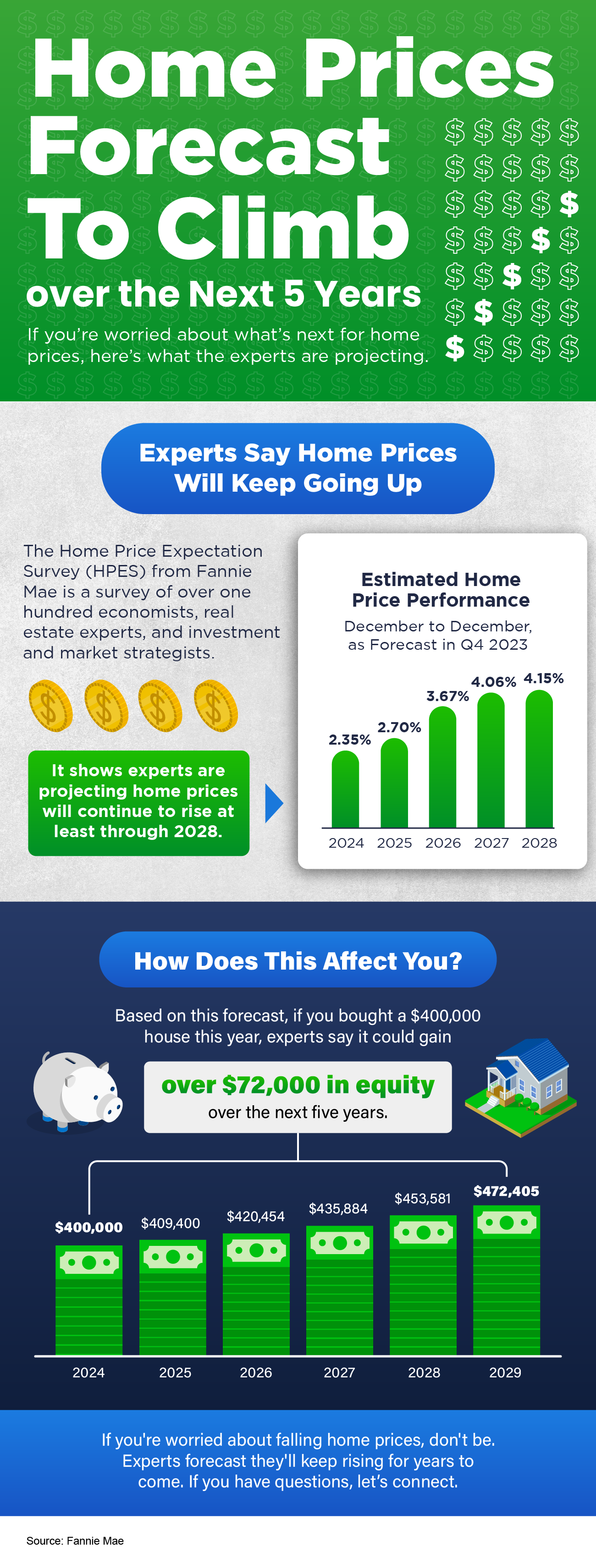

Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 experts—economists, real estate professionals, and investment and market strategists—what they think will happen with home prices.

In the latest survey, those experts say home prices are going to keep going up for the next five years (see graph below):

Here’s what all the green on this chart should tell you. They’re not expecting any price declines. Instead, they’re saying we’ll see a 3-4% rise each year.

And even though home prices aren’t expected to climb by as much in 2025 as they are 2024, keep in mind these increases can really add up over time. It works like this. If these experts are right and your home’s value goes up by 3.78% this year, it’s set to grow another 3.36% next year. And another 3.87% the year after that.

What Does This Mean for You?

Knowing that prices are forecasted to keep going up should make you feel good about buying a home. That’s because it means your home is an asset that’s projected to grow in value in the years ahead.

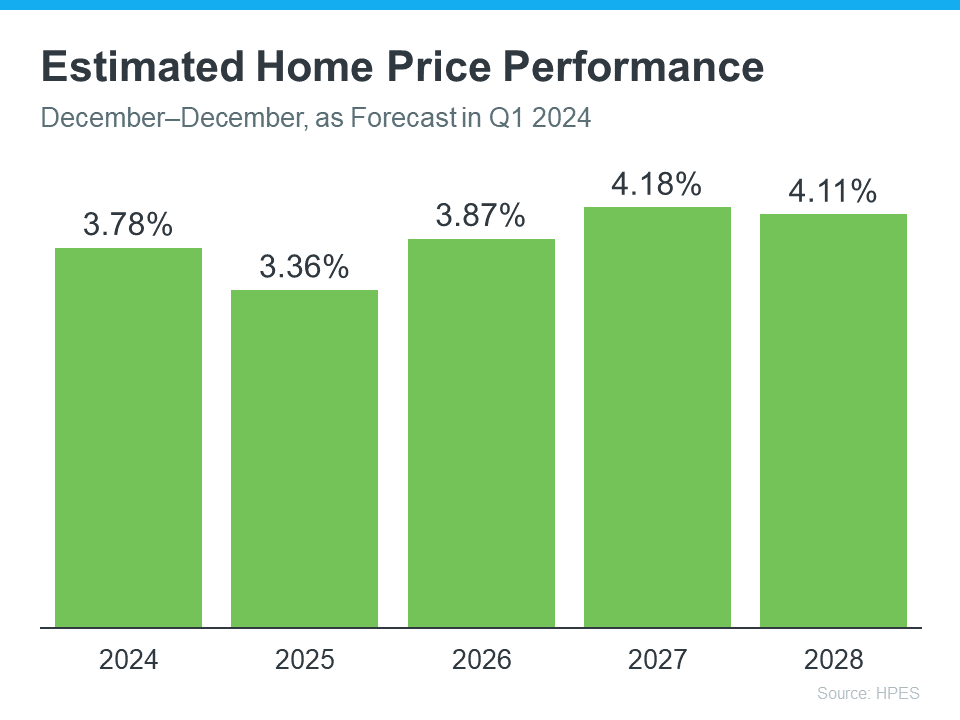

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using expert projections from the HPES. Check out the graph below:

In this example, imagine you bought a home for $400,000 at the start of this year. Based on these projections, you could end up gaining over $83,000 in household wealth over the next five years as your home grows in value.

Of course, you could also wait – but if you do, buying a home is just going to end up costing you more.

Bottom Line

If you’re thinking it’s time to get your own place, and you’re ready and able to do so, buying now might make sense. Your home is expected to keep getting more valuable as prices go up. Let’s team up to start looking for your next home today.

The Benefits of Downsizing When You Retire in Phoenix, Arizona

The Benefits of Downsizing When You Retire

If you’re taking a look at your expenses as you retire, saving money where you can has a lot of appeal. One long-standing, popular way to do that is by downsizing to a smaller home.

When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:

“A smaller home typically means lower bills and less upkeep. Then there’s the potential windfall that comes from selling your larger home and buying something smaller.”

That windfall is thanks to your home equity. If you’ve been in your house for a while, odds are you’ve built up a considerable amount of equity. And that equity is something you can use to help you buy a home that better fits your needs today. Daniel Hunt, CFA at Morgan Stanley, explains:

“Home equity can be a significant source of wealth for retirees, often representing a large portion of their net worth. . . . Retirement planning can be complex, but your home equity shouldn’t be overlooked.”

And when you’re ready to use that equity to fuel your next move, your real estate agent will be your guide through every step of the process. That includes setting the right price for your current house when you sell, finding the home that best fits your evolving needs, and understanding what you can afford at today’s mortgage rate.

What This Means for You

If you’re thinking about downsizing, ask yourself these questions:

- Do the original reasons I bought my current house still stand, or have my needs changed since then?

- Do I really need and want the space I have right now, or could somewhere smaller be a better fit?

- What are my housing expenses right now, and how much do I want to try to save by downsizing?

Then, meet with a real estate agent to get an answer to this one: What are my options in the market right now? A local real estate agent can walk you through how much equity you have in your house and how it positions you to win when you downsize.

Bottom Line

Want to save money in retirement? Consider downsizing – it could really help you out. When you’re ready, let’s connect about your goals in the housing market this year.

Why There Won’t Be a Recession That Tanks the Housing Market in Prescott Valley, Arizona

Why There Won’t Be a Recession That Tanks the Housing Market

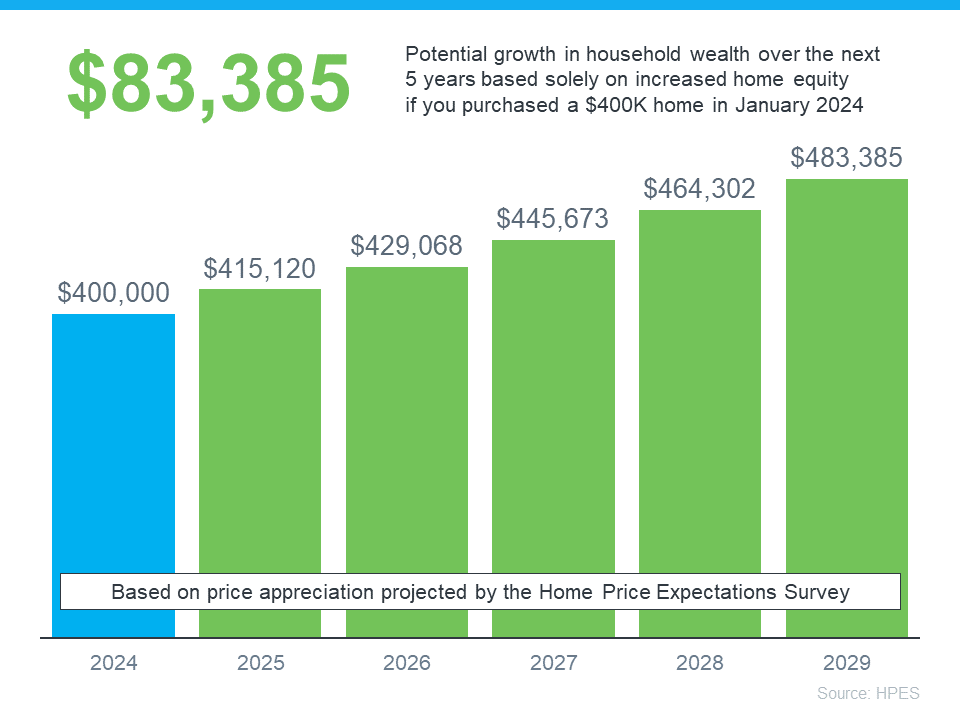

There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to show you why that isn’t going to happen.

According to Jacob Channel, Senior Economist at LendingTree, the economy’s pretty strong:

“At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.”

That might be why a recent survey from the Wall Street Journal shows only 39% of economists think there’ll be a recession in the next year. That’s way down from 61% projecting a recession just one year ago (see graph below):

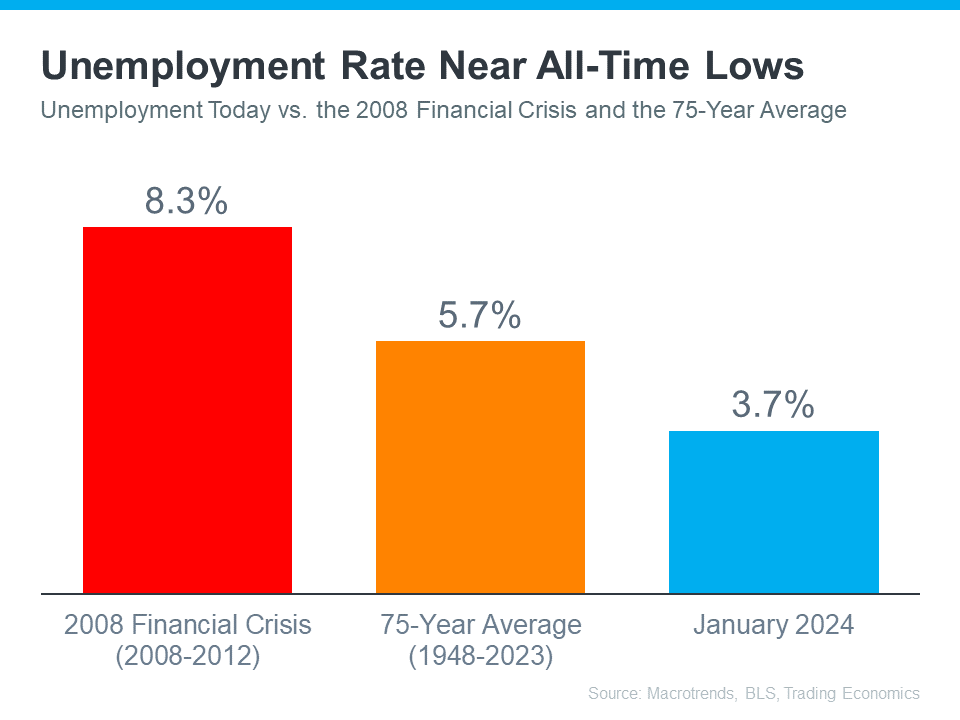

Most experts believe there won’t be a recession in the next 12 months. One reason why is the current unemployment rate. Let’s compare where we are now with historical data from Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics. When we do, it’s clear the unemployment rate today is still very low (see graph below):

The orange bar shows the average unemployment rate since 1948 is about 5.7%. The red bar shows that right after the financial crisis in 2008, when the housing market crashed, the unemployment rate was up to 8.3%. Both of those numbers are much larger than the unemployment rate this January (shown in blue).

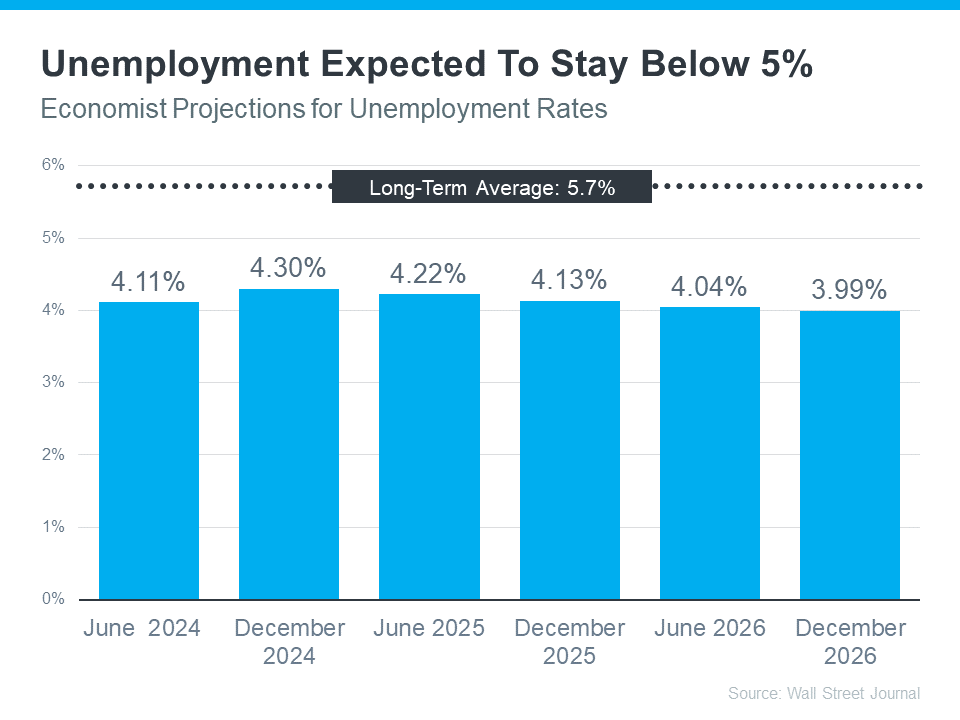

But will the unemployment rate go up? To answer that, look at the graph below. It uses data from that same Wall Street Journal survey to show what the experts are projecting for unemployment over the next three years compared to the long-term average (see graph below):

As you can see, economists don’t expect the unemployment rate to even come close to the long-term average over the next three years – much less the 8.3% we saw when the market last crashed.

Still, if these projections are correct, there will be people who lose their jobs next year. Anytime someone’s out of work, that’s a tough situation, not just for the individual, but also for their friends and loved ones. But the big question is: will enough people lose their jobs to create a flood of foreclosures that could crash the housing market?

Looking ahead, projections show the unemployment rate will likely stay below the 75-year average. That means you shouldn’t expect a wave of foreclosures that would impact the housing market in a big way.

Bottom Line

Most experts now think we won’t have a recession in the next year. They also don’t expect a big jump in the unemployment rate. That means you don’t need to fear a flood of foreclosures that would cause the housing market to crash.

Why So Many People Fall in Love with Homeownership in Scottsdale, Arizona

Why So Many People Fall in Love with Homeownership

Chances are at some point in your life you’ve heard the phrase, home is where the heart is. There’s a reason that’s said so often. Becoming a homeowner is emotional.

So, if you’re trying to decide if you want to keep on renting or if you’re ready to buy a home this year, here’s why it’s so easy to fall in love with homeownership.

Customizing to Your Heart’s Desire

Your house should be a space that’s uniquely you. And, if you’re a renter, that can be hard to achieve. When you rent, the paint colors are usually the standard shade of white, you don’t have much control over the upgrades, and you’ve got to be careful how many holes you put in the walls. But when you’re a homeowner, you have a lot more freedom. As the National Association of Realtors (NAR) says:

“The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.”

Whether you want to paint the walls a cheery bright color or go for a dark moody tone, you can match your interior to your vibe. Imagine how it would feel to come home at the end of the day and walk into a space that feels like you.

Greater Stability for the Ones You Love Most

One of the hardest things about renting is the uncertainty of what happens at the end of your lease. Does your payment go up so much that you have to move? What if your landlord decides to sell the property? It’s like you’re always waiting for the other shoe to drop. Jeff Ostrowski, a business journalist covering real estate and the economy, explains how homeownership can give you more peace of mind in a Money Geek article:

“Homeownership means you are the boss and have the biggest say in your lifestyle and family decisions. Suppose your kids are in public school and you don’t want to risk having them change schools because your landlord doesn’t renew your lease. Owning a home would remove much of the risk of having to move.”

A Feeling of Belonging

You may also find you feel much more at home in the community once you own a house. That’s because, when you buy a home, you’re staking a claim and saying, I’m a part of this community. You’ll have neighbors, block parties, and more. And that’ll give you the feeling of being a part of something bigger. As the International Housing Association explains:

“. . . homeowning households are more socially involved in community affairs than their renting counterparts. This is due to both the fact that homeowners expect to remain in the community for a longer period of time and that homeowners have an ownership stake in the neighborhood.”

The Emotional High of Achieving Your Dream

Becoming a homeowner is a journey – and it may have been a long road to get to the point where you’re ready to take the plunge. If you’re seriously considering leaving behind your rental and making this commitment, you should know the emotions that come with this owning a home are powerful. You’ll be able to walk up to your front door every day and have that sense of accomplishment welcome you home.

Bottom Line

A home is a place that reflects who you are, a safe space for the ones you love the most, and a reflection of all you’ve accomplished. Let’s connect if you’re ready to break up with your rental and buy a home.

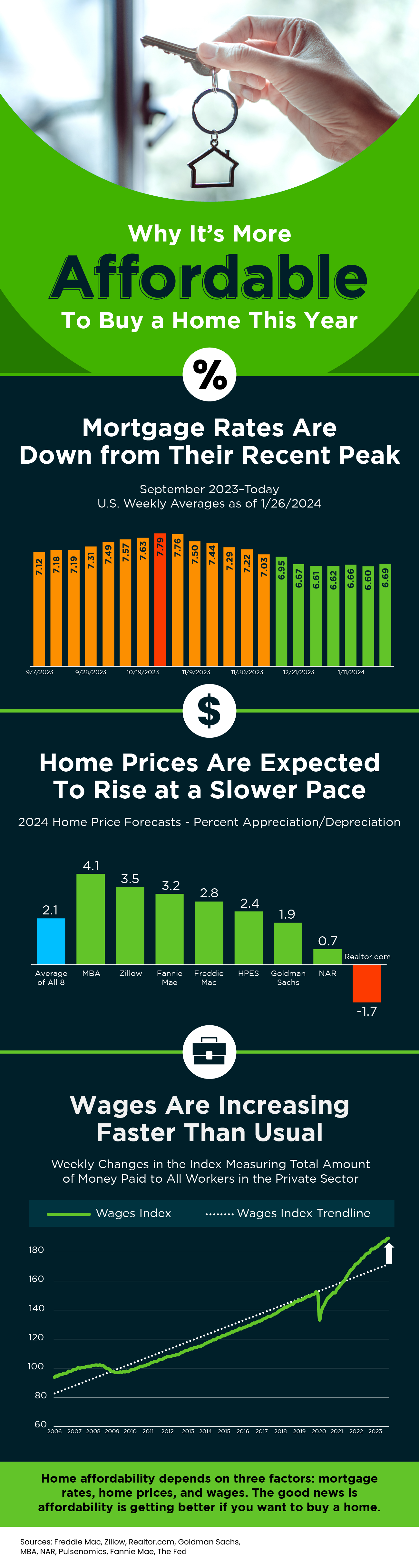

Why It’s More Affordable To Buy a Home in Phoenix, Arizona This Year [INFOGRAPHIC]

Why It’s More Affordable To Buy a Home This Year [INFOGRAPHIC]

Some Highlights

- Home affordability depends on three factors: mortgage rates, home prices, and wages.

- Mortgage rates are down from their recent peak, home prices are expected to rise at a slower pace, and wages are increasing faster than usual.

- That’s good news if you want to buy a home because it means affordability is getting better.

The Top Benefits of Buying a Multi-Generational Home in Prescott, Arizona

The Top Benefits of Buying a Multi-Generational Home

Has the idea of sharing a home with loved ones like your grandparents, parents, or other relatives crossed your mind? If so, you’re not alone. More buyers are choosing to go this route and buy a multi-generational home. Here’s a look at some of the top reasons why, to see if a home like this may be right for you too.

Why Buyers Are Opting for Multi-Generational Living

According to the National Association of Realtors (NAR), two of the top reasons buyers are opting for multi-generational homes today have to do with affordability (see graph below):

First-time buyers are focused most on cost savings – with 28% saying this was a key reason for them. By pooling their resources with others, they can share financial responsibilities like mortgage payments, utilities, and more to make homeownership more affordable. This is especially helpful for those first-time homebuyers who may be finding it tough to afford a home on their own in today’s market.

Buyers are also turning to multi-generational homes so they can more easily afford their dream home. Both first-time (28%) and repeat buyers (18%) chose to live with others so they could buy a larger home. When everyone chips in and combines their incomes, that big dream home with more space could be more within reach.

But multi-generational living isn’t just about the financial side of things. According to the same study from NAR, 23% of repeat buyers chose to buy a multi-generational home to make it easier to care for an aging parent. Many older adults want to age in place and a multi-generational home can help make that possible. For those older adults, it gives them an opportunity to maintain their quality of life while being surrounded by their loved ones. As Axios explains:

“Financial concerns and caregiving needs are two of the major reasons people live with their parents (and parents’ parents).”

Lean on an Expert

Finding the perfect multi-generational home isn’t as simple as shopping for a regular house. That’s because there are more people with even more opinions and needs to be considered. It’s like solving a puzzle, and the pieces need to fit just right.

So if you’re interested in the many benefits multi-generational living offers, partner with a local real estate agent who has the expertise to help.

Bottom Line

Whether your motives are financial or focused on the people you’ll share your home with, buying a multi-generational home may make sense for you. If you’re interested in learning more, let’s connect.

Home Prices in Prescott Valley, Arizona Forecast To Climb over the Next 5 Years [INFOGRAPHIC]

Home Prices Forecast To Climb over the Next 5 Years [INFOGRAPHIC]

Some Highlights

- If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028.

- Based on that forecast, if you bought a $400,000 house this year, experts say it could gain over $72,000 in equity over the next five years.

- If you’re worried about falling home prices, don’t be. Many experts forecast they’ll keep rising for years to come. If you have questions, let’s connect.

The Dramatic Impact of Homeownership on Net Worth in Ventura, California

The Dramatic Impact of Homeownership on Net Worth

If you’re trying to decide whether to rent or buy a home this year, here’s a powerful insight that could give you the clarity and confidence you need to make your decision.

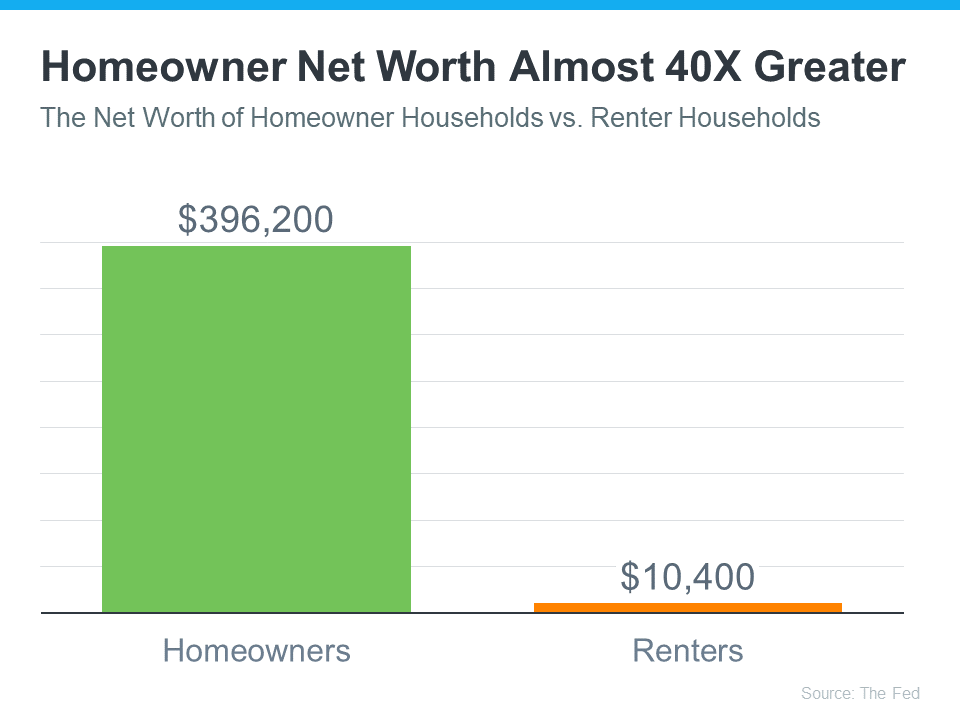

Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares net worth for homeowners and renters. The latest report shows the average homeowner’s net worth is almost 40X greater than a renter’s (see graph below):

One reason a wealth gap exists between renters and homeowners is because when you’re a homeowner, your equity grows as your home appreciates in value and you make your mortgage payment each month. When you own a home, your monthly mortgage payment acts like a form of forced savings, which eventually pays off when you decide to sell. As a renter, you’ll never see a financial return on the money you pay out in rent every month. Ksenia Potapov, Economist at First American, explains it like this:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments . . .”

The Largest Part of Most Homeowner Net Worth Is Their Equity

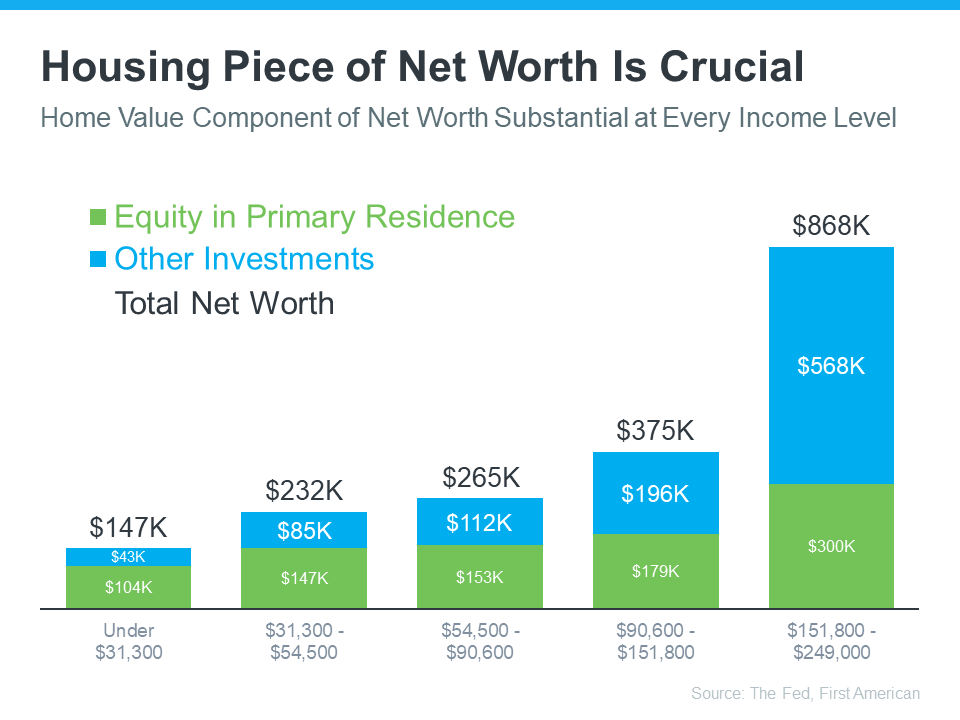

Home equity does more to build the average household’s wealth than anything else. According to data from First American and the Federal Reserve, this holds true across different income levels (see graph below):

The green segment in each bar represents how much of a homeowner’s net worth comes from their home equity. Based on this data, it’s clear no matter what your income level is, owning a home can really boost your wealth. Nicole Bachaud, Senior Economist at Zillow, shares:

“The biggest asset most people are ever going to own is a home. Homeownership is really that financial key that helps unlock stability and wealth preservation across generations.”

If you’re ready to start building your net worth, the current real estate market offers several opportunities you should consider. For example, with mortgage rates trending lower lately, your purchasing power may be higher now than it has been in months. And, with more inventory coming to the market, there are more options for you to consider. A local real estate agent can walk you through the opportunities you have today and guide you through the process of finding your ideal home.

Bottom Line

If you’re unsure about whether to rent or buy a home, keep in mind that owning a home can increase your overall wealth in the long run, no matter your income. To discover more about this and the many other benefits of homeownership, let’s connect.

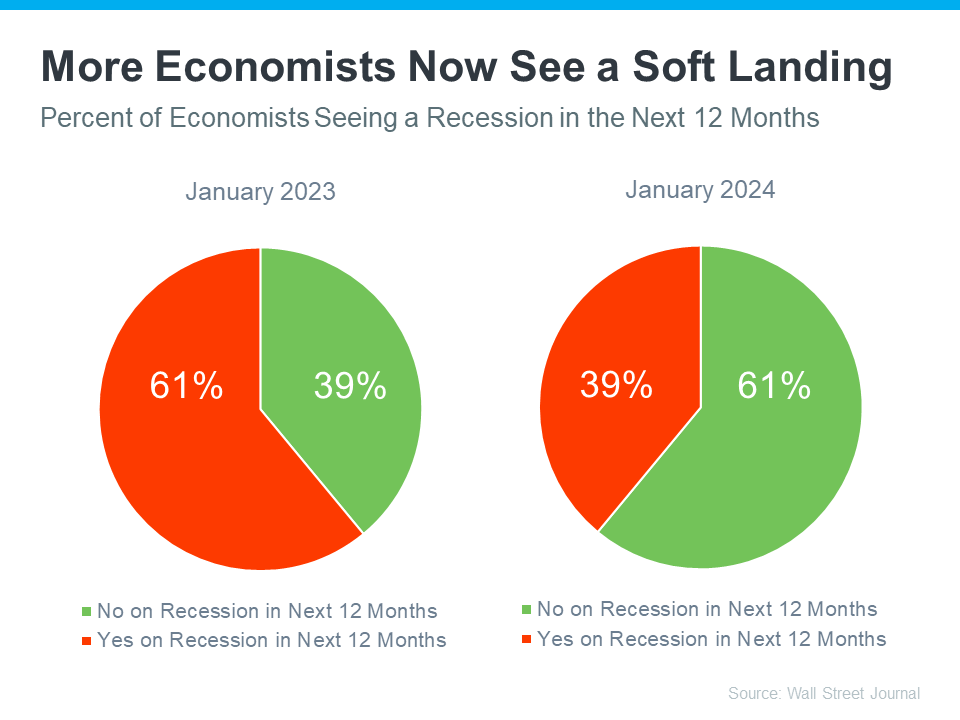

Ways Your Home Equity Can Help You Reach Your Goals in Camarillo, California

Ways Your Home Equity Can Help You Reach Your Goals

If you’ve owned your house for at least a couple of years, there’s something you’re going to want to know more about – and that’s home equity. If you’re not familiar with that term, Freddie Mac defines it like this:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

That means your equity grows as you pay down your home loan over time and as home values climb. While it’s true home prices dipped slightly last year, they rebounded and have been climbing in many areas since then. Here’s why that price growth is good news for you.

In the latest Equity Insights Report, Selma Hepp, Chief Economist at CoreLogic, explains:

“With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year. And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up.”

And that figure is just for the last year. To help you really understand how that number can add up over time, the report also says the average homeowner with a mortgage has more than $300,000 in equity. That much equity can have a big impact.

Here are a few examples of how you can put your home equity to work for you.

1. Buy a Home That Fits Your Needs

If your current space no longer meets your needs, it might be time to think about moving to a bigger home. And if you’ve got too much space, downsizing to a smaller one could be just right. Either way, you can put your equity toward a down payment on something that fits your changing lifestyle.

2. Reinvest in Your Current Home

And, if you’re not ready to move just yet, you can use the equity you have to improve your current home. But it’s important to consider the long-term benefits certain upgrades can bring to your home’s value. A real estate agent is a great resource on which projects to prioritize to get the greatest return on your investment when you sell later on.

3. Pursue Personal Ambitions

Home equity can also serve as a catalyst for realizing your life-long dreams. That could mean investing in a new business venture, retirement, or funding an education. While you shouldn’t use your equity for unnecessary spending, using it responsibly for something meaningful and impactful can really make a difference in your life.

4. Understand Your Options to Avoid Foreclosure

While the number of foreclosure filings remains below the norm, there are still some homeowners who go into foreclosure each year. If you’re in a tough spot financially, having a clear understanding of your options can help. Equity can act as a cushion if you’re not able to make your mortgage payments on time.

Bottom Line

If you want to know how much equity you have in your home, let’s connect. That way you have someone who can do a professional equity assessment report on how much you’ve built up over time. Then let’s talk through how you can use it to help you reach your goals.