Is It Easier To Find a Home To Buy Now?

One of the biggest hurdles buyers have faced over the past few years has been a lack of homes available for sale. But that’s starting to change.

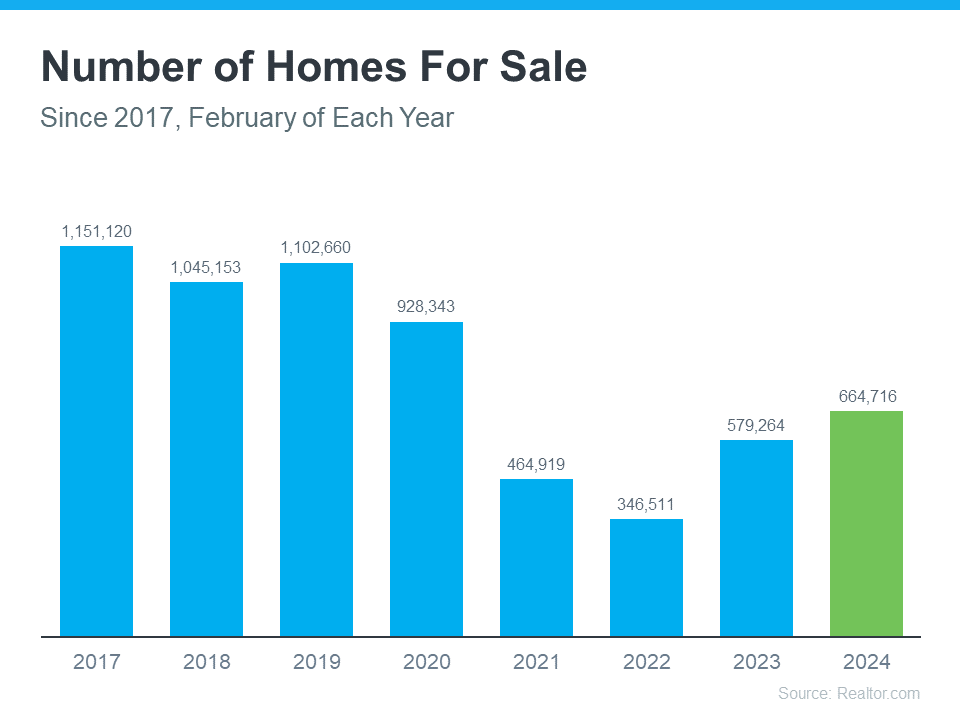

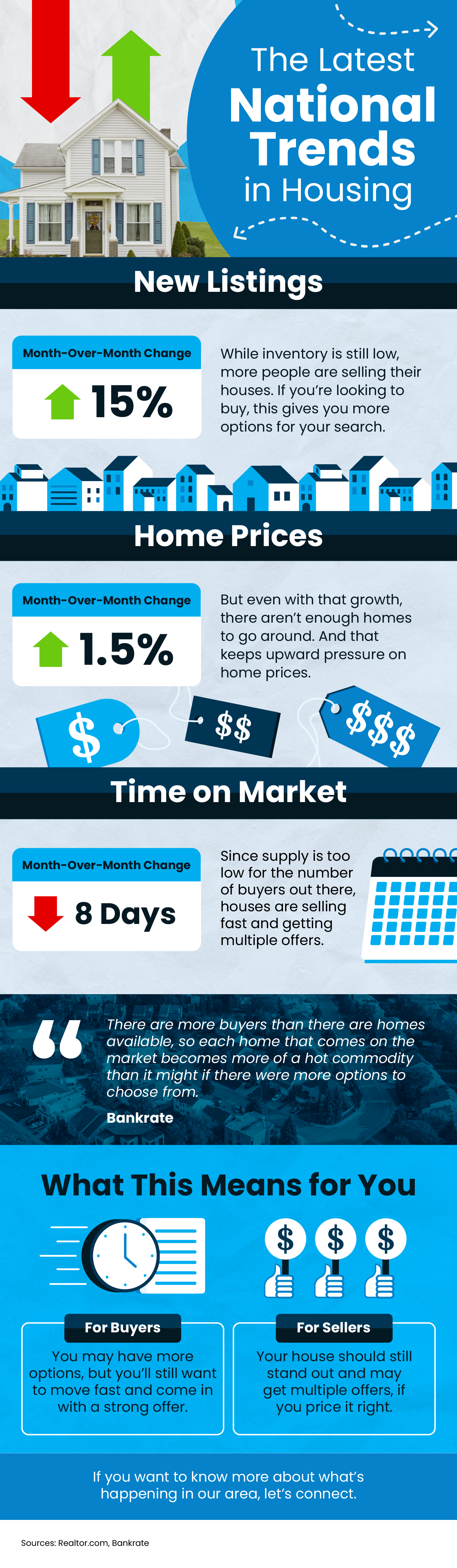

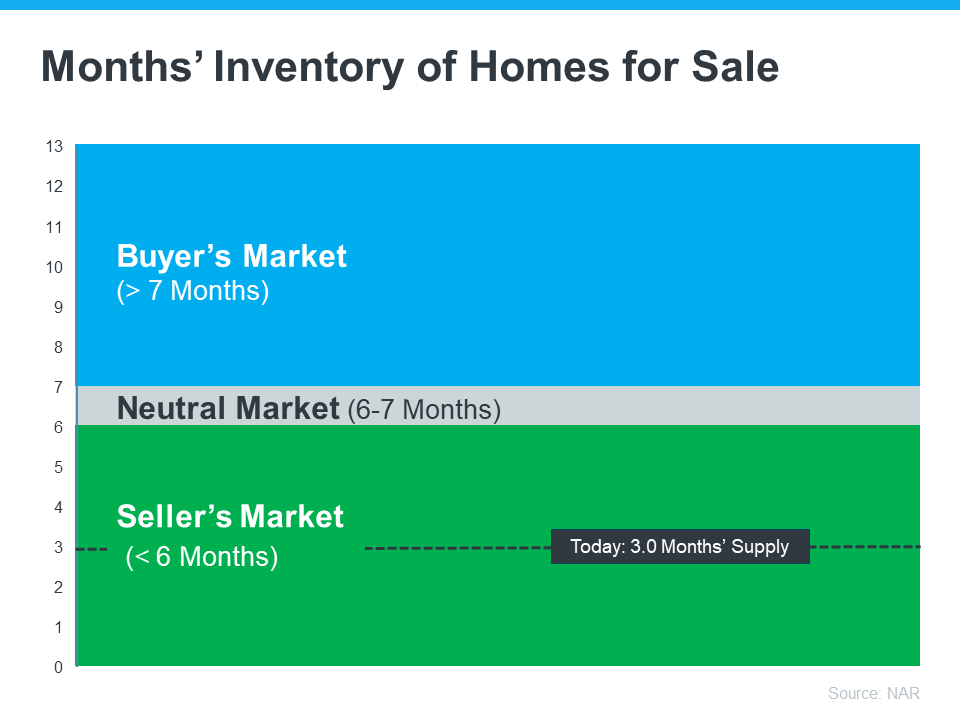

The graph below uses the latest data from Realtor.com to show there are more homes on the market in 2024 than there have been in any of the past several years (2021-2023):

Does That Mean Finding a Home Is Easier?

The answer is yes, and no. As an article from Realtor.com says:

“There were nearly 15% more homes for sale in February than a year earlier . . . That alone could jolt the housing market a bit if more “For Sale” signs continue to appear. However, the nation is still suffering from a housing shortage even with all of that new inventory.”

Context is important. On the one hand, inventory is up over the past few years. That means you’ll likely have more options to choose from as you search for your next home.

But, at the same time, the graph above also shows there are still significantly fewer homes for sale than there would usually be in a more normal, pre-pandemic market. And that deficit isn’t going to be reversed overnight.

What Does This Mean for You?

You might find a few more choices now than in recent years, but you shouldn’t expect a ton of options.

To help you explore the growing list of choices you have now, team up with a local real estate agent you trust. They can really help you understand the inventory situation where you want to buy. That’s because real estate is local. An experienced agent can share some smart tips they’ve used to help other buyers in your area deal with ongoing low housing supply.

Bottom Line

If you’re thinking about buying a home, let’s team up. That way, you’ll be up to date on everything that could affect your move, including how many homes are for sale right now.