The Secret To Selling? Using an Agent To Get Your House Noticed in Oxnard, California.

The Secret To Selling? Using an Agent To Get Your House Noticed

In a recent survey, the National Association of Realtors (NAR) asked sellers what they want most from a real estate agent. The number one answer was to help market their house.

It makes sense. The way your agent markets your house can be the difference between whether or not it stands out and gets attention from buyers. That’s why it’s so important to work with an expert local agent that knows what they’re doing.

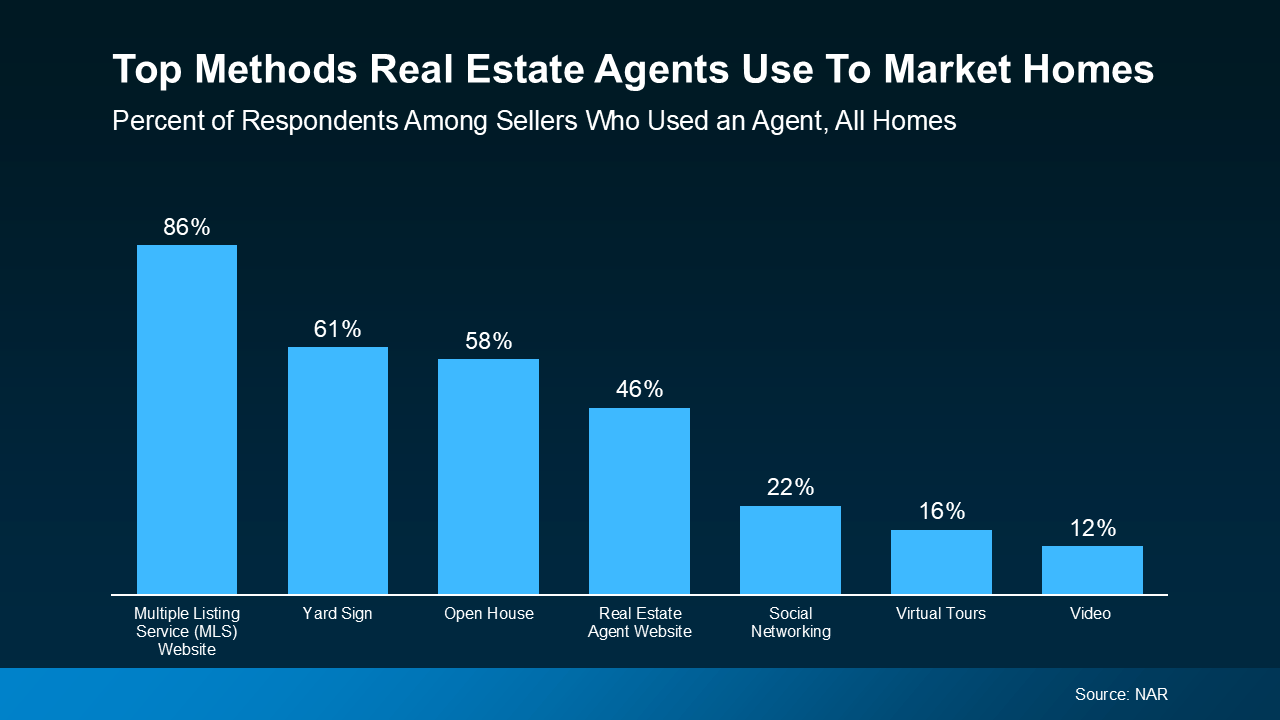

According to that same report from NAR, here are some of the most common methods real estate agents use to market homes, and how you benefit when your agent uses them effectively (see graph below):

- Listing on the MLS – Real estate agents have access to the Multiple Listing Service (MLS) database. And that’s great for you because having your house on the MLS helps it get more visibility from other agents and buyers. And the more people who see it, the more likely it is to sell.

- Using a Yard Sign – A yard sign may seem simple, but it’s one of the best ways to catch the attention of people driving or walking by. And when it does, they’ll help spread the word to friends and family who are looking to buy that there’s a house for sale in the area. It also puts your agent’s contact information on display, making it easy for interested buyers to get in touch.

- Having an Open House – An open house is a great way to create a sense of competition and urgency among buyers – and that can lead to stronger offers. And since you’ll only need to leave once for many buyers to visit, it makes the process easier for you, too. Plus, an open house helps your agent get real-time feedback about what buyers love and what they’re not as sold on.

- Showcasing on Your Agent’s Website – Having your house on your agent’s website presents it in a professional way to buyers. And odds are, people visiting your agent’s website are serious and ready to make a move, so this is a smart way to get in front of motivated buyers.

- Social Networking – Posting your house on social helps get your house in front of buyers who may not have seen it with traditional marketing. It also makes it easy for people to share your listing with friends and loved ones.

- Providing Virtual Tours – For buyers who are relocating from out of town, virtual tours allow them to check out your house anytime from wherever they are. This helps reach more potential buyers who may not be able to come to see your house in person.

- Using Video – Video is an excellent way for your agent to show off some of the top features of your house like your kitchen, large closets, outdoor entertainment areas, and other key details that could attract buyers.

- Sending Emails – Sending out information about your house to your agent’s expansive database is another way they’ll get it in front of even more people. Great agents may even send emails teasing that your house is coming to the market as a way to boost interest and excitement before it officially has an open house.

Here’s what it comes down to. Most good agents will write a description of your house for the listing and pair it with high-quality photos. But a great agent will do so much more than that.

They’ll not only lean on their expertise, they’ll put in the time and effort to make sure your house makes an impression on buyers, and ultimately, sells.

Bottom Line

As a seller, working with a creative local real estate agent is a smart way to ensure your house grabs the attention of the right buyers. If you’re ready to sell and want to talk about strategies we can use to get your house sold, let’s chat.

Two Resources That Can Help You Buy a Home Right Now in Camarillo, California.

Two Resources That Can Help You Buy a Home Right Now

A recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s the thing. With the right resources and help, you can still make it happen.

There are options that can help make buying a home possible today — even if your savings are limited or your credit isn’t perfect. Let’s explore just two of the solutions that could help get you into your first home no matter the market.

1. FHA Loans

If your down payment savings and your credit score aren’t where you want them to be, an FHA loan could be your pathway to buying a home. According to the U.S. Department of Housing and Urban Development (HUD) and Bankrate, the big perks of an FHA home loan are:

- Lower Down Payments: They typically require a smaller down payment than conventional loans, sometimes as low as 3.5% of the home’s purchase price.

- Lower Credit Score Requirements: They’re designed to help buyers with credit scores that might not qualify for conventional financing. This means, when conventional loans aren’t an option, you may still be able to get an FHA loan.

The first step is to connect with a lender who can help you explore your options and determine if you qualify.

2. Homeownership Assistance Programs

And if you need a more budget-friendly down payment, that’s not your only option. Did you know there are over 2,000 homeownership assistance programs available across the U.S. according to Down Payment Resource? And more than 75% of these programs are designed to help buyers with their down payment. Here’s a bit more information about why these could be such powerful tools for you:

- Financial Support: The average benefit for buyers who qualify for down payment assistance is $17,000. And that’s not a small number.

- Stackable Benefits: To make it even better, in some cases, you may be able to qualify for multiple programs at once, giving your down payment an even bigger boost.

Rob Chrane, CEO of Down Payment Resource confirms a little-known fact:

“Some of these programs can be layered. And so, in other words, you may not be limited to just one program.”

If you want to learn more or see what you qualify for, be sure to lean on the pros. A trusted real estate agent and a lender can guide you through the process, explain the help that’s out there, and connect you with resources to make buying a home a reality.

Bottom Line

If you’re ready to stop wondering if buying a home is possible and start exploring solutions, let’s connect.

3 Reasons To Buy a Home Before Spring in Prescott Valley, Arizona

3 Reasons To Buy a Home Before Spring

Let’s face it — buying a home can feel like a challenge with today’s mortgage rates. You might even be thinking, “Should I just wait until spring when more homes hit the market and rates might be lower?”

But here’s the thing, no one knows for sure where mortgage rates will go from here, and waiting could mean facing more competition, higher prices, and a lot more stress.

What if buying now — before the spring rush — might actually give you the upper hand? Here are three reasons why that just might be the case.

1. Less Competition from Other Buyers

The winter months tend to be quieter in the real estate market. Fewer people are actively looking for homes, which means you’ll likely face less competition when you make an offer. This makes the process feel less rushed and less stressful.

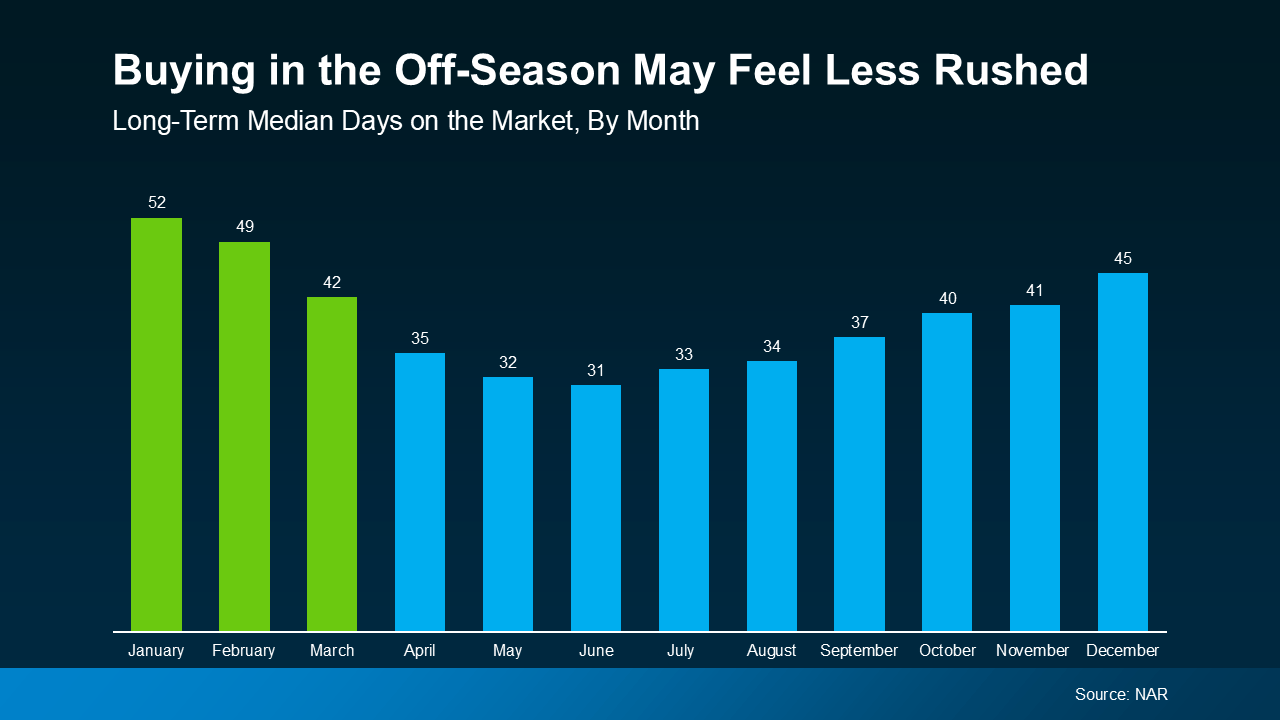

According to the National Association of Realtors (NAR), homes sit on the market longer in winter compared to spring and summer (see graph below):

“A significant benefit of buying a home in winter is the reduced competition. Because of the perceived benefits of spring, many buyers delay the start of their house hunt. As a result, you will find fewer people competing for the same properties during winter. Less demand can translate into more negotiating power as sellers may be more willing to entertain offers or agree to concessions to get a deal closed quickly.”

2. More Negotiating Power

With homes staying on the market longer, sellers may be more willing to negotiate. This can lead to better deals for you as a buyer, whether that means a lower price or added incentives, like sellers covering closing costs or making repairs. As Chen Zhao, an Economist at Redfin, points out:

“. . . buying during the off season means less competition from other buyers. That means potentially negotiating a better deal.”

Plus, when demand is lower, sellers often feel more pressure to work with serious buyers. This could give you an edge to negotiate terms that work best for your situation.

3. Lock in Today’s Prices Before They Rise

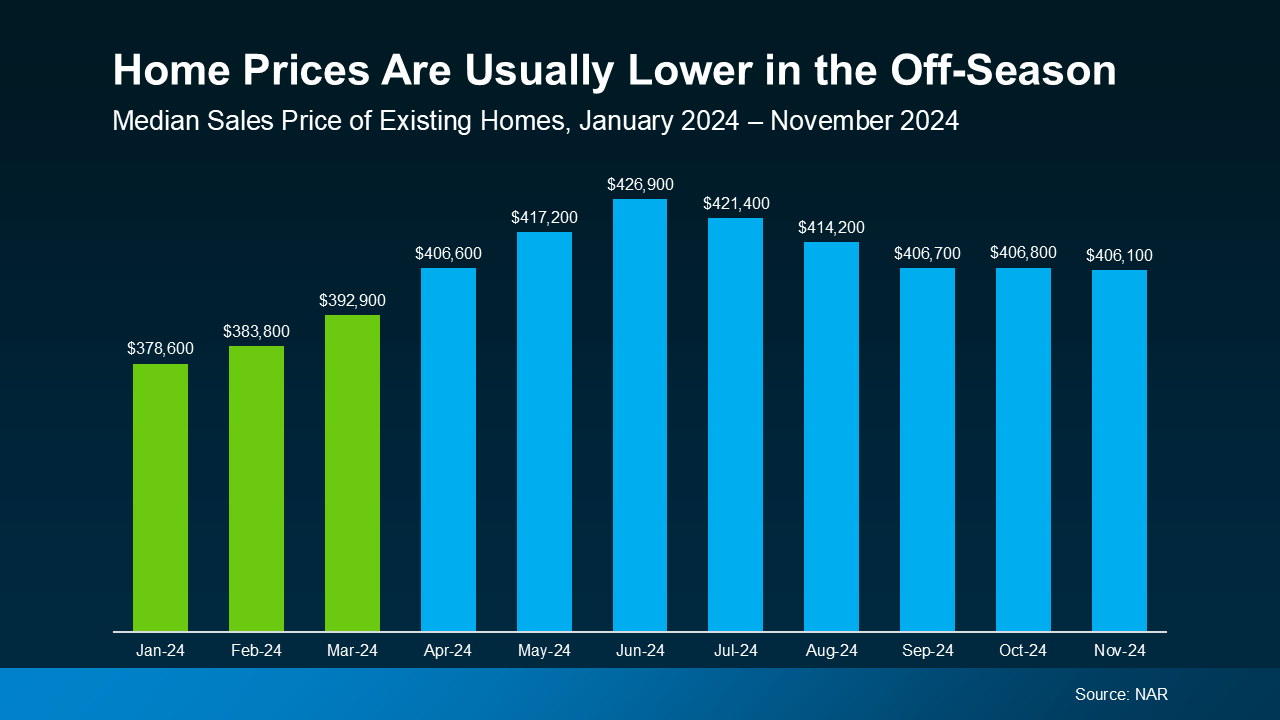

Historically, home prices tend to be at their lowest point in the winter months, too. According to data from NAR, home prices last year were at their lowest in January, February, and March — right before the spring buying season kicked in (see graph below):

On top of that, home prices generally appreciate over time, meaning they tend to go up year after year. That means if you’re ready to buy and you can make it happen, you’re not only taking advantage of what might be the lowest prices of the year, but you’re also locking in today’s price before it increases in the future.

Bottom Line

While spring may seem like the obvious time to buy, moving before the peak season can give you significant advantages, like less competition, more negotiation power, and lower prices.

If you’re ready to explore your options, let’s connect.

Why More People Are Buying Multi-Generational Homes Today in Scottsdale, Arizona

Why More People Are Buying Multi-Generational Homes Today

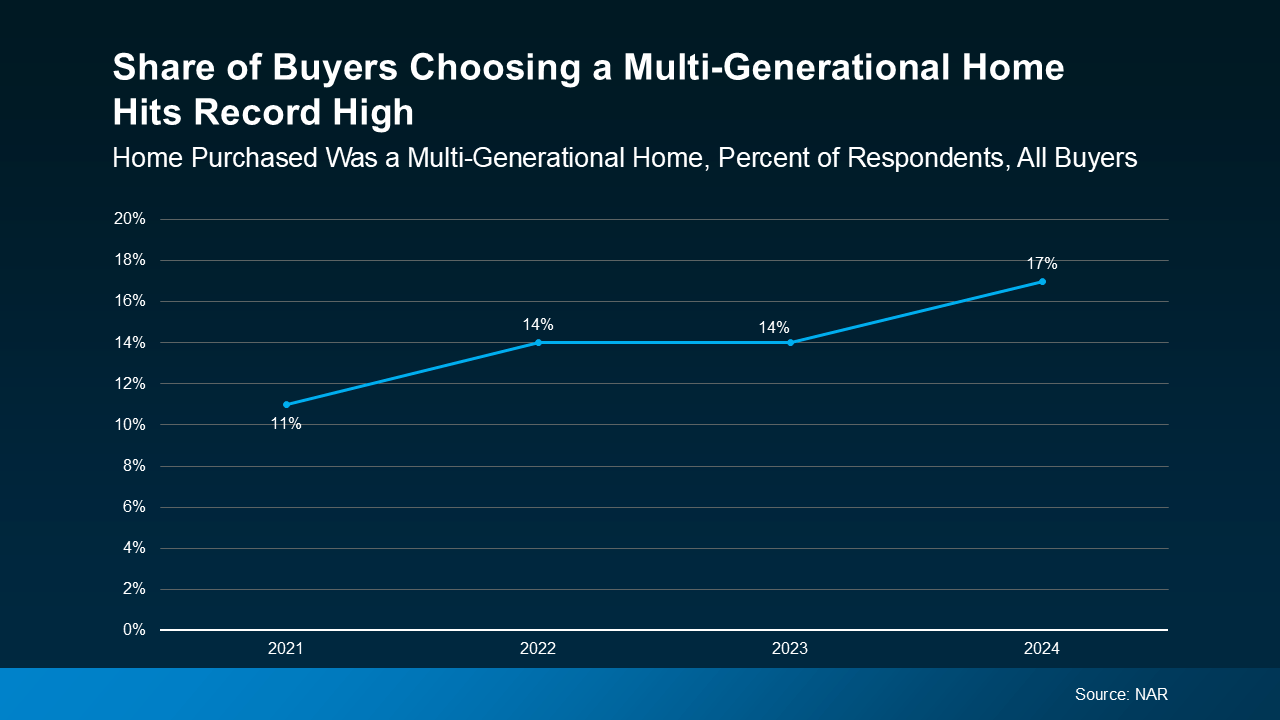

Today, 17% of homebuyers are choosing multi-generational homes — that’s when you buy a house with your parents, adult children, or even distant relatives. What makes that noteworthy is that 17% is actually the highest level ever recorded by the National Association of Realtors (NAR). But what’s driving the recent rise in multi-generational living?

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home

In the past, homebuyers often opted for multi-generational homes to make it easier to care for their parents. And while that’s still a key reason, it’s not the only one. Right now, there’s another powerful motivator: affordability.

According to the latest data from NAR, cost savings are the main reason more people are choosing to live with family today.

The rising cost of homeownership is making it harder for many people to afford a home on their own. This has led to more families pooling their resources to make buying a home possible.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

“There are a few ways to improve affordability, at least marginally. . . purchase a property with a family member — there are a growing number of multi-generational households across the country today, and affordability is one of the reasons for this.”

You may even find it helps you afford a bigger home than you would have been able to on your own. So, if you need more room, but can’t afford it with today’s rates and prices, this could be an option to still get the space you need.

On top of the financial benefits, it could also bring your family closer together and strengthen your bonds by getting more quality time together.

Bottom Line

If you’re considering a move, buying a multi-generational home might be worth exploring – especially if your budget is stretched too thin on your own.

Let’s discuss your needs and find a home that fits your family’s unique situation.

When Is the Perfect Time to Move in Prescott, Arizona?

When Is the Perfect Time To Move?

It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices will fall. But here’s what you need to realize: trying to time the market rarely works. And here’s why.

There is no perfect market.

No matter when you buy, there’s always some benefit and some sort of trade-off – and that’s not a bad thing. That’s just the reality of it. If you’re not sure you buy into that, think back to the last 5 years in housing.

Just a few years ago, mortgage rates hit a historic low. To take advantage of that, a ton of buyers rushed to buy a home and lock in those lower rates. The side effect? With such a big increase in how many buyers were purchasing, the homes on the market were snapped up fast. And since that resulted in so few homes left for sale, bidding wars became the norm and home prices went through the roof. Those buyers got a great rate, but they had other things to contend with.

Now, with higher rates and higher prices, it’s more expensive to buy. You can’t argue that. But at the same time, the number of homes for sale is at the highest point in several years. That means you have more options to choose from and you’ll be less likely to find yourself in a pull-out-all-the-stops bidding war. Again, there are benefits and trade-offs in any market.

So, if you have a reason to move and can afford to do so, you’ve got to take advantage of the trends that work in your favor and lean on a pro to help you navigate the rest. As Bankrate says:

“The complexities of the current conditions mean that, now more than ever, it’s smart to lean on the guidance of an experienced local real estate agent. If you want to enter the housing market in 2025, whether as a buyer or a seller, let a pro lead the way for you.”

While achieving your goals may feel like an uphill battle in today’s complex market, it is doable. But you’ll need the help of a trusted real estate agent and a lender.

Your agent will help you explore creative solutions – like looking into different housing types (like smaller condos), considering homes that need a little elbow grease, or casting a wider net for your search area. And your lender will walk you through different loan options and down payment assistance programs, so you know what you need to do to make the numbers work for you. As Yahoo Finance says:

“Buying a house at a time when both mortgage rates and home prices are favorable is a challenge. You probably shouldn’t try to time the housing market . . . Buy when it makes sense for you personally.”

Bottom Line

There’s no perfect time to move – every market has its pros and cons. The key is knowing how to make the most of the factors working in your favor. If you need to move and can afford to do it, let’s connect so you’ll have the guidance and tools to make it possible.

If Your House’s Price Is Not Compelling, It’s Not Selling in Phoenix, Arizona.

If Your House’s Price Is Not Compelling, It’s Not Selling

There’s one big mistake you need to avoid when you sell your house this year: setting your price too high. It might seem like overpricing gives you room to negotiate or could really boost your profit, but the reality is, it usually backfires.

In fact, Realtor.com says almost 20% of sellers — that’s one in five — have to reduce their price to get their house sold. And you don’t want to be one of them. Here’s why starting too high can lead to trouble, and how to avoid it.

Overpricing Pushes Buyers Away

With mortgage rates and home prices where they are right now, buyers are already stretching their budgets to make a move. So, when they see a house that’s priced too high, they’re not thinking, “I can negotiate.” They’re more likely to think, “next” and skip over your house entirely. An article from the National Association of Realtors (NAR) explains:

“Some sellers are pricing their homes higher than ever just because they can, but this may drive away serious buyers . . .”

And if they skip over your listing, you’ll miss out on the chance to get them through the door. That’s the last thing you want because fewer showings mean fewer chances to receive an offer.

The Longer Your House Sits, the More Skeptical Buyers Will Get

Here’s the other issue. An overpriced house tends to sit on the market longer. And the longer a house lingers, the more buyers start to wonder what’s wrong with it. Is there a problem with the house itself? Are you difficult to work with? Even if the only issue is the price, that extra time creates doubt. As U.S. News says:

“. . . setting an unrealistically high price with the idea that you can come down later doesn’t work in real estate . . . A home that’s overpriced in the beginning tends to stay on the market longer, even after the price is cut, because buyers think there must be something wrong with it.”

At that point, you’ll have no choice but to lower your price to drum up interest. But that price reduction comes with its own downside: buyers may see it as another red flag, that there’s an issue with the house.

The Key To Finding the Right Price for Your House

So, what’s the secret to avoiding all these headaches? It’s simple. Work with a local real estate agent who knows the market inside and out, and who’s going to be honest with you about how you should price your house.

You don’t want to partner with someone who just agrees to whatever number you throw out there. That’s not an expert who’s going to get you the best results.

You want an agent who recommends a price based on their expertise. The right agent will use real-time data from your local market to help you land on a price that makes sense — one that grabs attention, attracts buyers, and still helps you walk away with a great return. Someone who has been there and done that – and done it well. That’s the agent you want to work with.

Bottom Line

Remember, if the price isn’t compelling, it’s not selling. Instead of shooting too high and scaring off buyers, work with a local agent who knows how to price it right.

Let’s team up and make sure your house hits the market with the right price, gets noticed, and gets sold.

Smaller Homes, Bigger Opportunities: The Homebuilder Trend Buyers Love in Camarillo, California.

Smaller Homes, Bigger Opportunities: The Homebuilder Trend Buyers Love

It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. But, if you don’t need a ton of space, you may find you have more cost-effective options in an unexpected place: new home communities.

Builders Are Building Smaller Homes

Since smaller homes typically come with smaller price tags, buyers have turned their attention to homes with less square footage — and builders have shifted their focus to capitalize on that demand. As U.S. News notes:

“The combination of higher home prices and mortgage rates has strained a lot of people’s budgets. And that’s something builders recognize. To this end, they may be leaning toward smaller spaces . . .That, in turn, can lead to savings for buyers.”

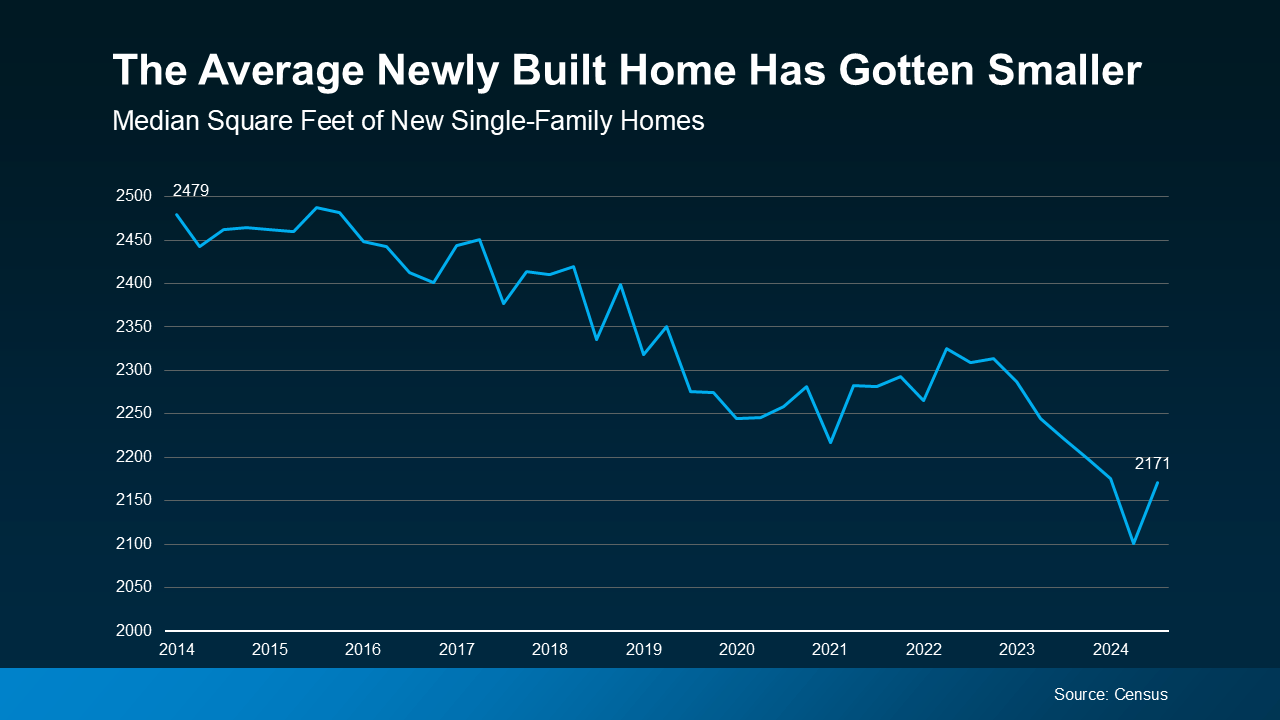

Data from the Census shows the overall builder trend toward smaller, single-family homes has been over the last couple of years (see graph below):

At the end of the day, builders want to build what they know will sell. And the number one thing homebuyers are looking for right now is less expensive options to help offset today’s affordability challenges. As Multi-Housing News notes:

“The growing trend toward smaller homes is evident. These homes are less expensive to build and more attainable for many middle-income families, meeting both housing needs and modern lifestyle preferences.”

The Benefits of These Brand-New Homes

So, if you’re having trouble finding a home in your budget, it might be worth exploring newly built homes with a smaller footprint.

Not to mention, since newly built homes come with brand new everything, they have fewer maintenance needs and some of the latest features available, like energy-efficient appliances and HVAC. That’ll help you save on repair costs and your monthly utility bills. Sounds like an all-around win.

Bottom Line

Today’s builders are focusing their efforts on smaller homes at lower price points. That could give you more opportunity to find something that fits your budget. If you’re planning to buy soon, let’s connect to explore what’s on the market in your area and get your homeownership goals over the finish line.

What To Do If Your House Didn’t Sell in Oxnard, California

What To Save for When Buying a Home in Ventura, California

What To Save for When Buying a Home

Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.

Here are just a few things experts say you should be thinking about as you plan ahead.

1. Down Payment

Saving for your down payment is likely top of mind. But how much do you really need? A common misconception is that you have to put down 20% of the purchase price. But that’s not necessarily the case. Unless it’s specified by your loan type or lender, you don’t have to. There are some home loan options that require as little as 3.5% or even 0% down. An article from The Mortgage Reports explains:

“The amount you need to put down will depend on a variety of factors, including the loan type and your financial goals. If you don’t have a large down payment saved up, don’t worry—there are plenty of options available . . .”

A trusted lender will go over the various loan types with you, any down payment requirements on those, and down payment assistance programs you may qualify for. The more you know ahead of time, the easier the process will be. And the key to getting the information you need is working with a pro to see what’ll work best for your situation.

2. Closing Costs

Make sure you also budget for closing costs, which are a collection of fees and payments made to the various parties involved in your transaction. Bankrate explains:

“Mortgage closing costs are the fees associated with buying a home that you must pay on closing day. Closing costs typically range from 2 to 5 percent of the total loan amount, and they include fees for the appraisal, title insurance and origination and underwriting of the loan.”

When it comes to closing costs, a trusted lender can guide you through specifics and answer any questions you may have. They can also give you a better idea of how much you should be prepared to pay so you can cruise through your closing with confidence.

And as you plan ahead for closing day, be sure to budget for your real estate agent’s professional service fee too, in case the seller doesn’t cover it. But don’t worry, you’ll work with your agent ahead of time to agree on what this is, so you won’t be surprised at the finish line.

3. Earnest Money Deposit

And if you want to cover all your bases, you can also consider saving for an earnest money deposit (EMD). According to Realtor.com, an EMD is typically between 1% and 2% of the total home price and is money you pay as a show of good faith when you make an offer on a house.

But, it’s not an added expense. Instead, it works like a credit and goes toward some of your upfront costs. You’re simply using some of the money you’ve already saved for your purchase to show the seller you’re committed and serious about buying their house. Realtor.com describes how it works as part of your sale:

“It tells the real estate seller you’re in earnest as a buyer . . . Assuming that all goes well and the buyer’s good-faith offer is accepted by the seller, the earnest money funds go toward the down payment and closing costs. In effect, earnest money is just paying more of the down payment and closing costs upfront.”

Keep in mind, this isn’t required, and it doesn’t guarantee your offer will be accepted. It’s important to work with a real estate advisor to understand what’s best for your situation and any specific requirements in your local area. They’ll advise you on what moves you should make so you can make the best possible decisions throughout the buying process.

Bottom Line

The key to a successful homebuying savings strategy? Being informed about what you need to save for. Because, when you understand what to expect, you can plan ahead. With an expert agent and a trusted lender, you’ll have the information you need to move forward with confidence.

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home