What Are Experts Saying About the Spring Housing Market?

If you’re planning to move soon, you might be wondering if there’ll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here’s what the professionals are saying about what’s in store for this season.

Odeta Kushi, Deputy Chief Economist, First American:

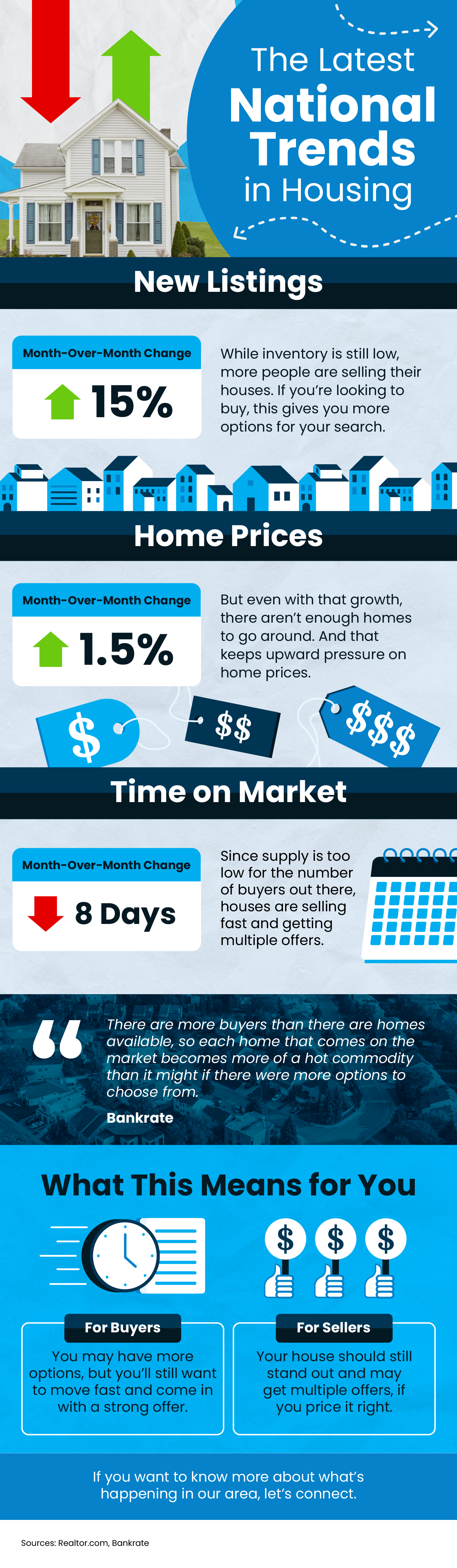

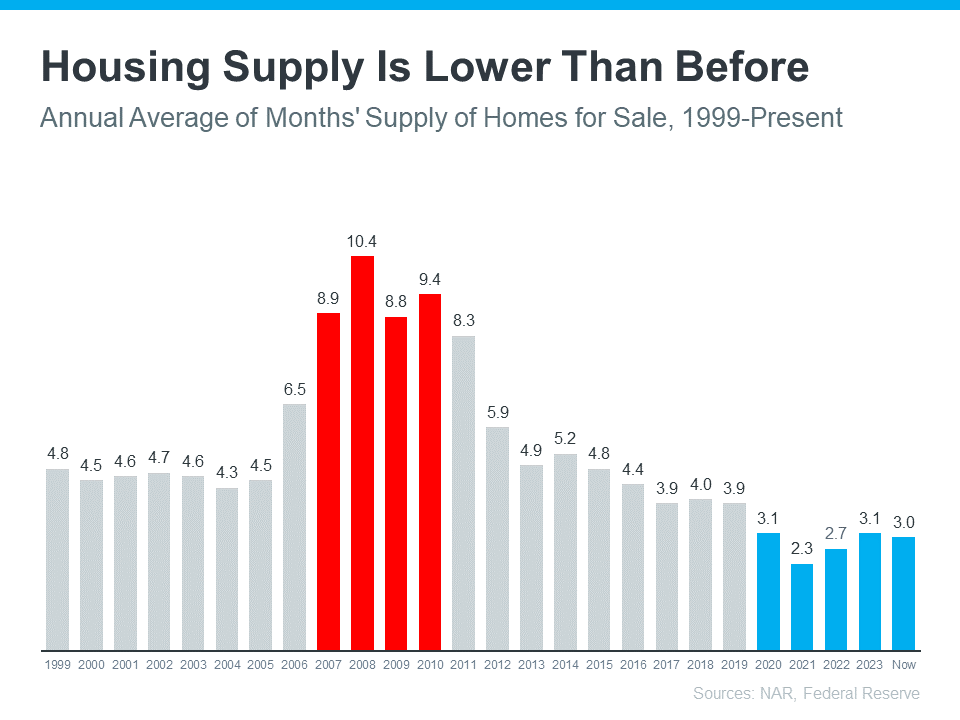

“. . . it seems our general expectation for the spring is that we will see a pickup in inventory. In fact, that already seems to be happening. But it won’t necessarily be enough to satiate demand.”

Lisa Sturtevant, Chief Economist, Bright MLS:

“There is still strong demand, as the large millennial population remains in the prime first-time homebuying range.”

Danielle Hale, Chief Economist, Realtor.com:

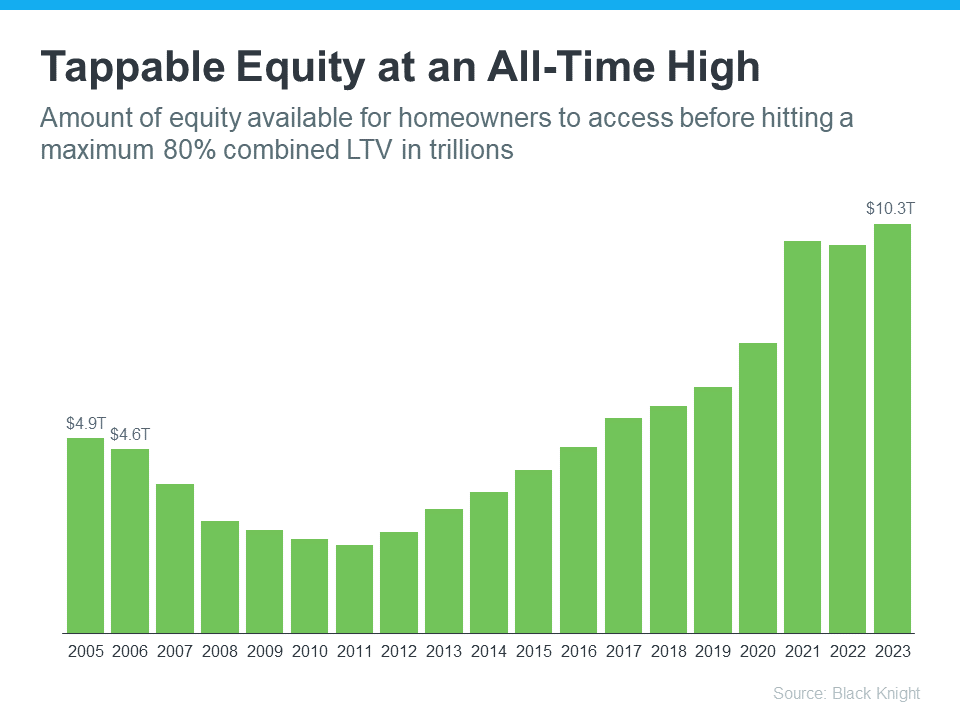

“Where we are right now is the best of both worlds. Price increases are slowing, which is good for buyers, and prices are still relatively high, which is good for sellers.”

Skylar Olsen, Chief Economist, Zillow:

“There are slightly more homes for sale than this time last year, and there is still plenty of competition for well-priced houses. Buyers should prep their credit scores and sellers should prep their properties now, attractive listings are going pending in less than a month, and time on market will shrink in the weeks ahead.”

Jiayi Xu, Economist, Realtor.com:

“While mortgage rates remain elevated, home shoppers who are looking to buy this spring could find more affordable homes on the market than they saw at the same time last year. Specifically, there were 20.6% more homes available for sale ranging between $200,000 and $350,000 in February 2024 than a year ago, surpassing growth in other price ranges.”

If you’re looking to sell, this spring might be your sweet spot because there just aren’t many homes on the market. Sure, inventory is rising, but it’s nowhere near enough to meet today’s buyer demand. That’s why they’re still selling so quickly.

If you’re looking to buy, the growing number of homes for sale this spring means you’ll have more choices than this time last year. But be prepared to move quickly since there’ll be plenty of competition with other buyers.

Bottom Line

No matter what you’re planning, let’s team up to confidently navigate the busy spring housing market.