3 Helpful Tips for First-Time Homebuyers [INFOGRAPHIC]

Some Highlights

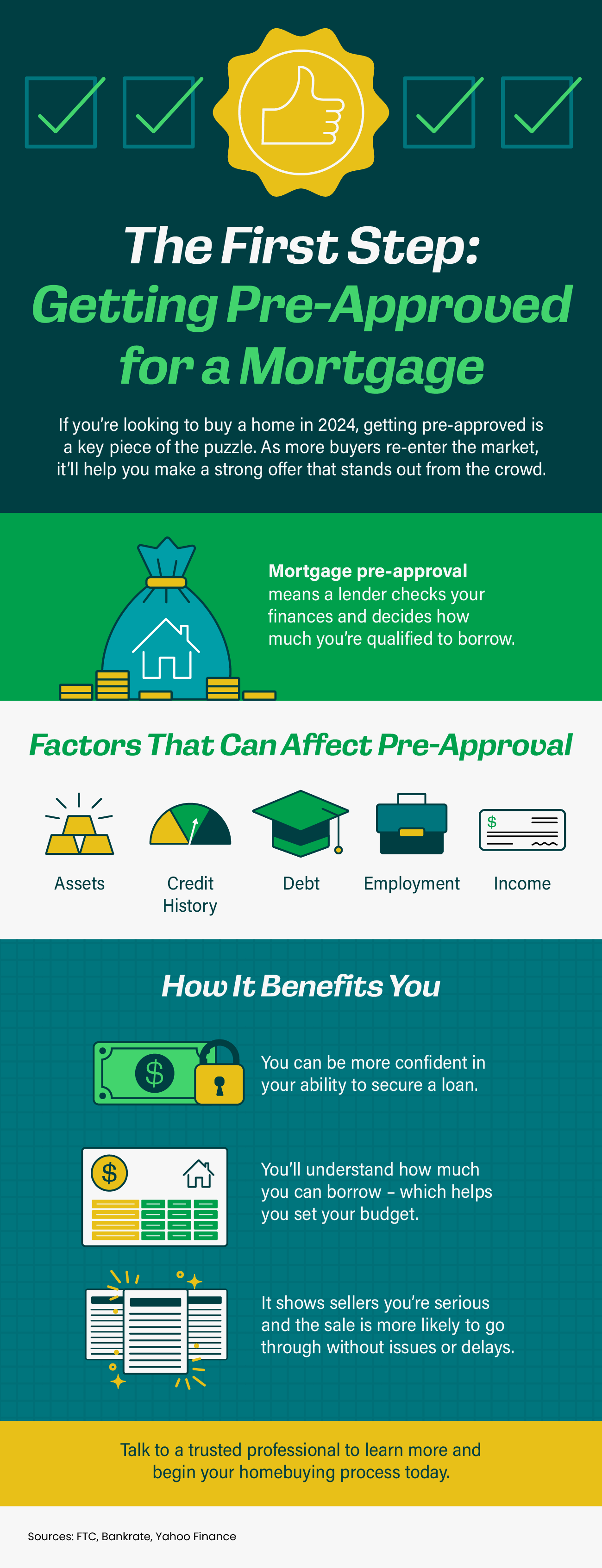

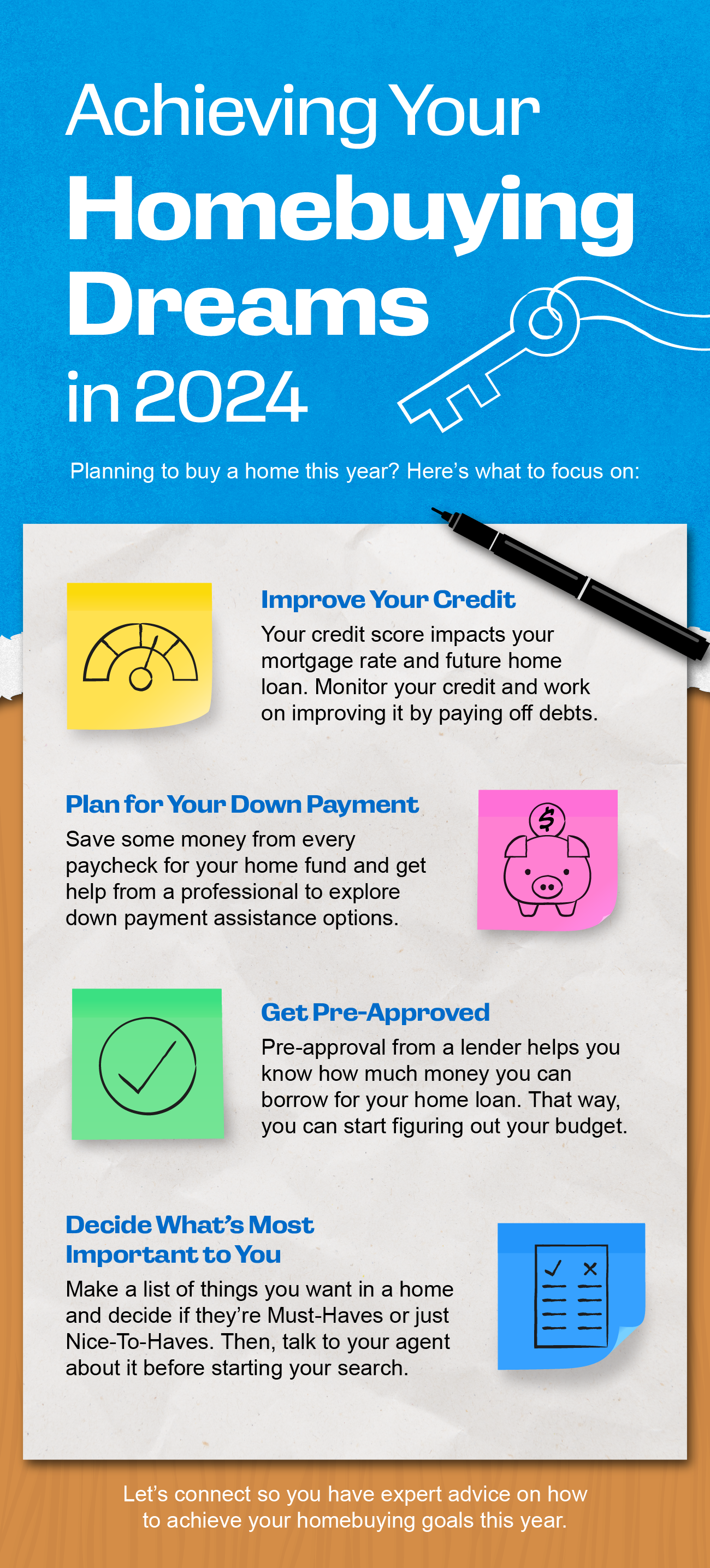

- Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help.

- Look into homebuyer programs, expand your search area, and consider a multi-generational home.

- Let’s connect so you have an expert on your side to help you make your dream a reality.